Case Study

Recurring Payments

This is a brief overview of this project (3 min read)

My role

User Interface Designer

User Experience Designer

Interaction Designer

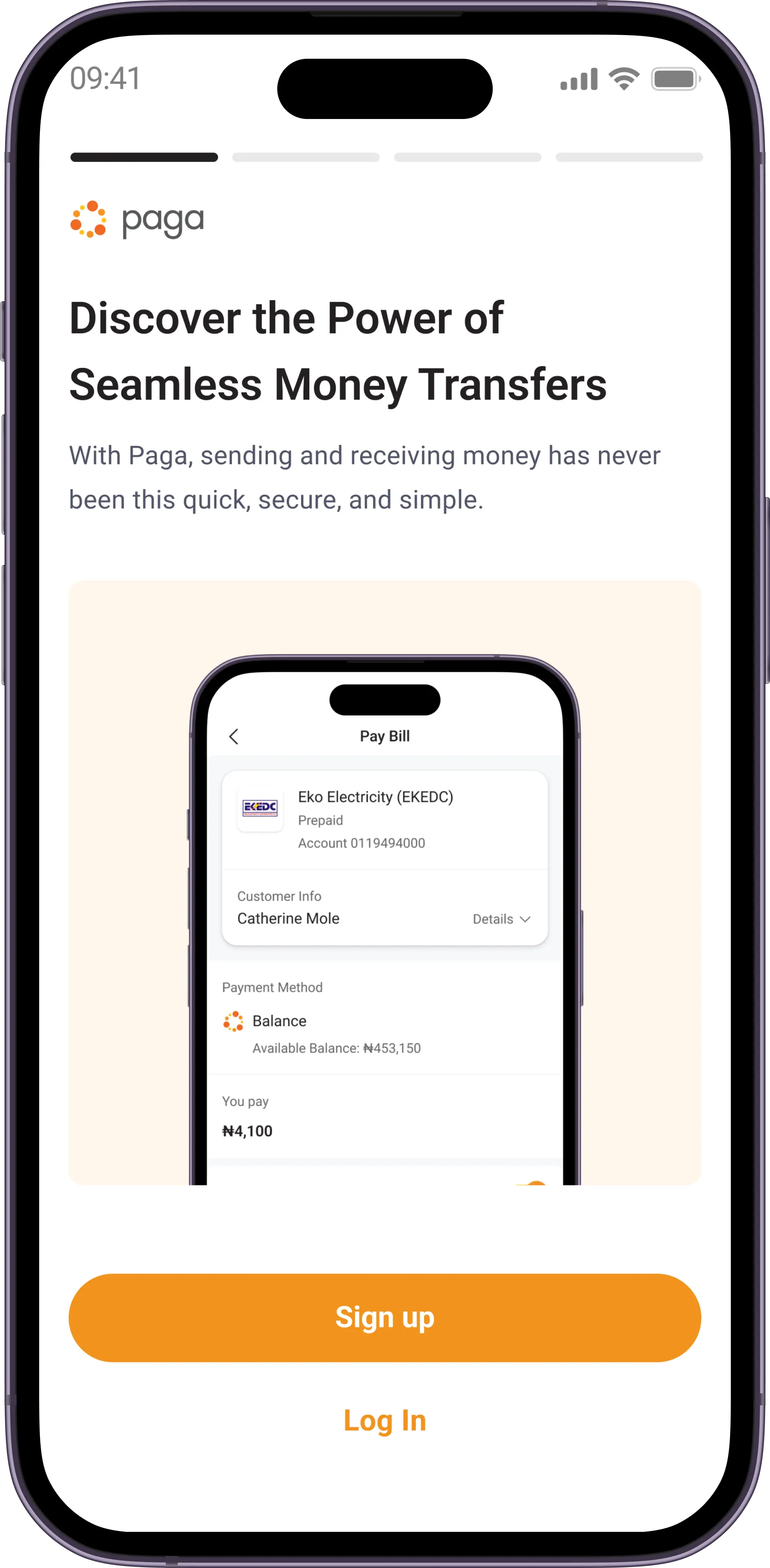

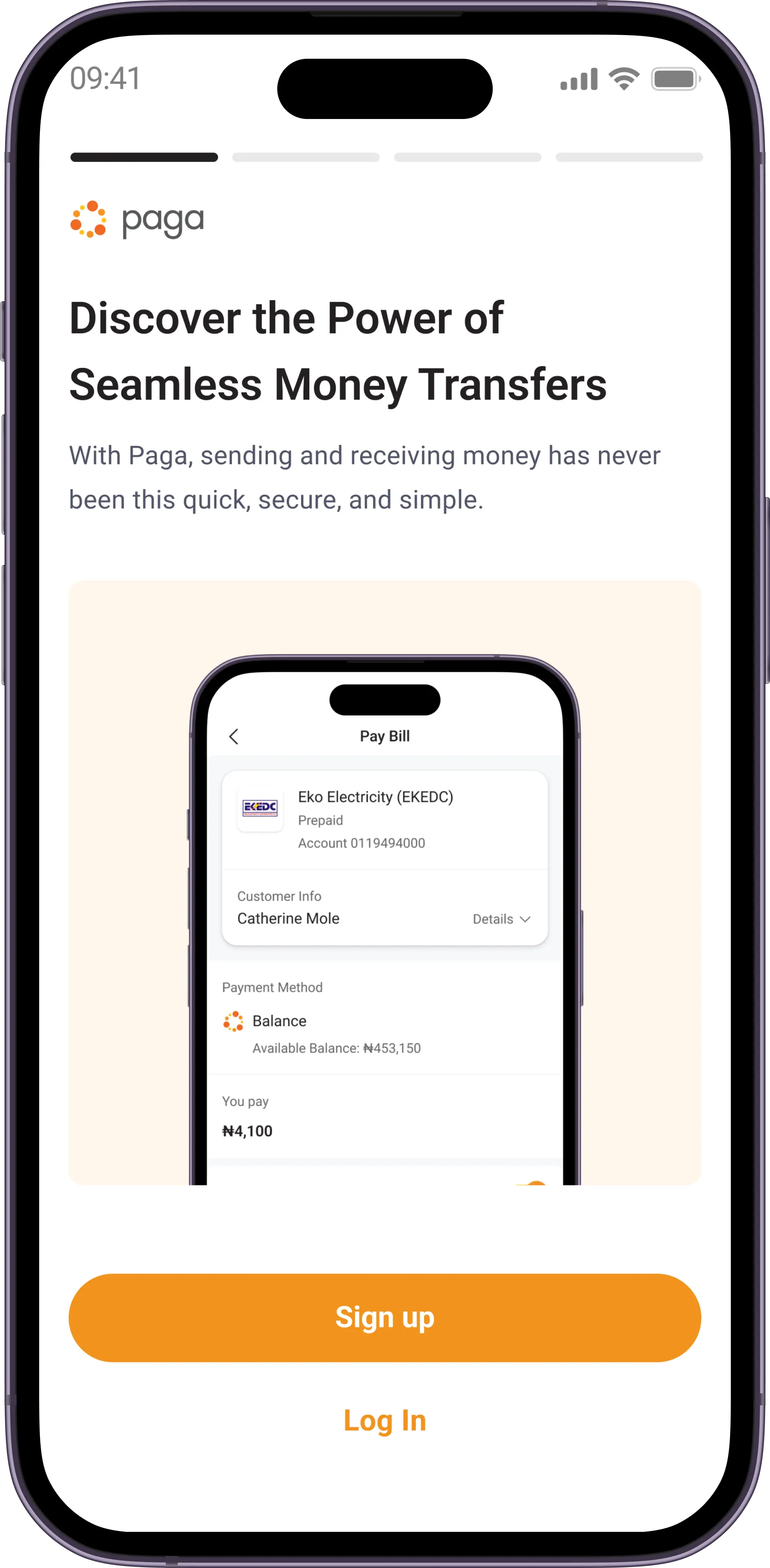

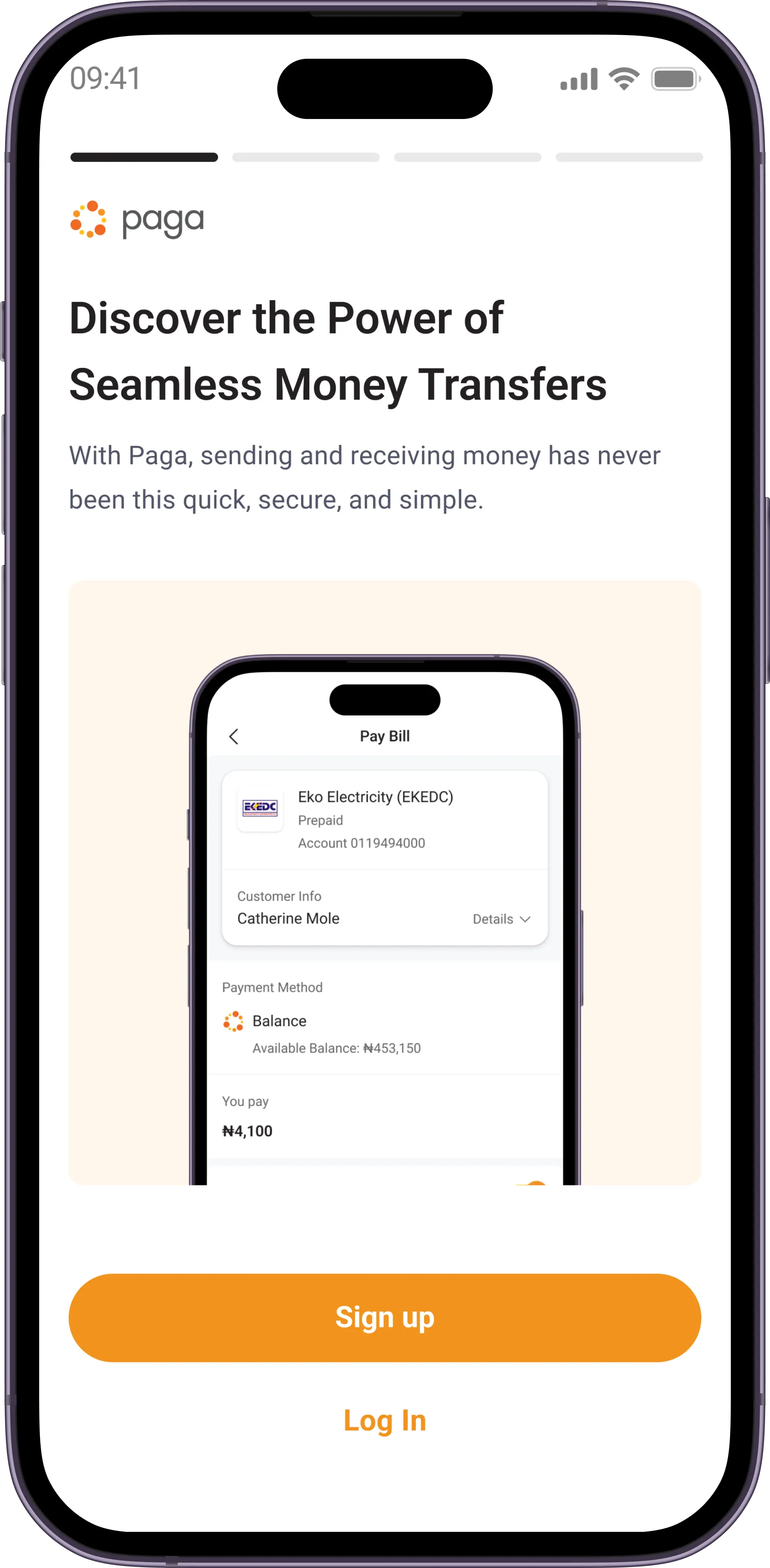

First let me tell you about Paga

Paga is a leading mobile money company that is building an ecosystem to enable people to digitally send and receive money, and creating simple financial access for everyone.

What is a recurring payment?

Recurring payment refers to a payment model in which consumers give merchant permission to deduct money automatically from their accounts on a regular basis for products and services that are supplied to them continuously.

JUN

24

Next due date

Why are we doing this?

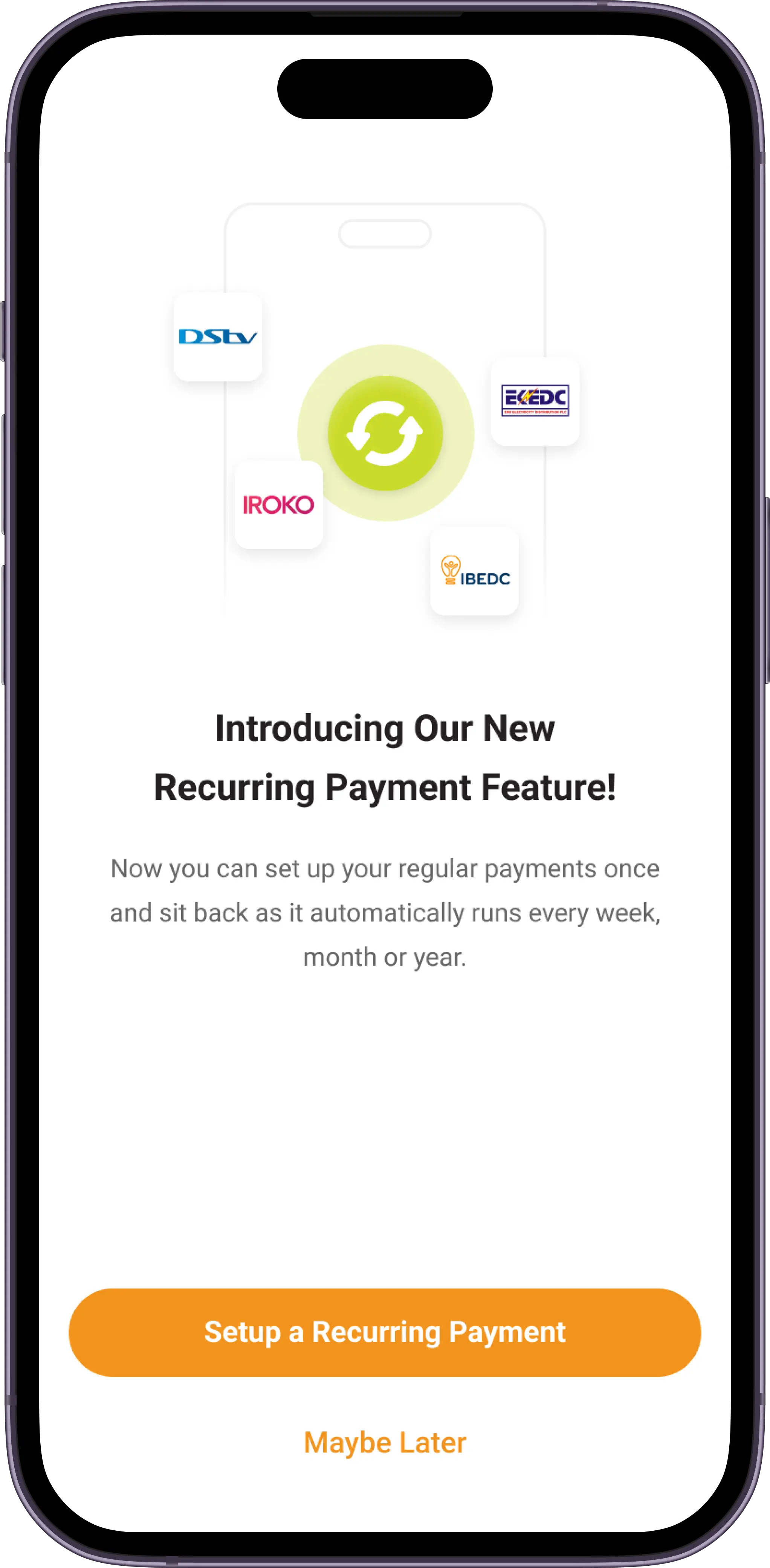

In a bid to increase user engagement and retention on Paga, the idea of a Recurring Payments feature emerged. The Recurring Payments Feature, designed as an extension of the existing platform, enables users to configure and automate payments for various recurring expenses such as subscriptions, memberships, and bills. Through this feature, users can experience a stress-free approach to managing their finances, while the platform strengthens its position as an indispensable tool in their daily lives.

What we aim to achieve

Seamless financial management

Simplify the process of managing regular financial obligations by allowing users to set up automatic payments.

Trust & reliability

Establish the platform as a dependable partner in users' financial routines, thereby building long-lasting trust.

Enhanced user engagement

Create a feature that not only fulfils a functional need but also encourages users to interact with the product on an ongoing basis.

Taking a deep dive

To lay the foundation for the Recurring Payments feature, I teamed up with key stakeholders and the product owner to conduct research and take a deep dive into this big idea.

This deep dive included conducting user interviews which included asking a number of strategically curated open-ended questions to get users current means of managing payments, and the struggles they face in the process.

Feedback from the surveys were carefully analysed to identify common points of friction between these users.

Deep in the ocean

After carefully understanding what users needed and were used to, i took an even deeper dive into how other products adopted automated payment models. This ranged from simple auto-debits to advanced predictive algorithms.

This process gave me a better understanding of both successes and shortcomings of various products, which in turn provided valuable insights that drove my design decisions.

Road blocks

Limited engineering resources

Limited engineering resources posed a challenge. The feature's complexity, encompassing automated renewals, customizable schedules, and seamless interactions, required balance. Striking the right mix between a comprehensive experience and resource capacity was crucial.

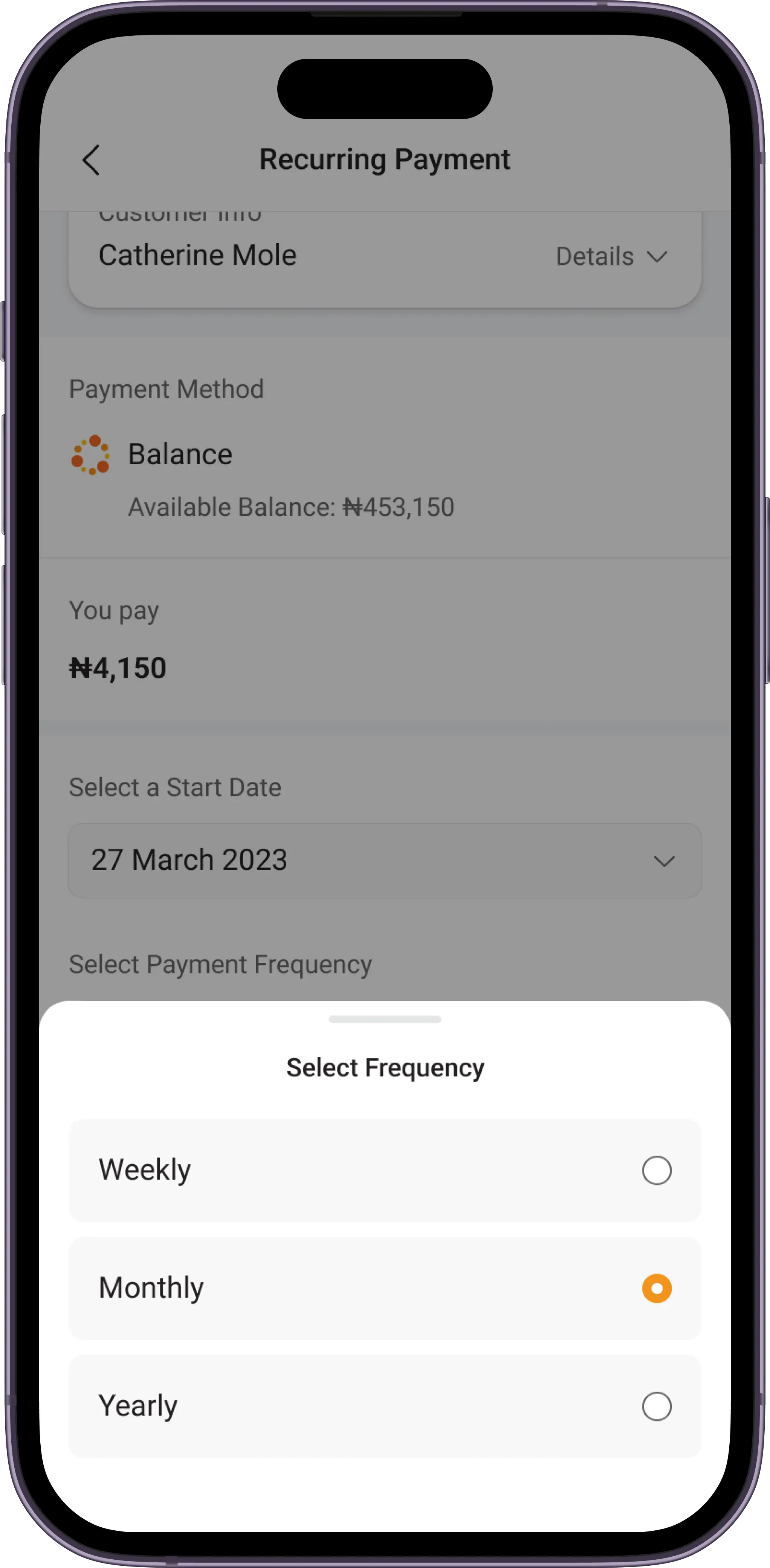

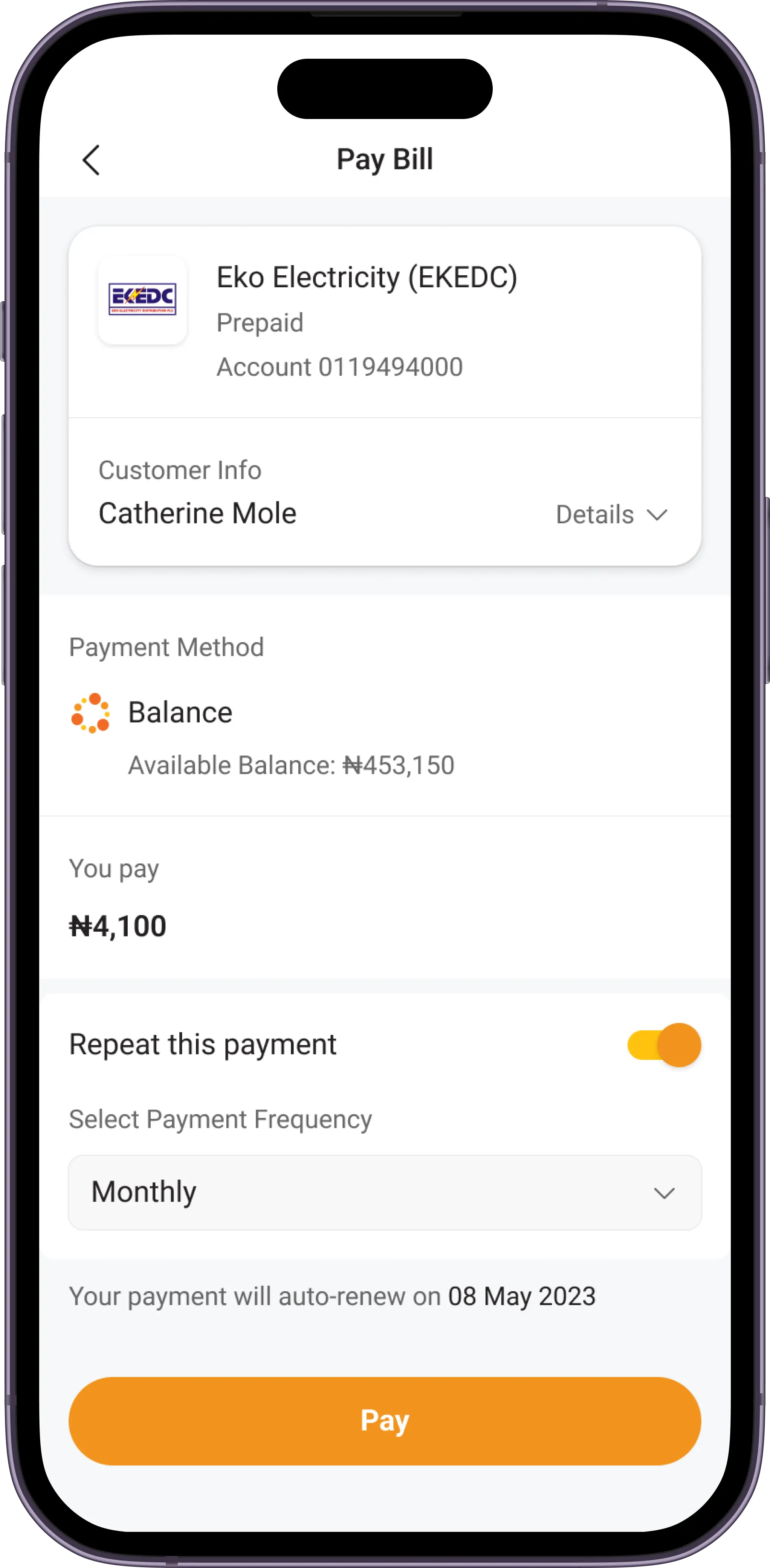

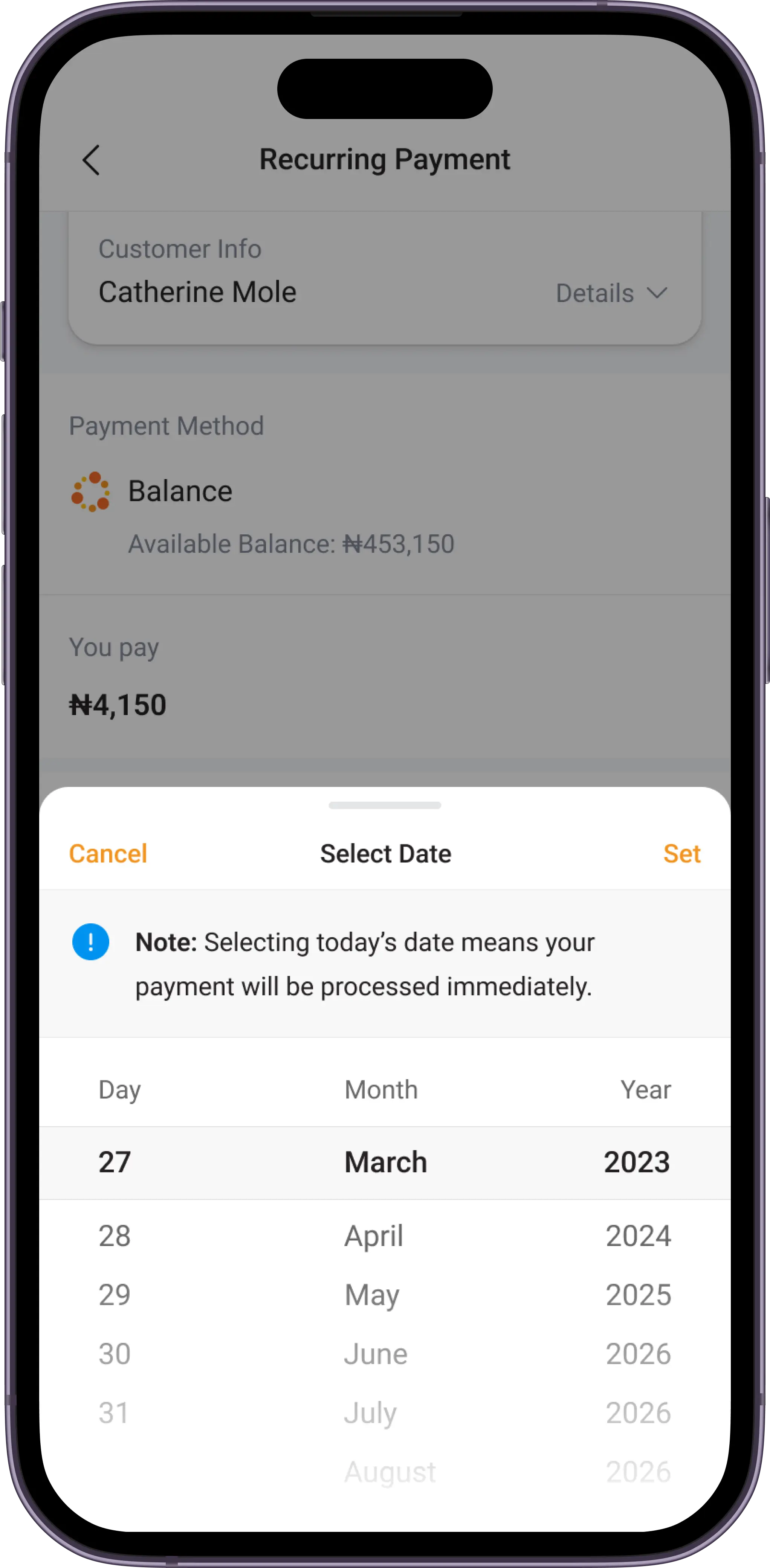

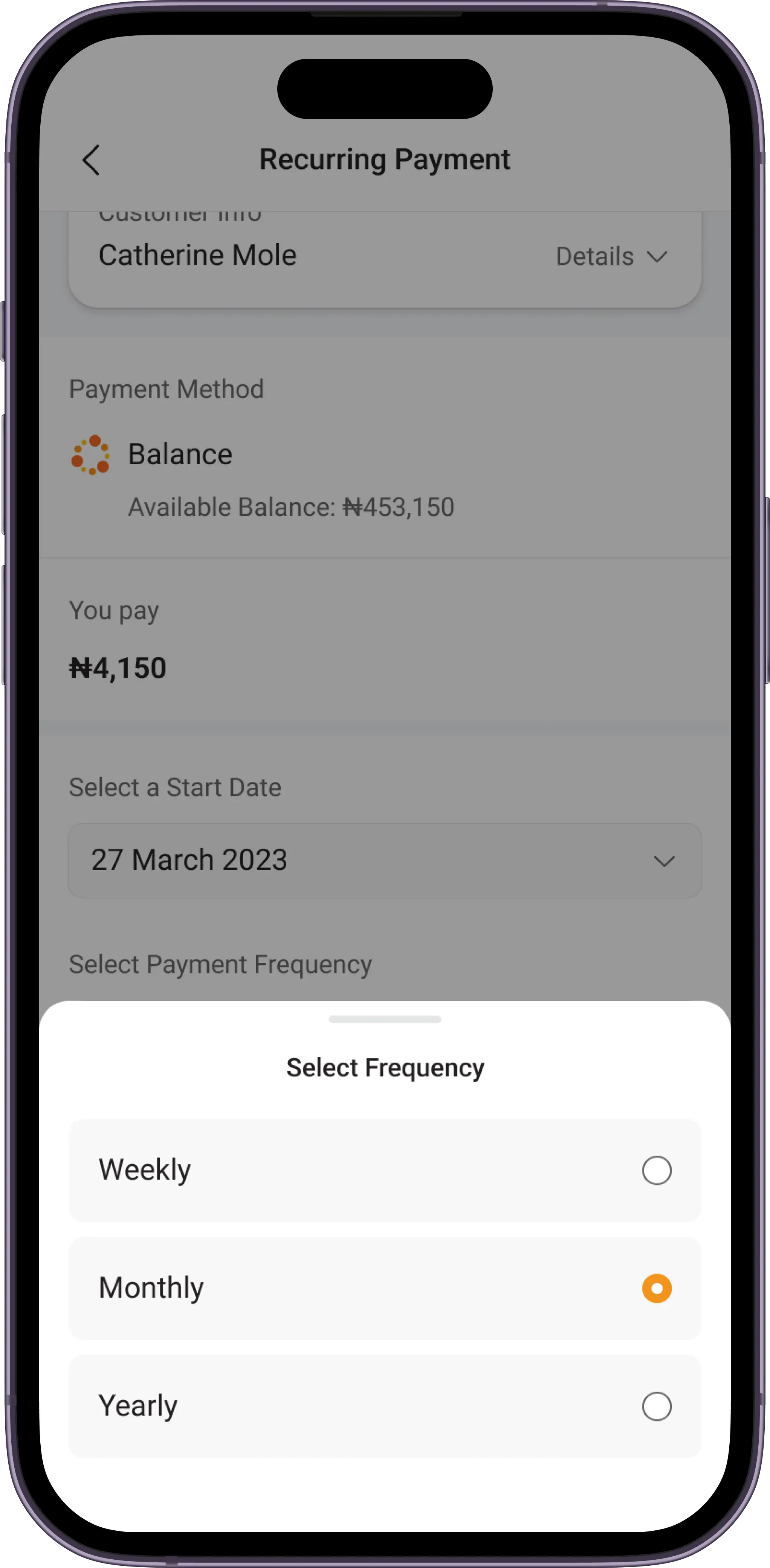

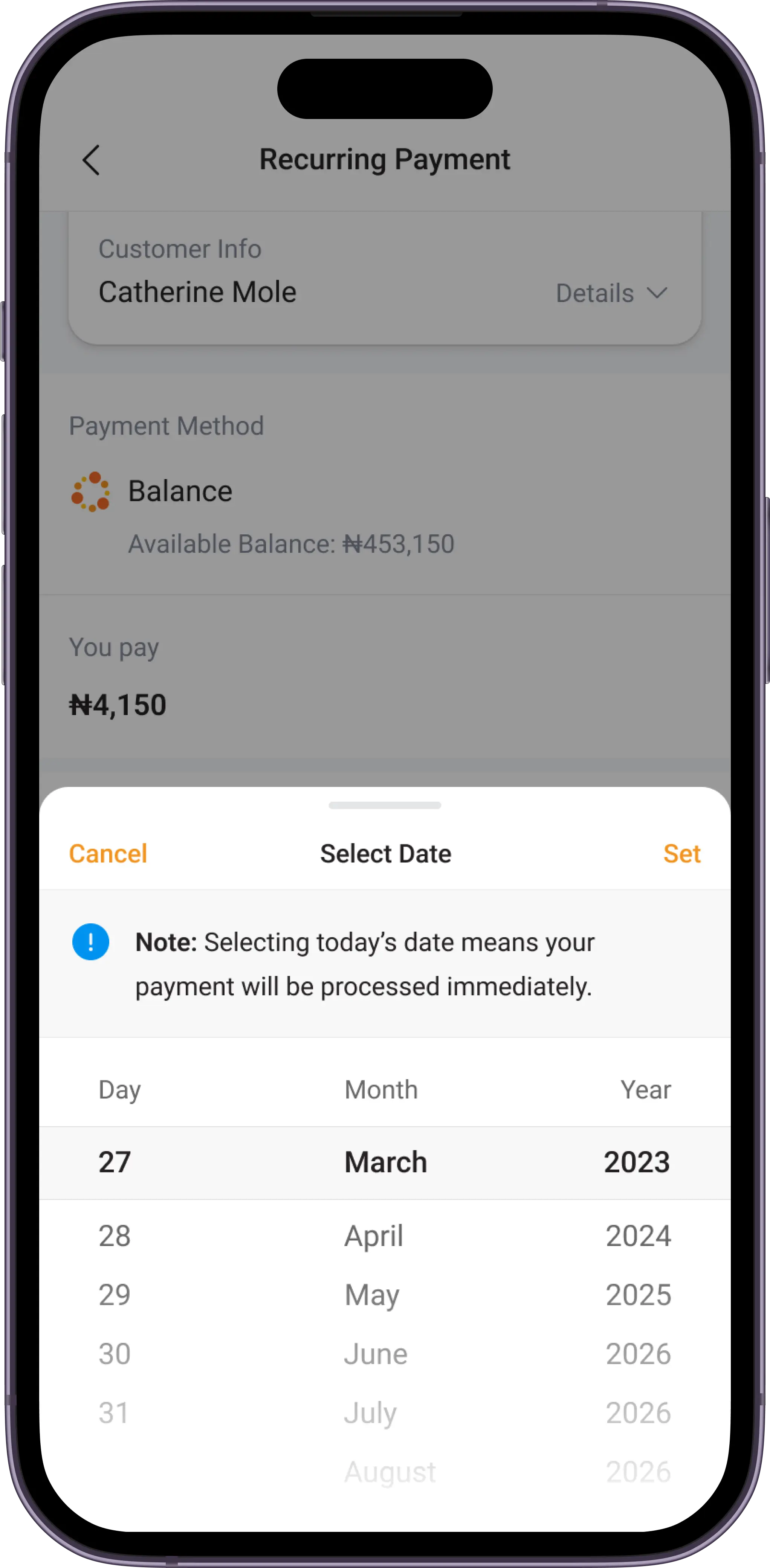

Ensuring simple flexibility

It was difficult to strike a balance between user flexibility and an easy-to-use UI. Users desired both customisation and the ease of automation. The challenge was creating a system that could be easily adjusted and still provided a clutter-free experience.

Building a bridge

To address the resource and complexity issues, we decided to build a SLC (Simple Lovable and Complete). This meant that we would build only the most essential feature of this product which is to allow auto-renewal of payments, that way we have a small product that can be built quickly, is useable and functional and we can choose to progressively introduce complexity by introducing other features - like customisation and much more later on. This way the engineers were able to implement quickly and the feature would roll-out with a clutter-free experience.

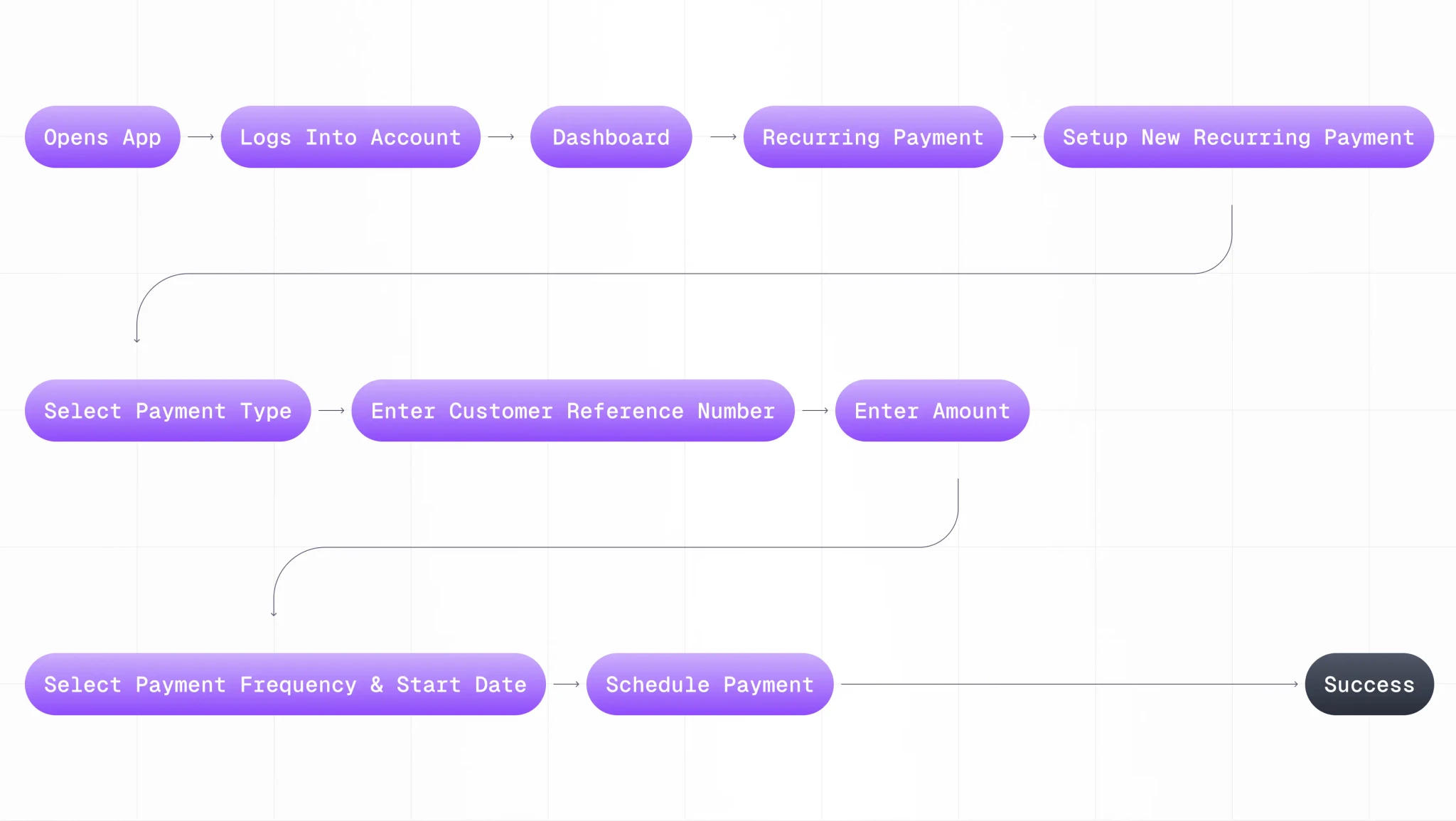

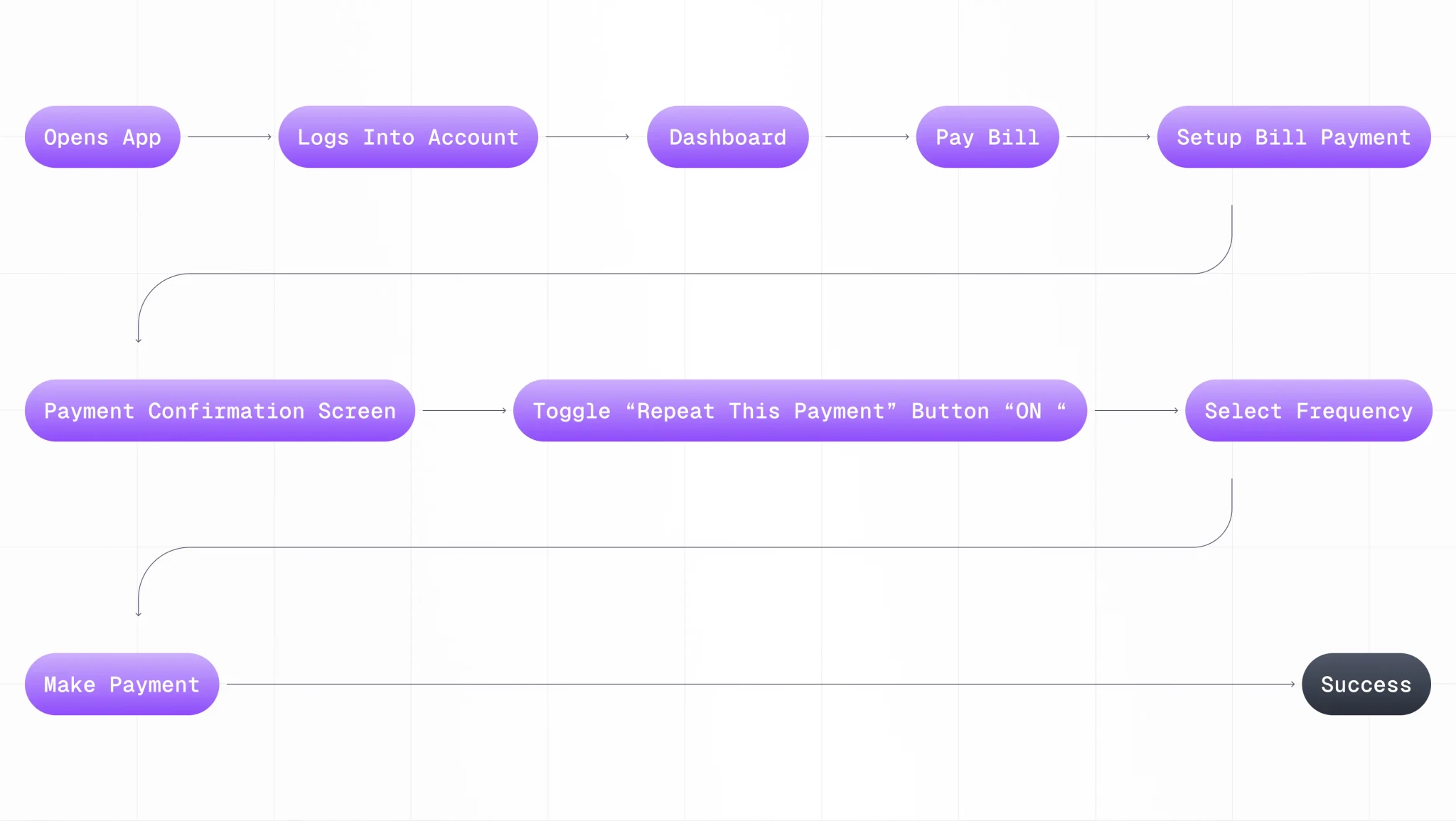

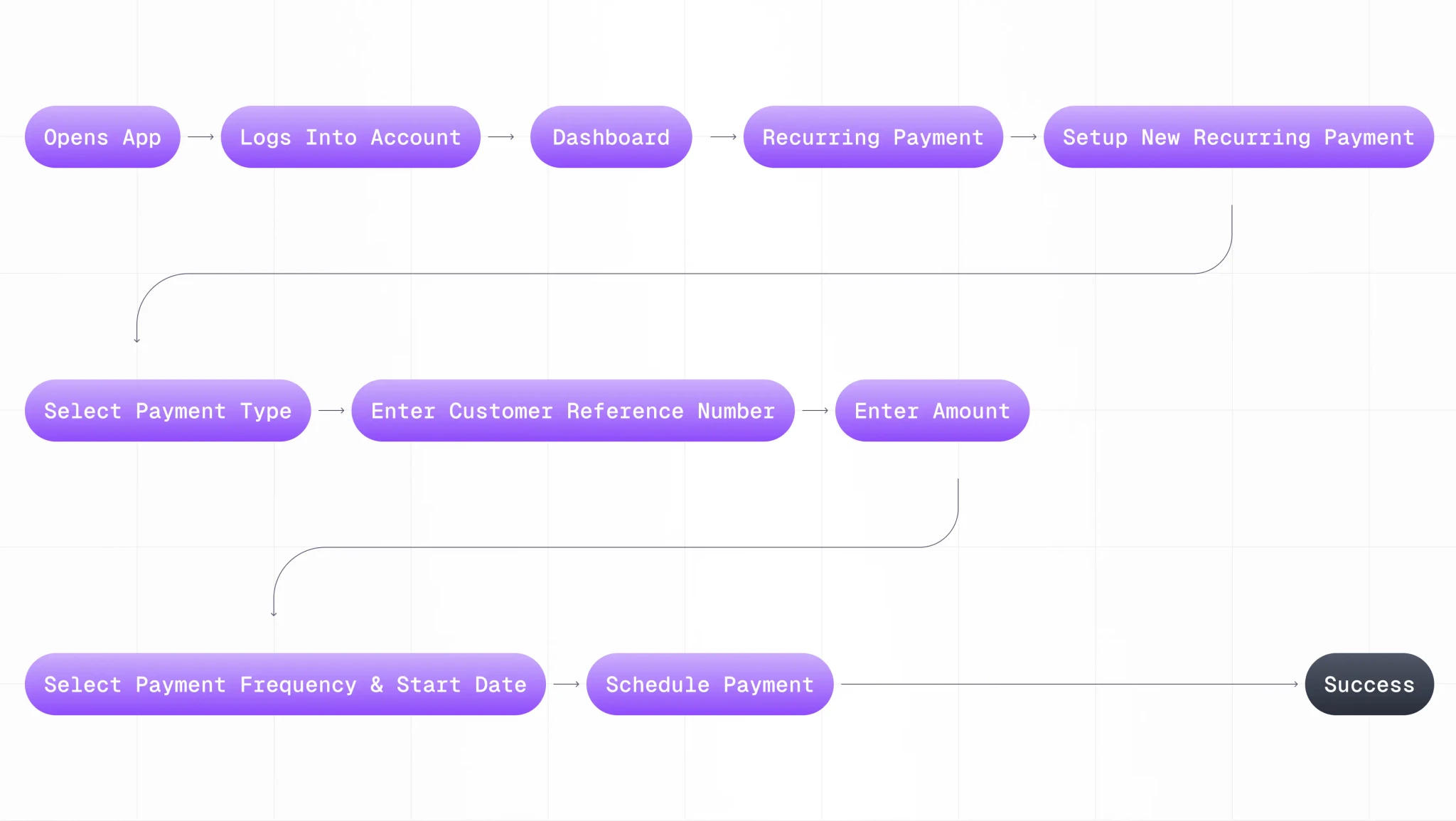

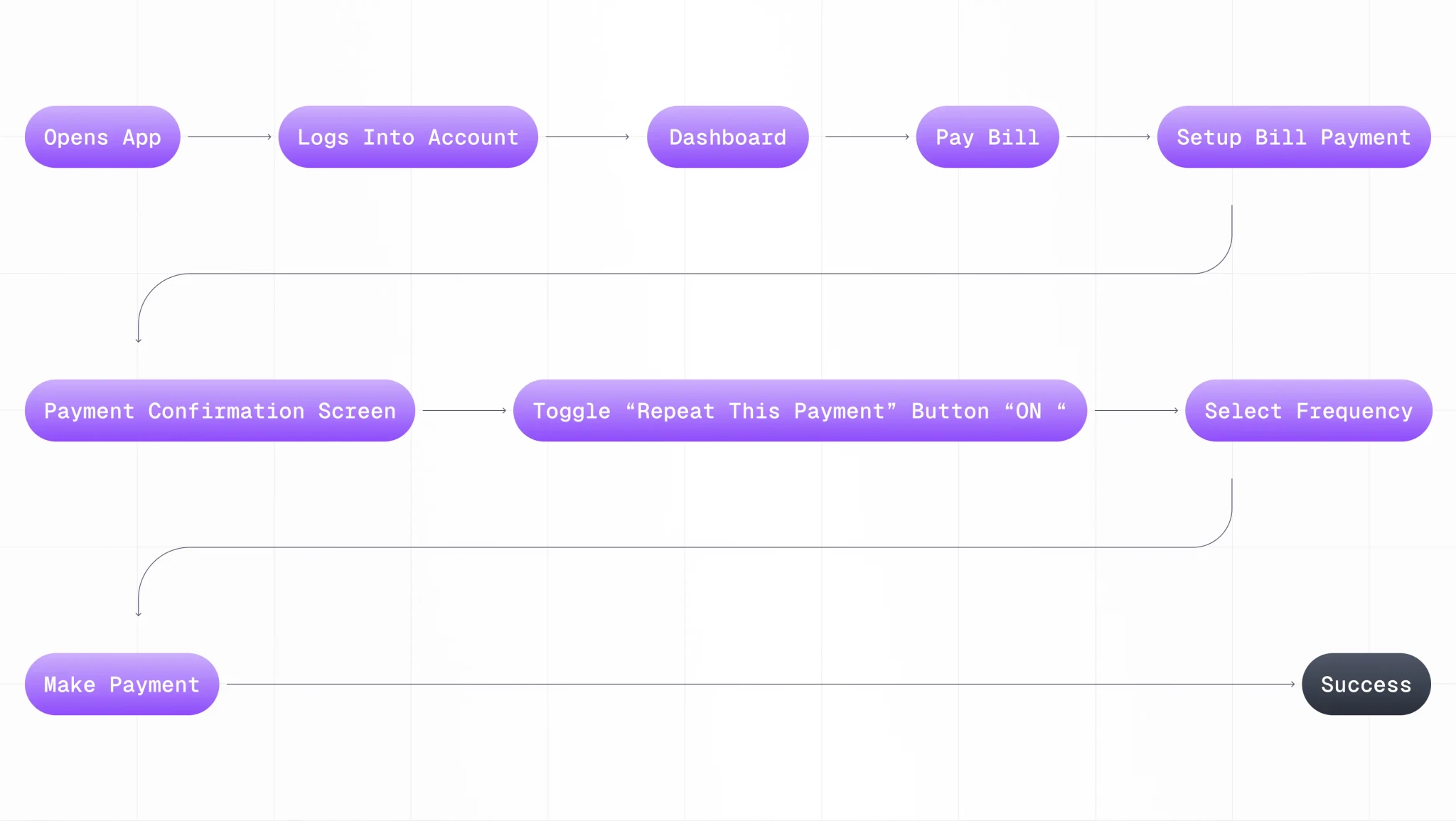

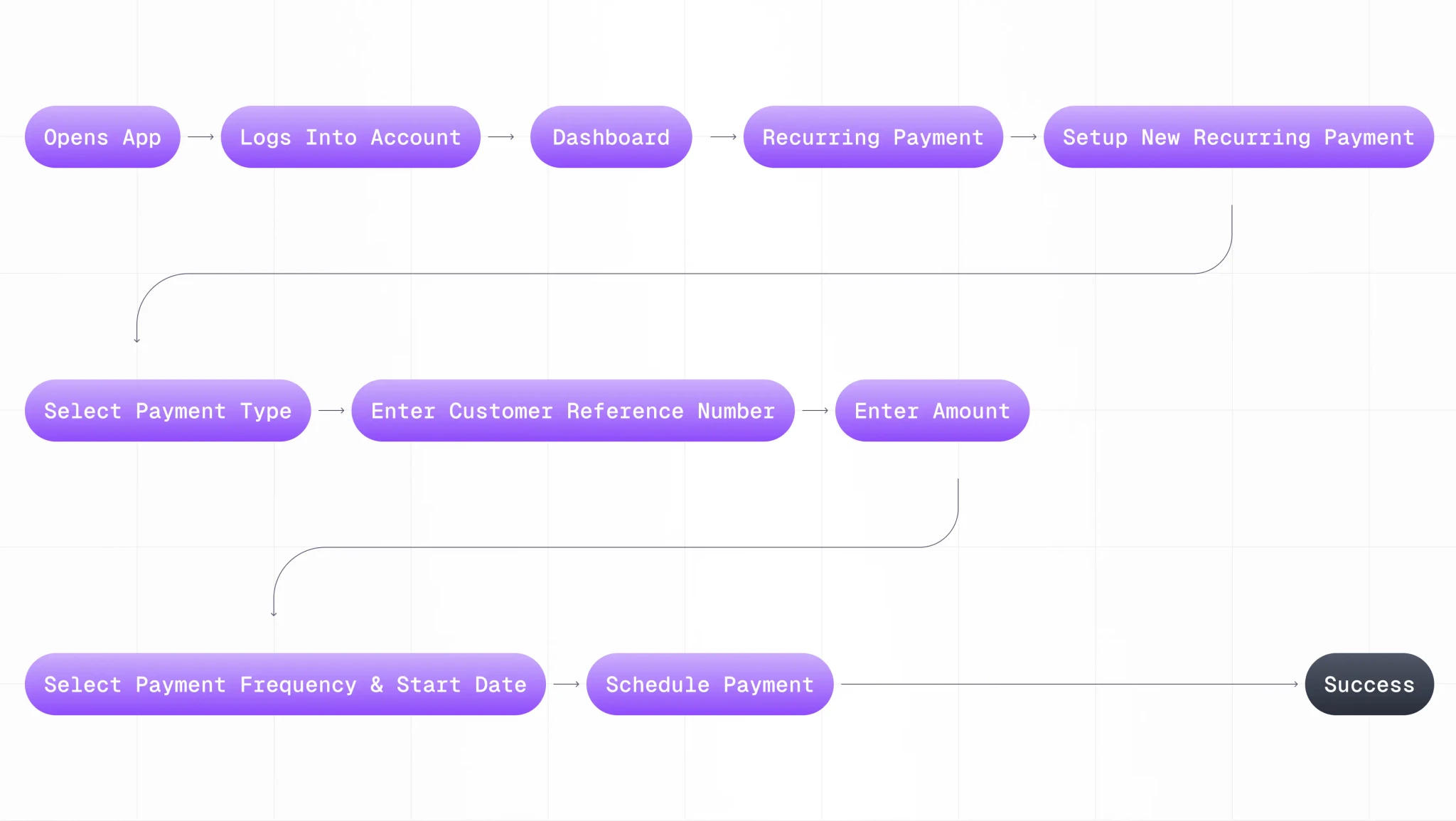

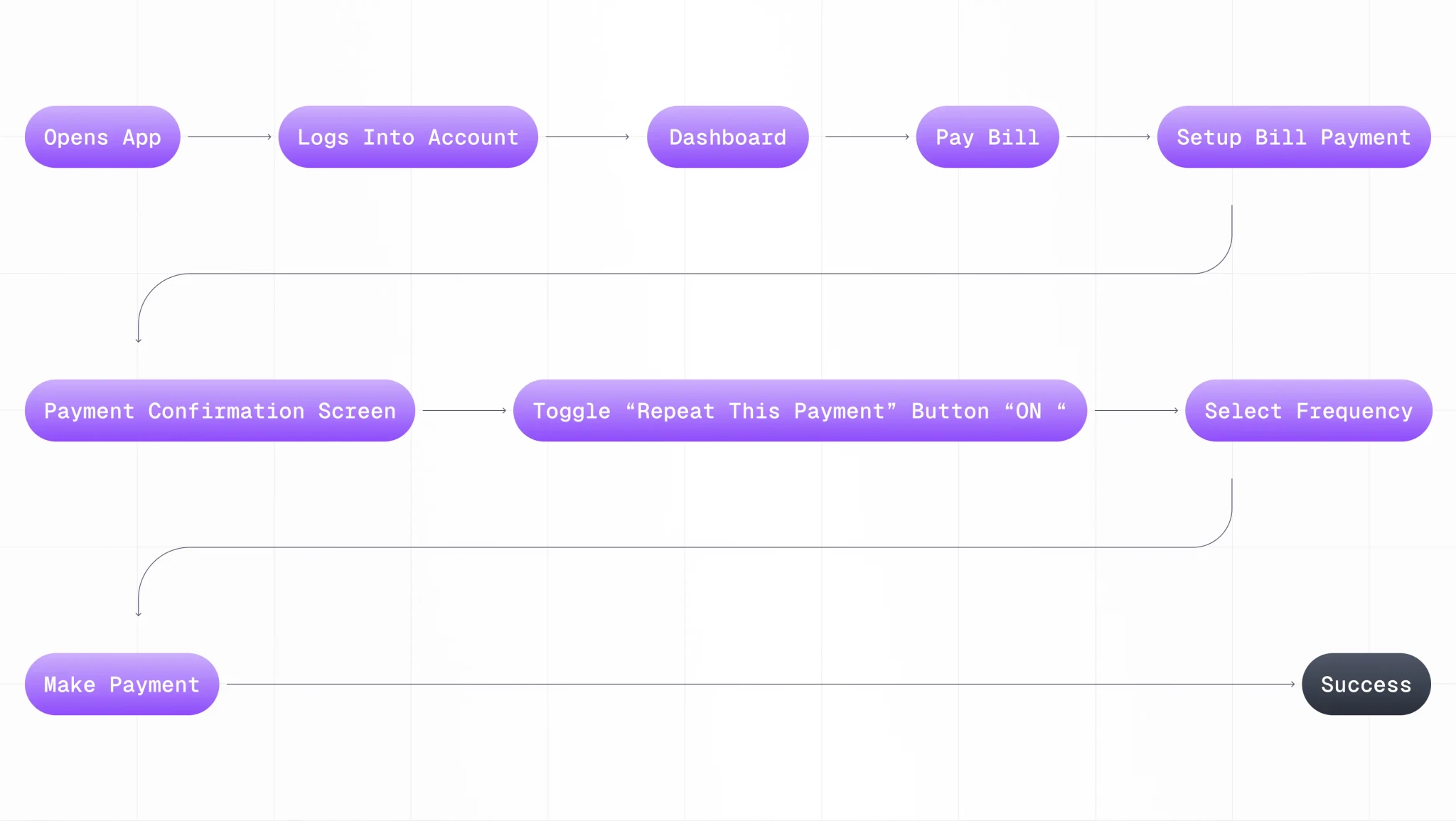

User flows

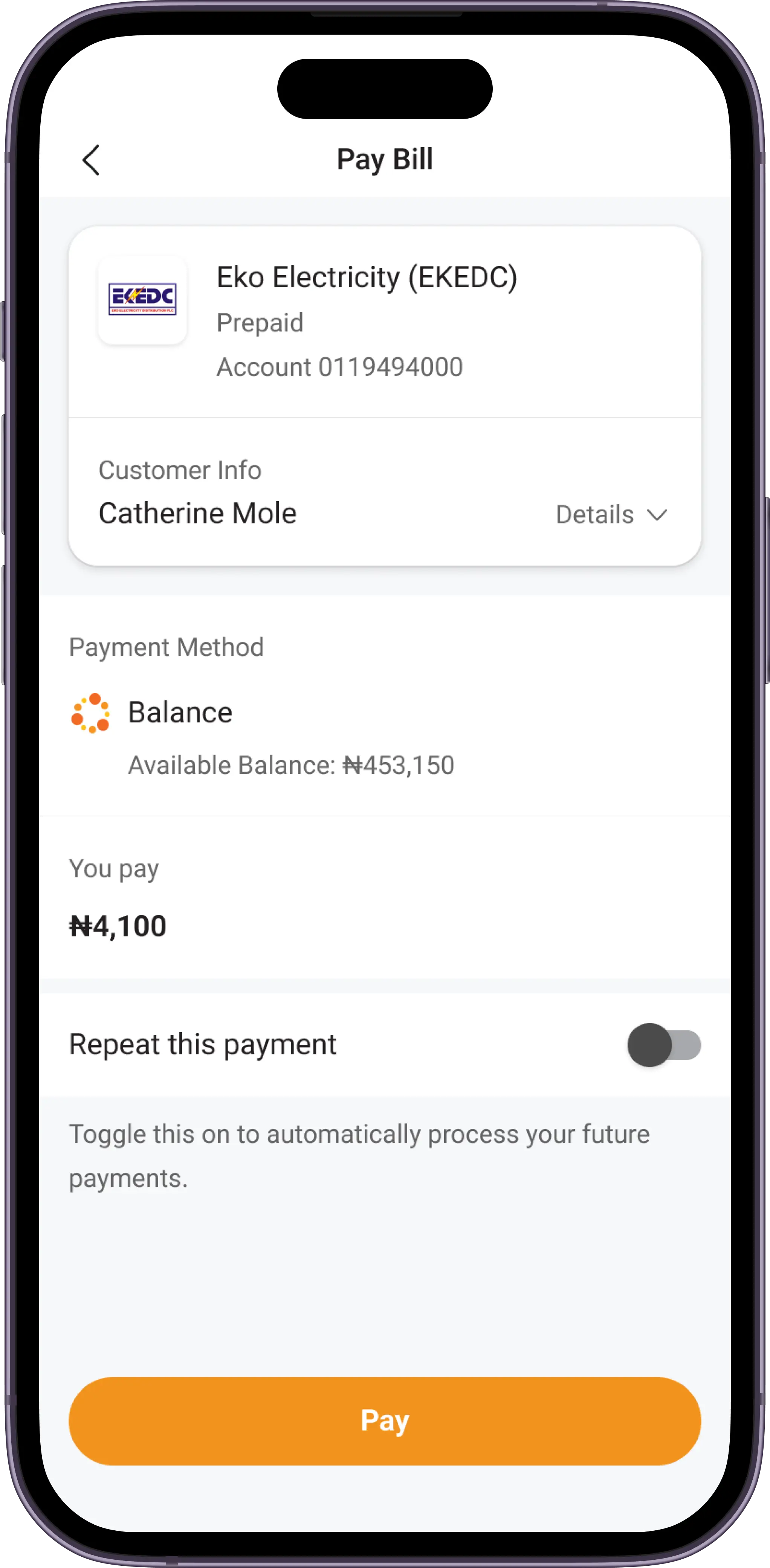

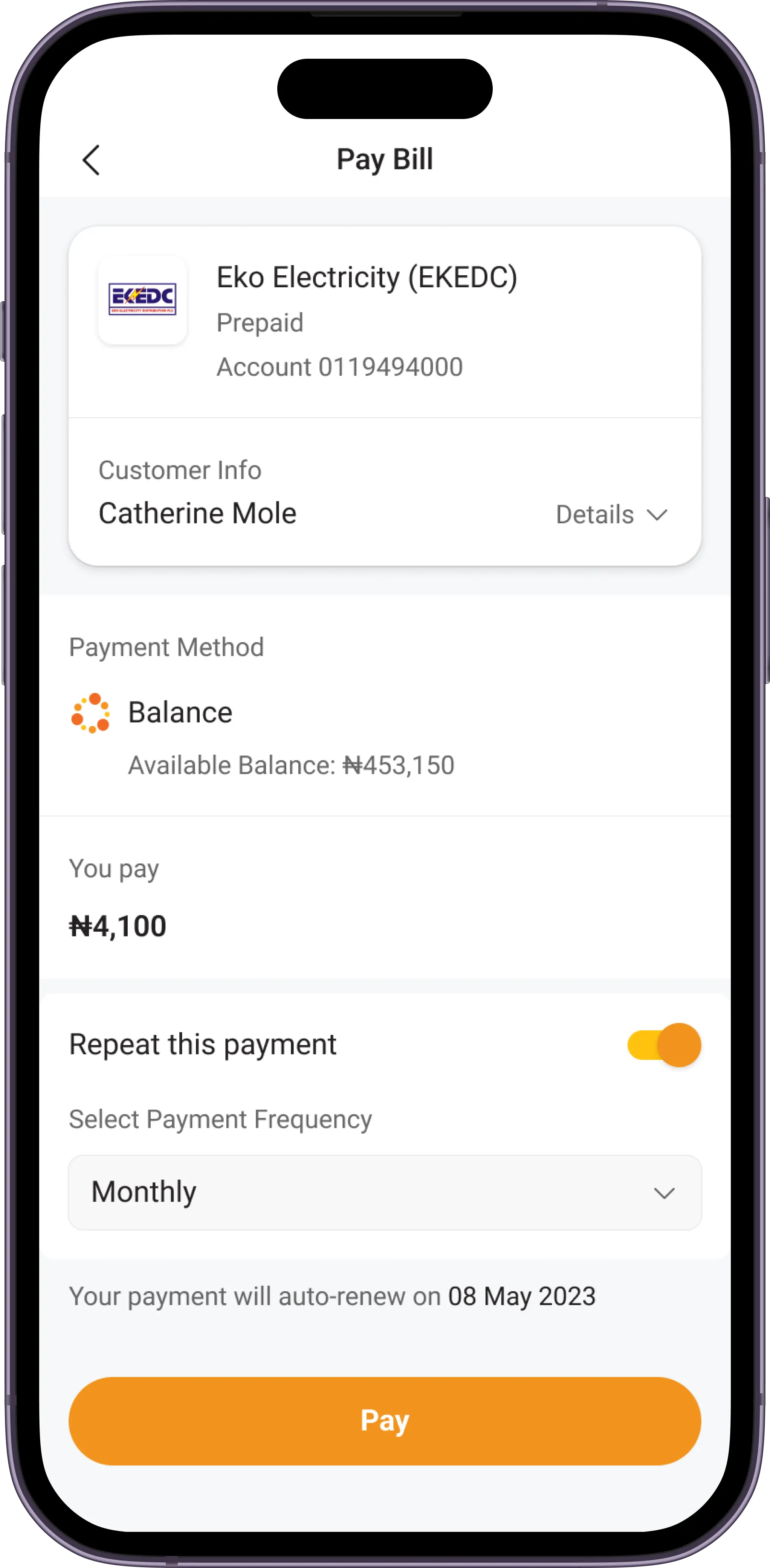

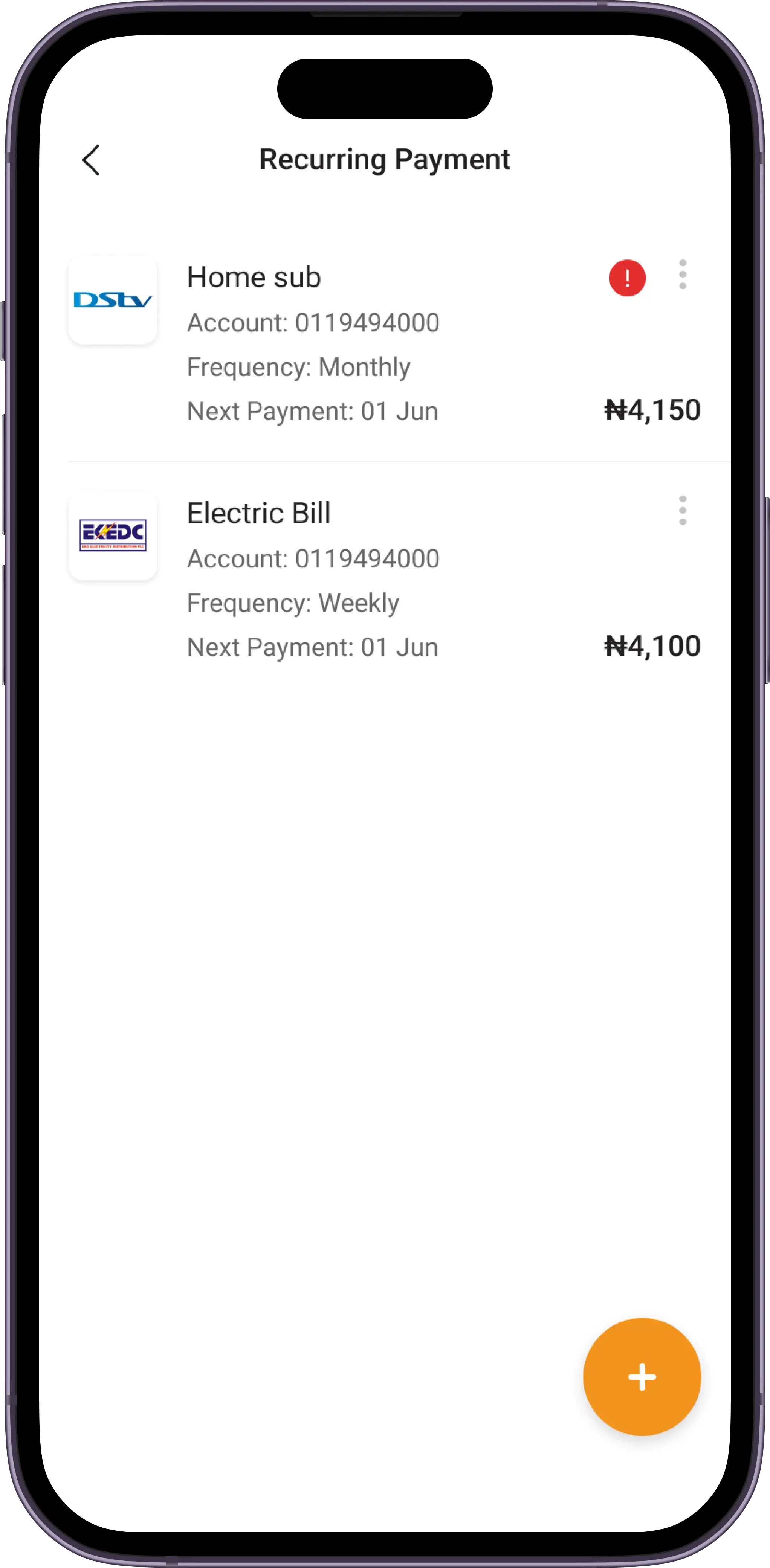

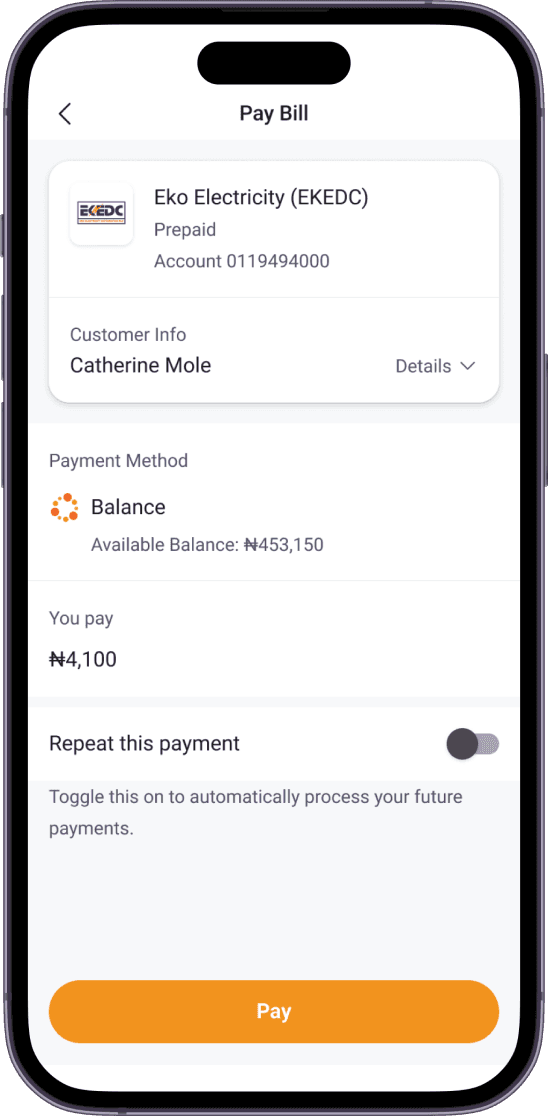

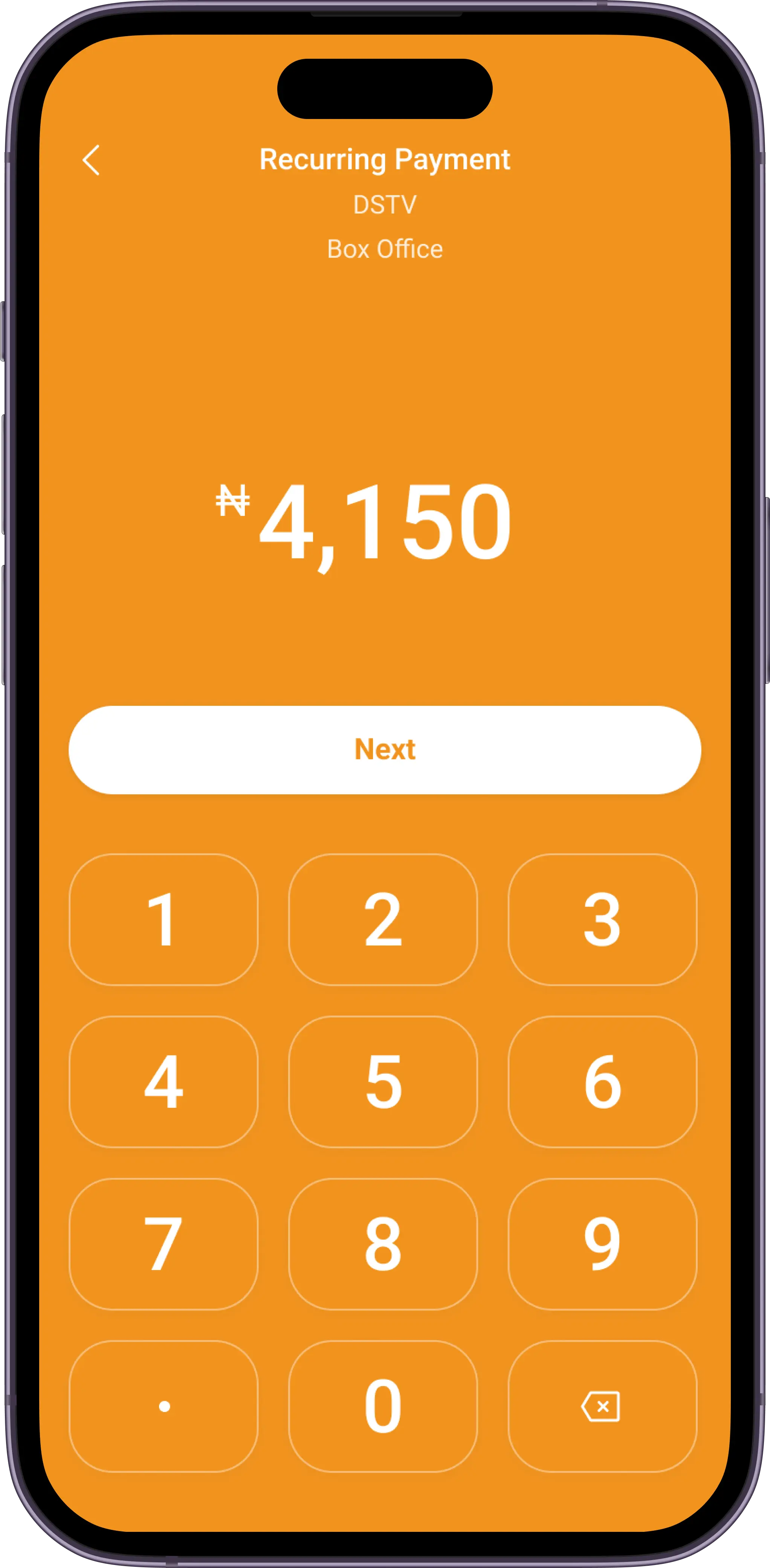

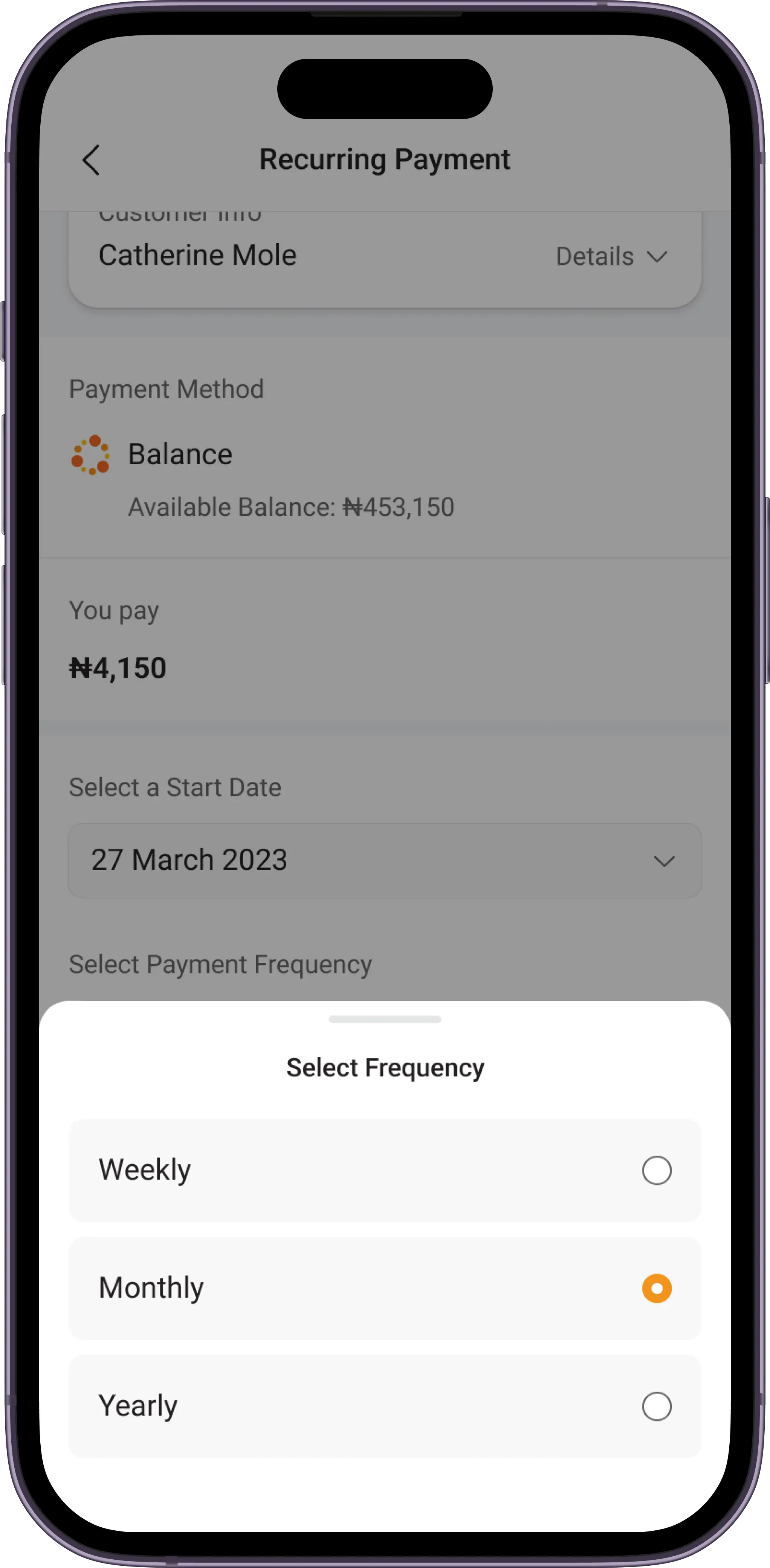

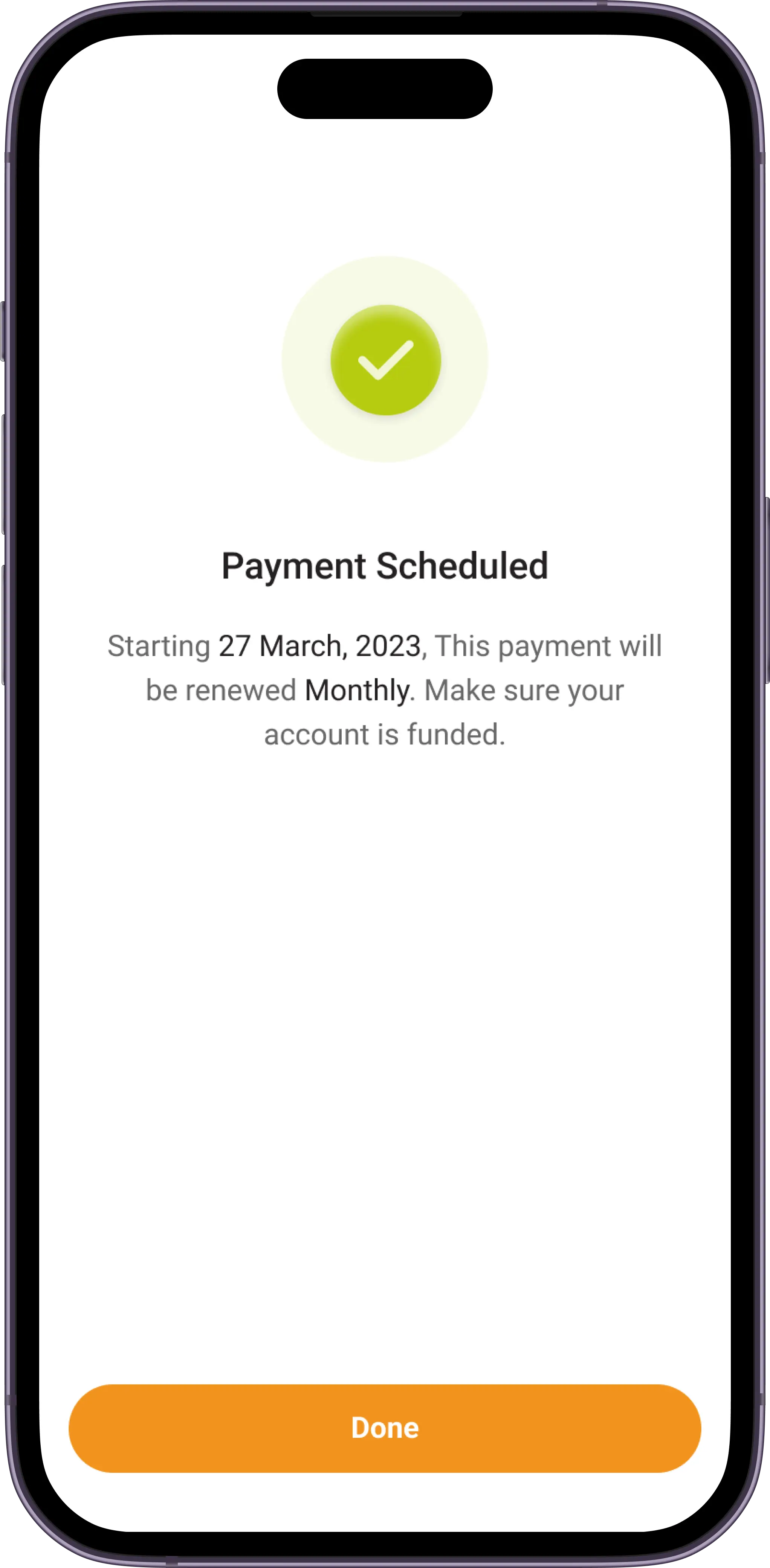

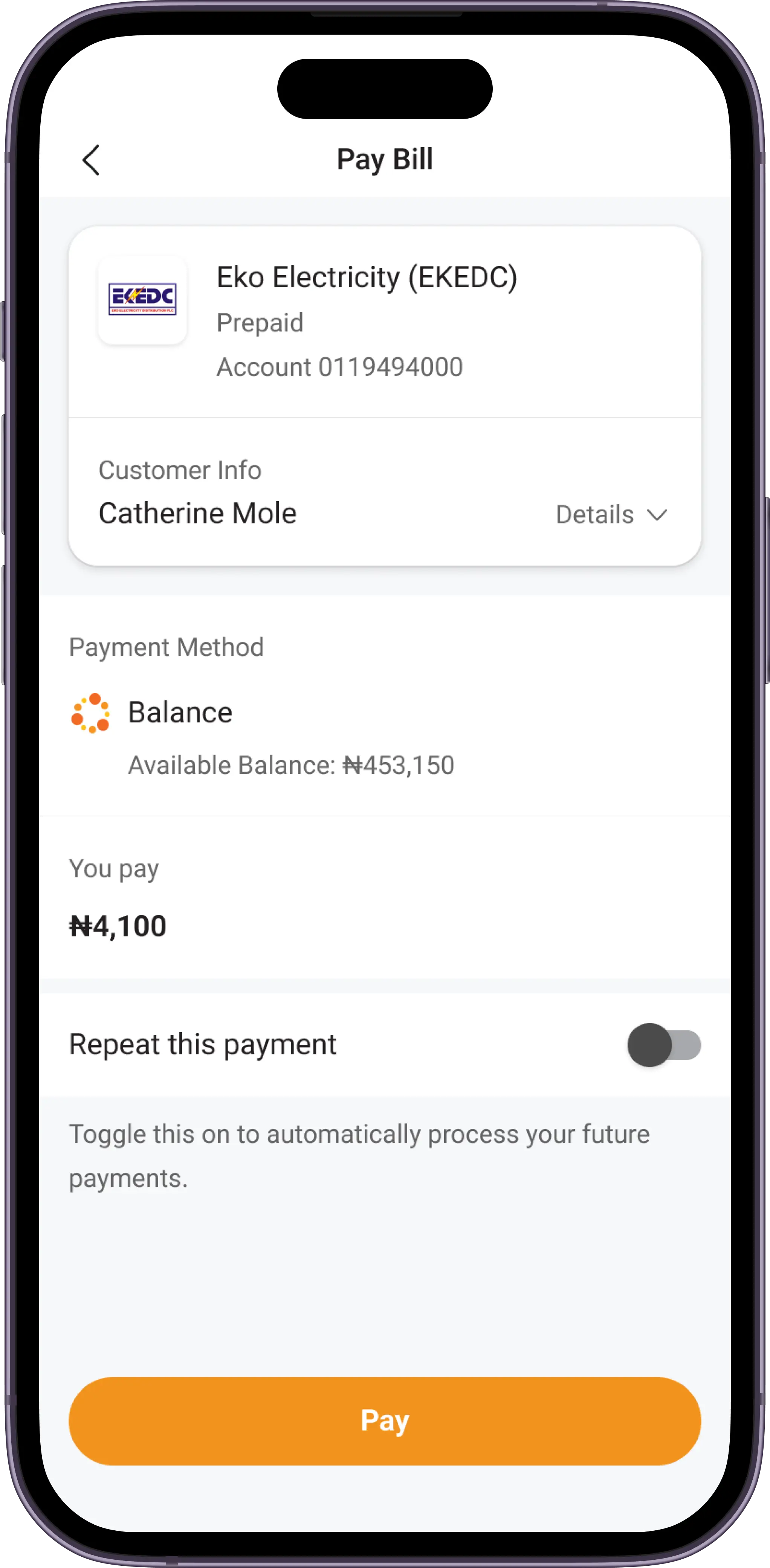

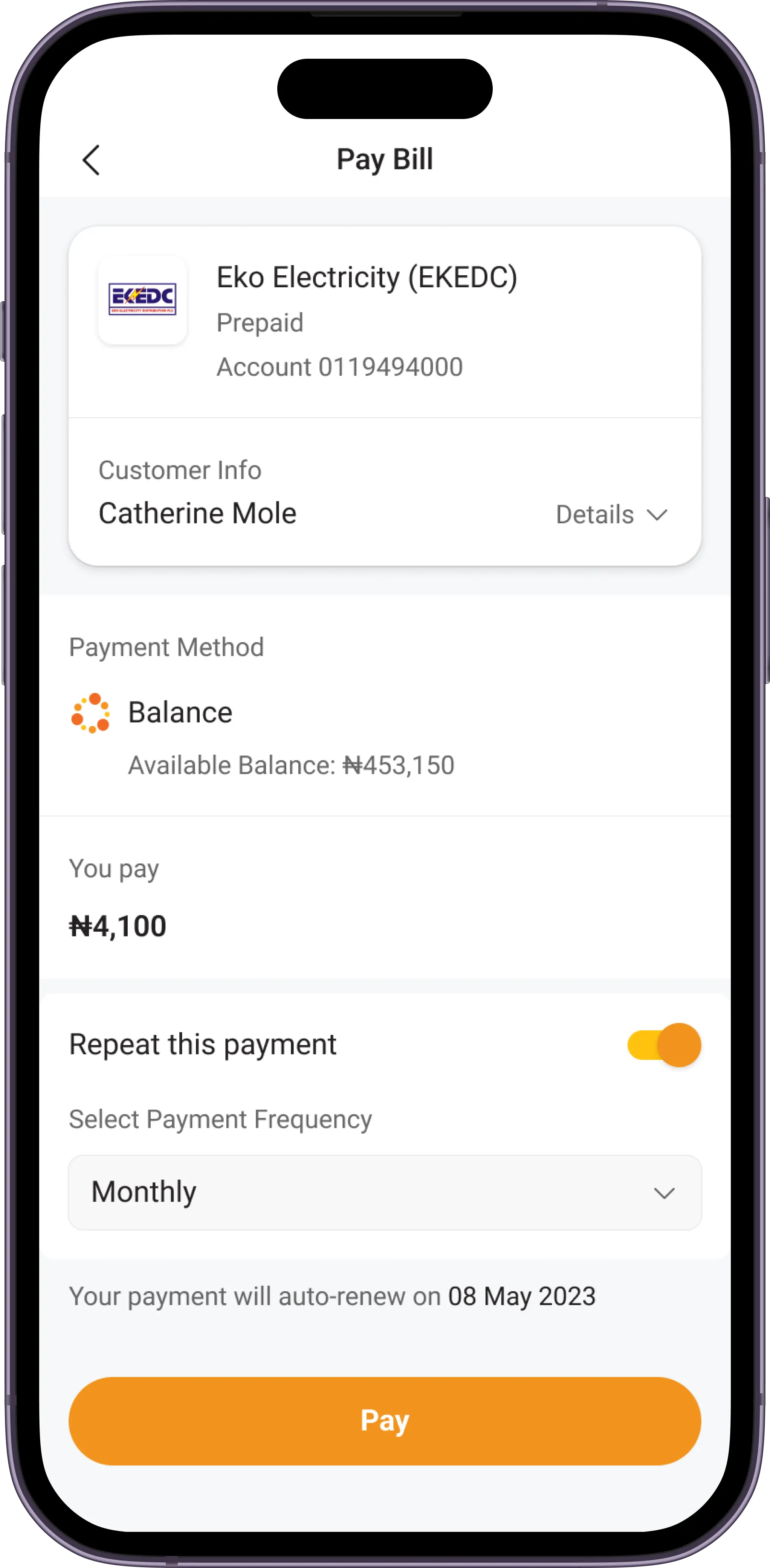

In a bid to achieve flexibility, the feature can be activated directly from the dashboard as well as during an ongoing payment flow.

Setting up a RP from the dashboard

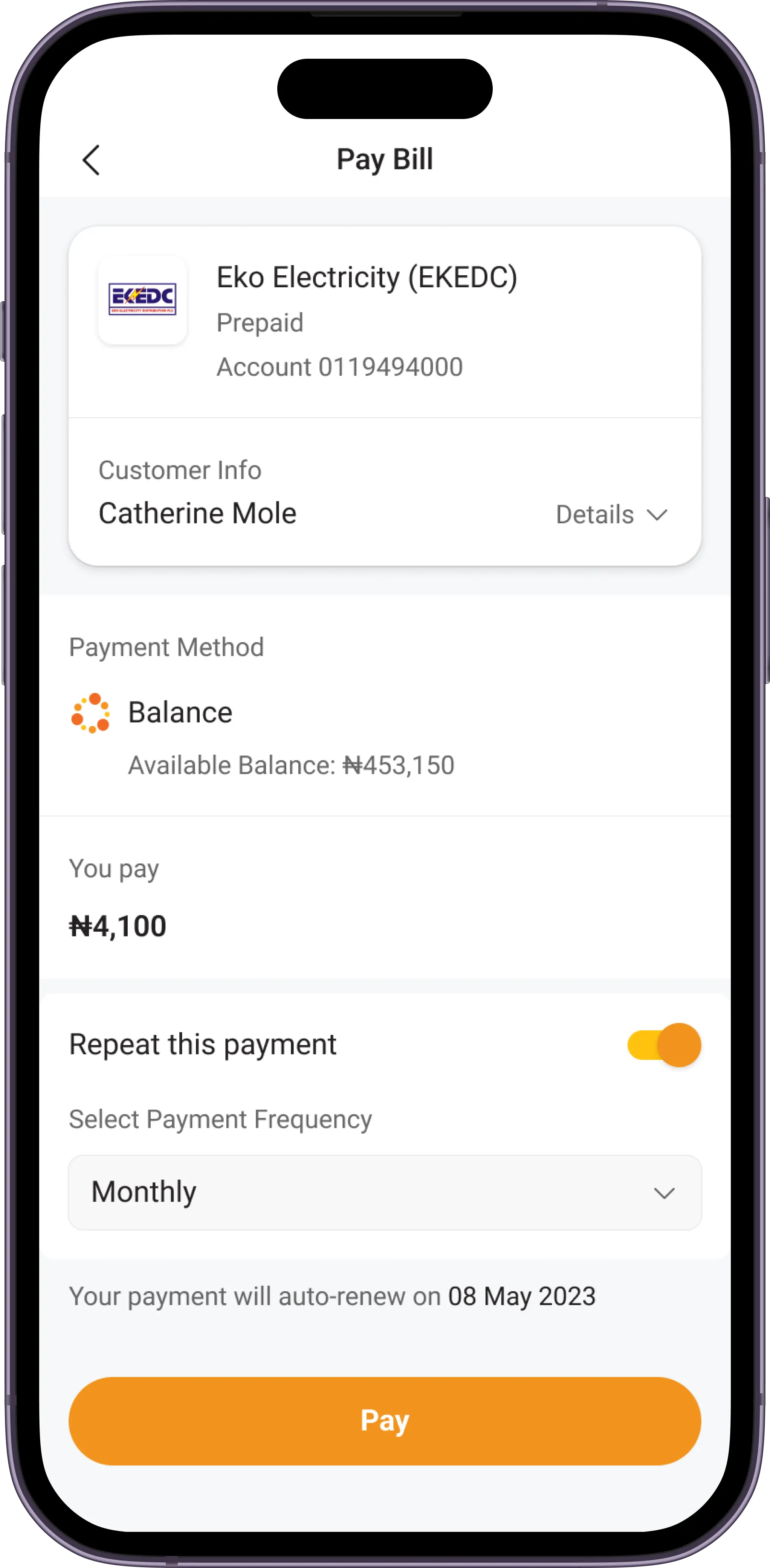

Setting up a RP during payment

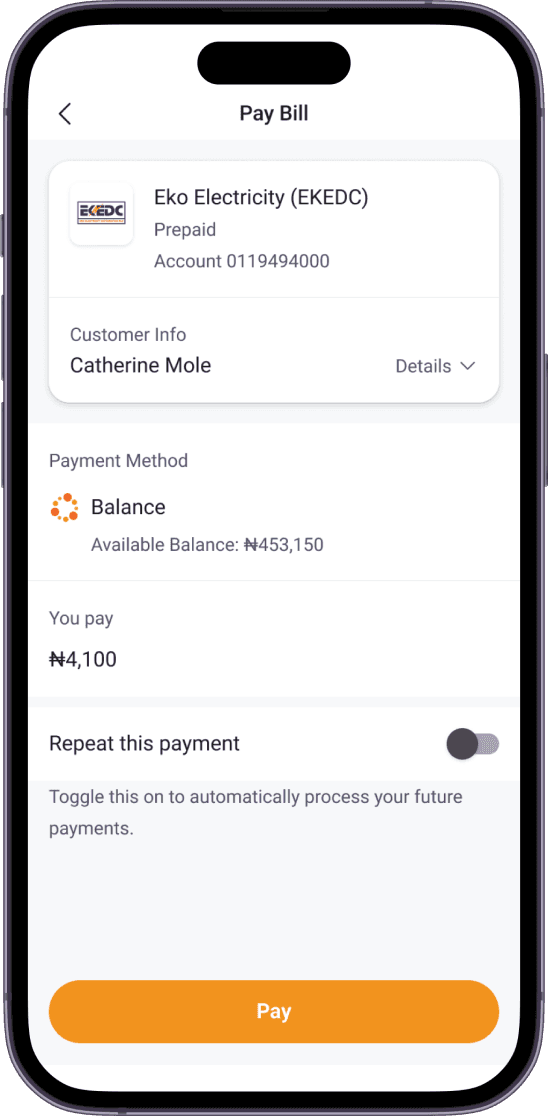

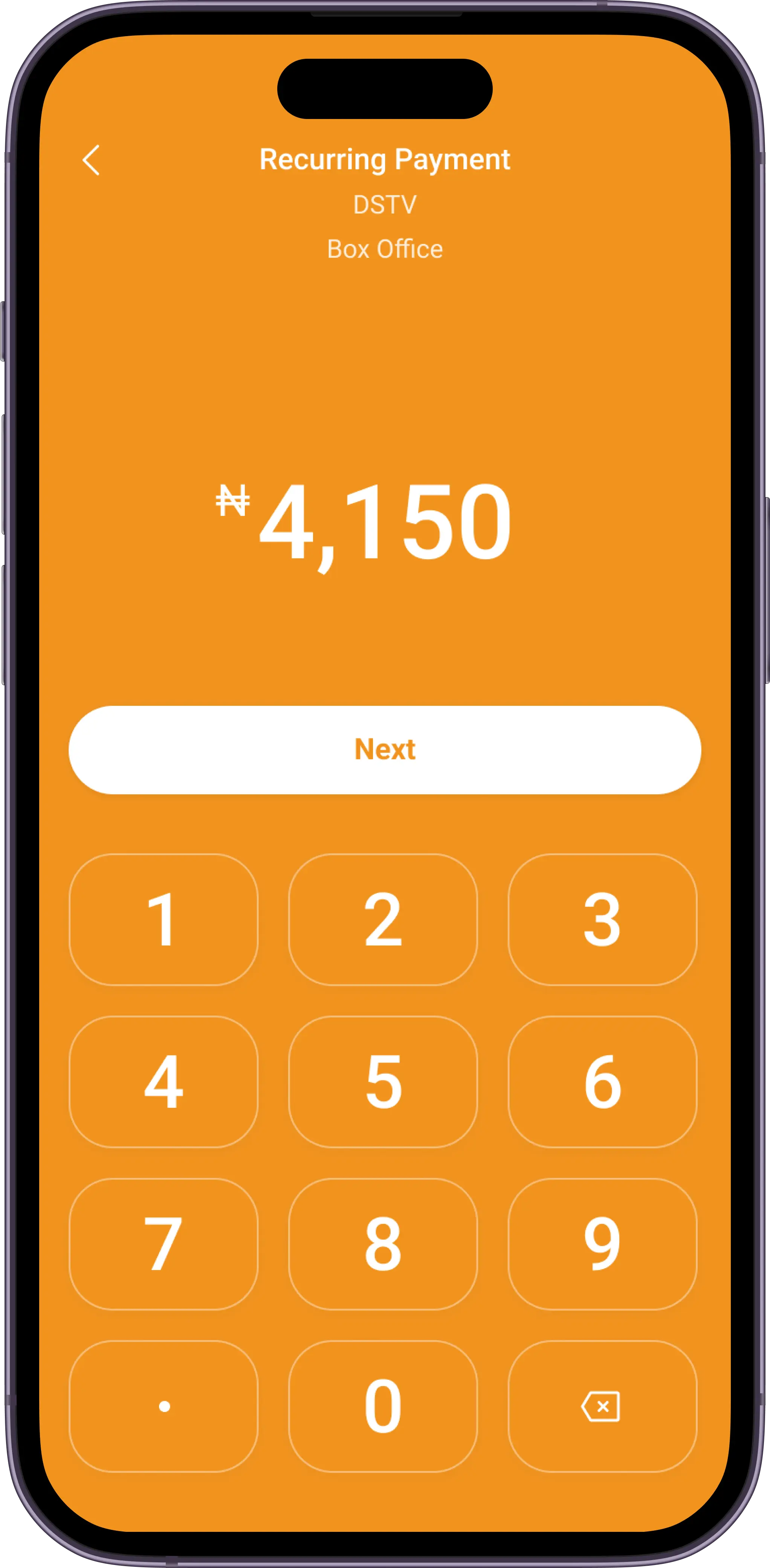

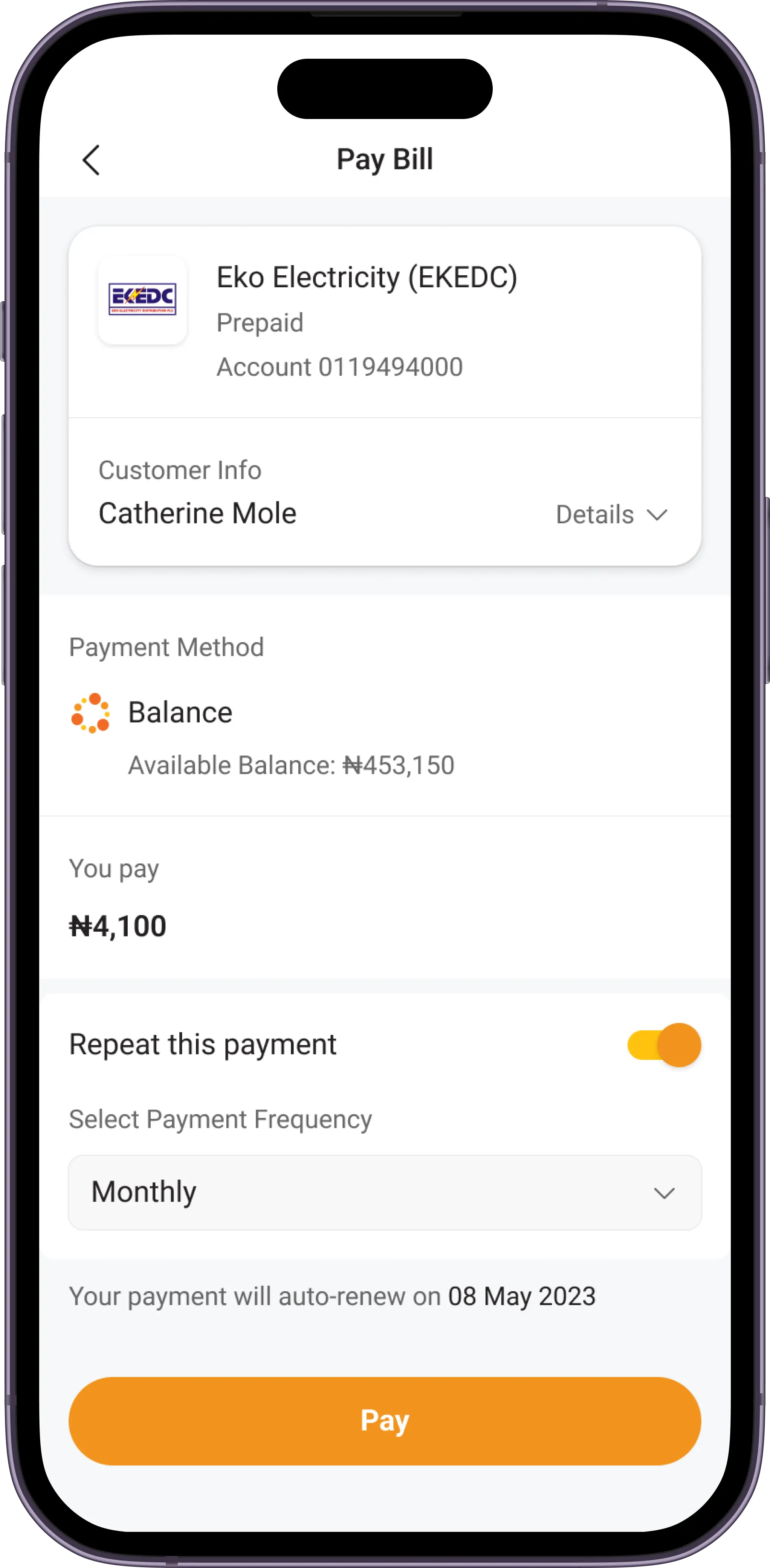

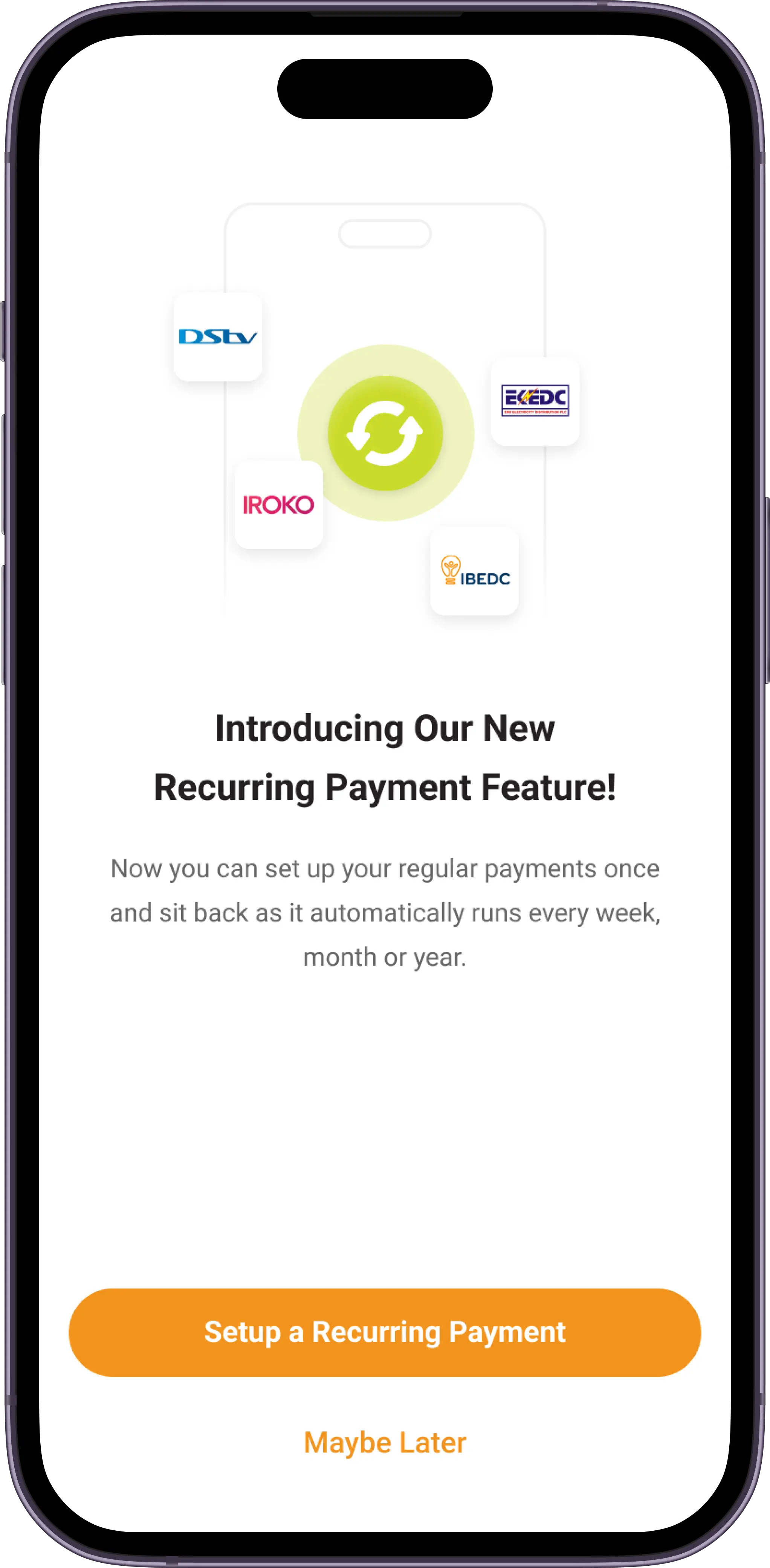

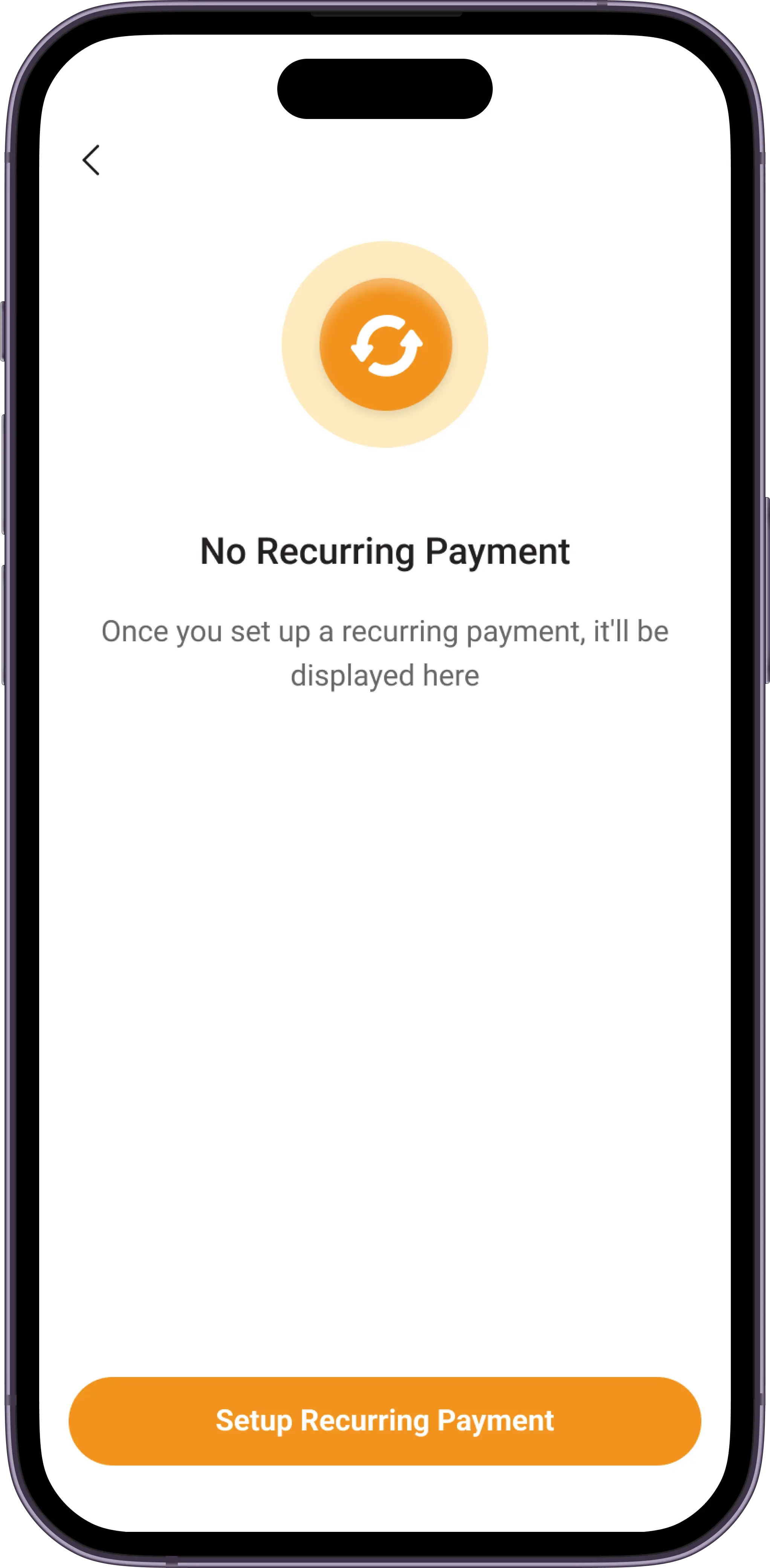

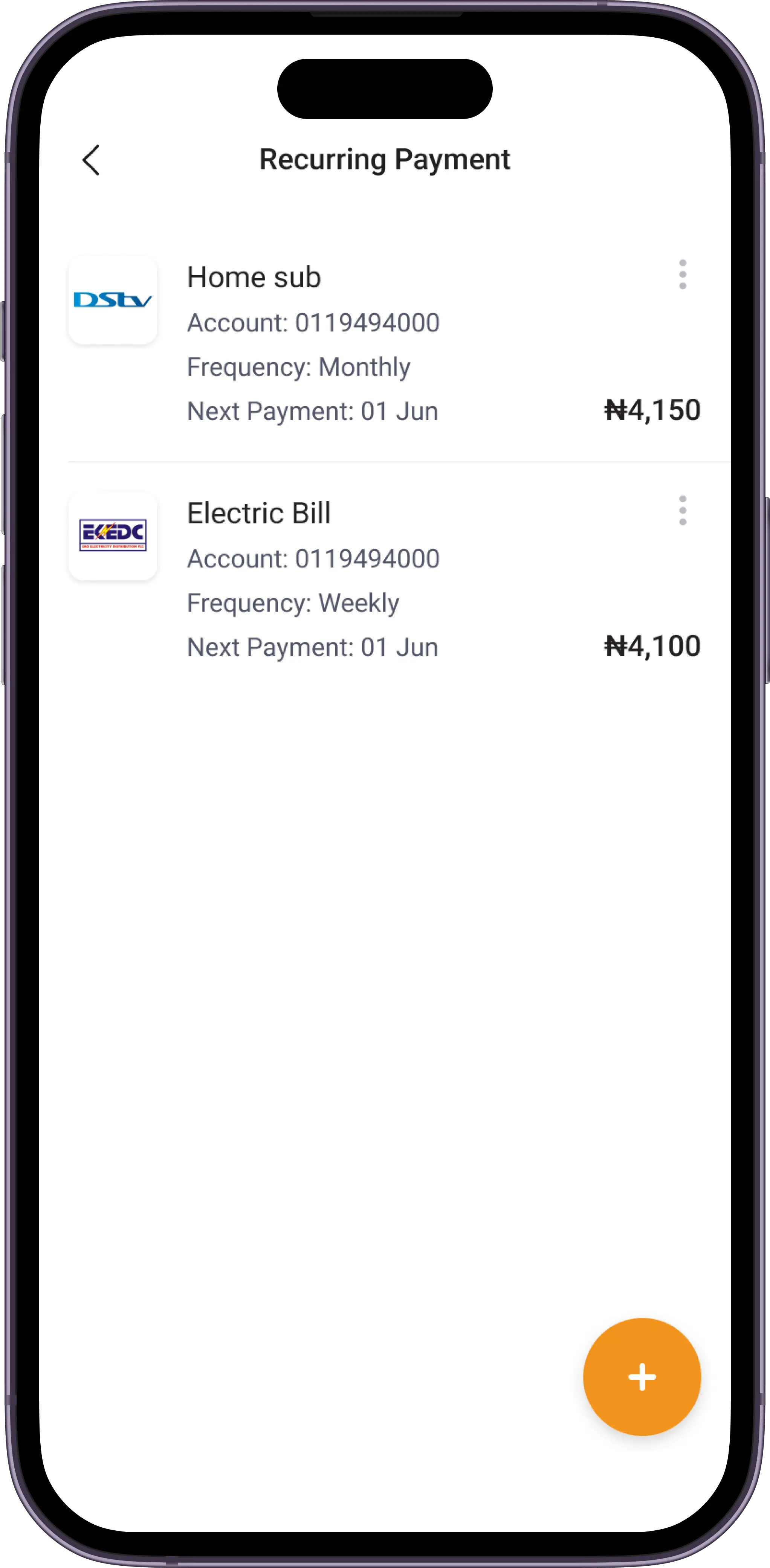

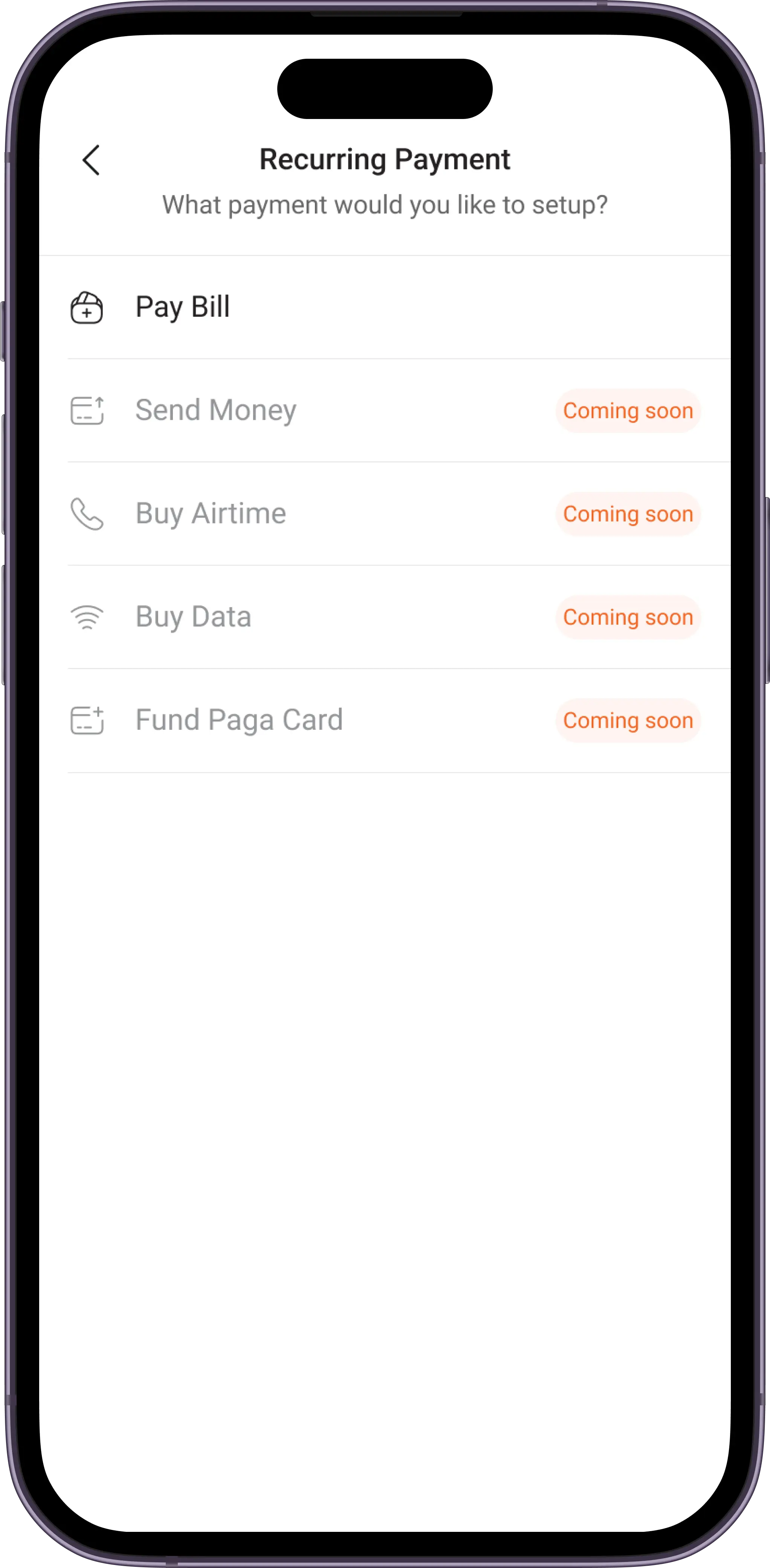

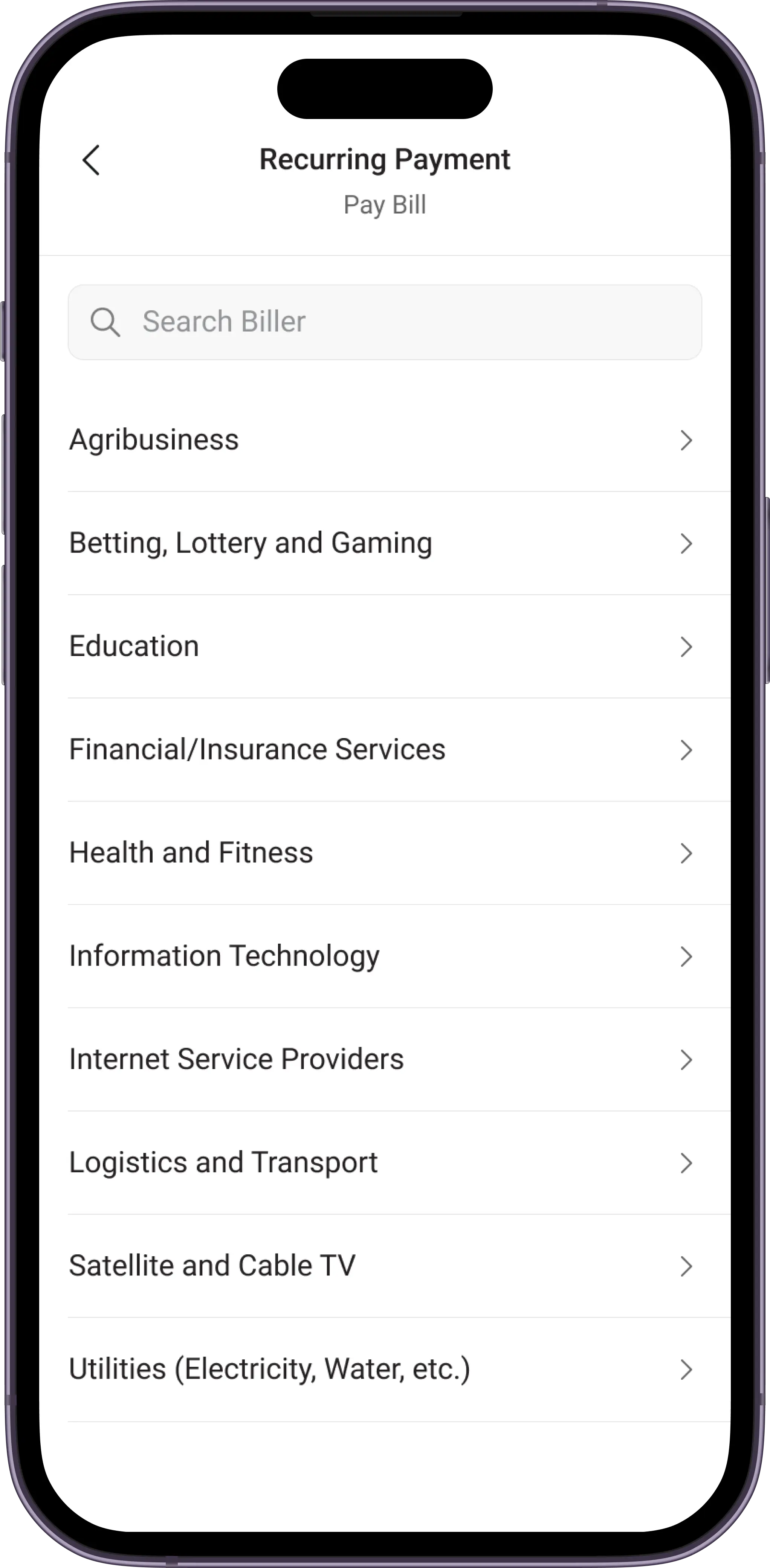

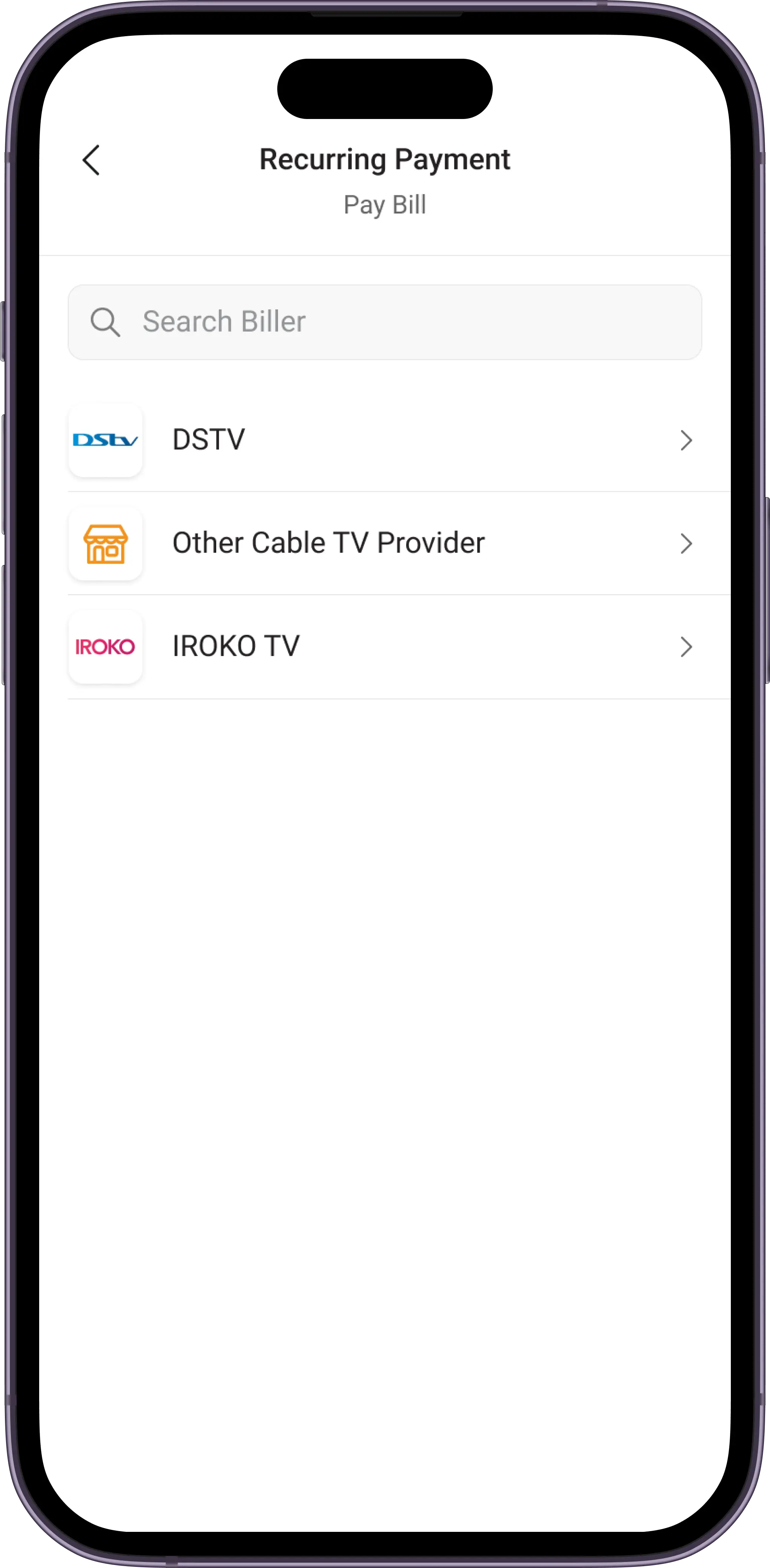

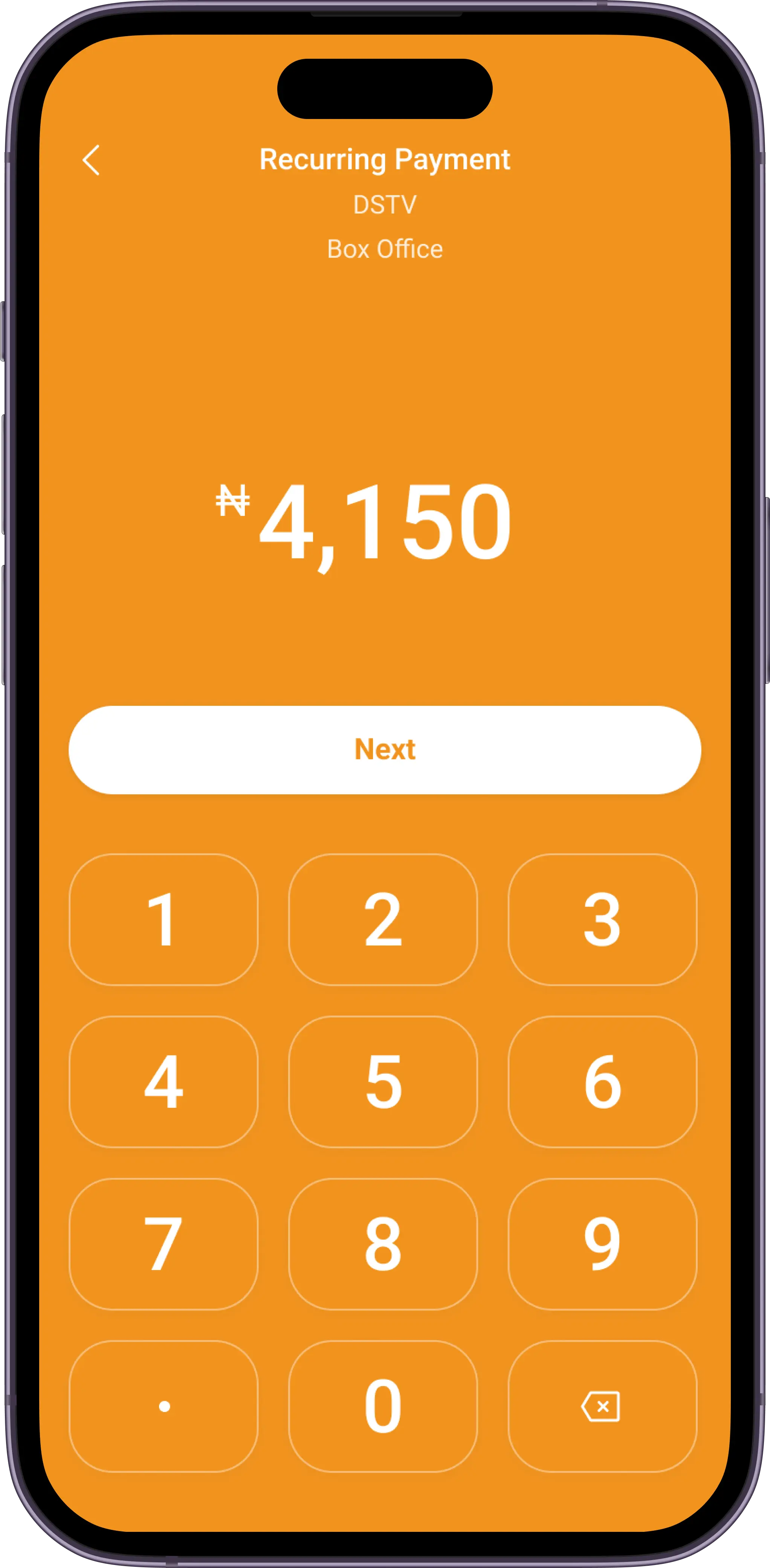

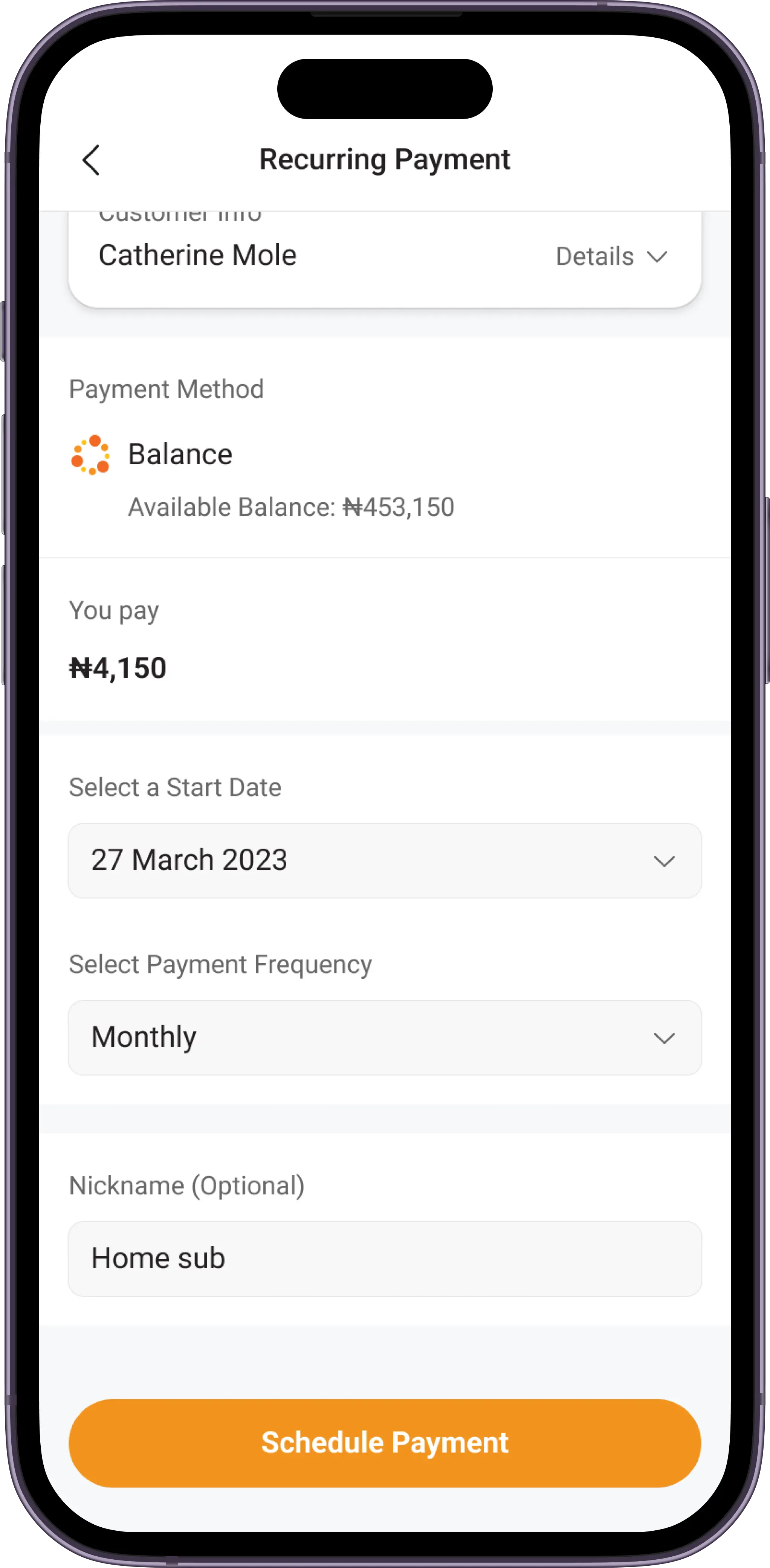

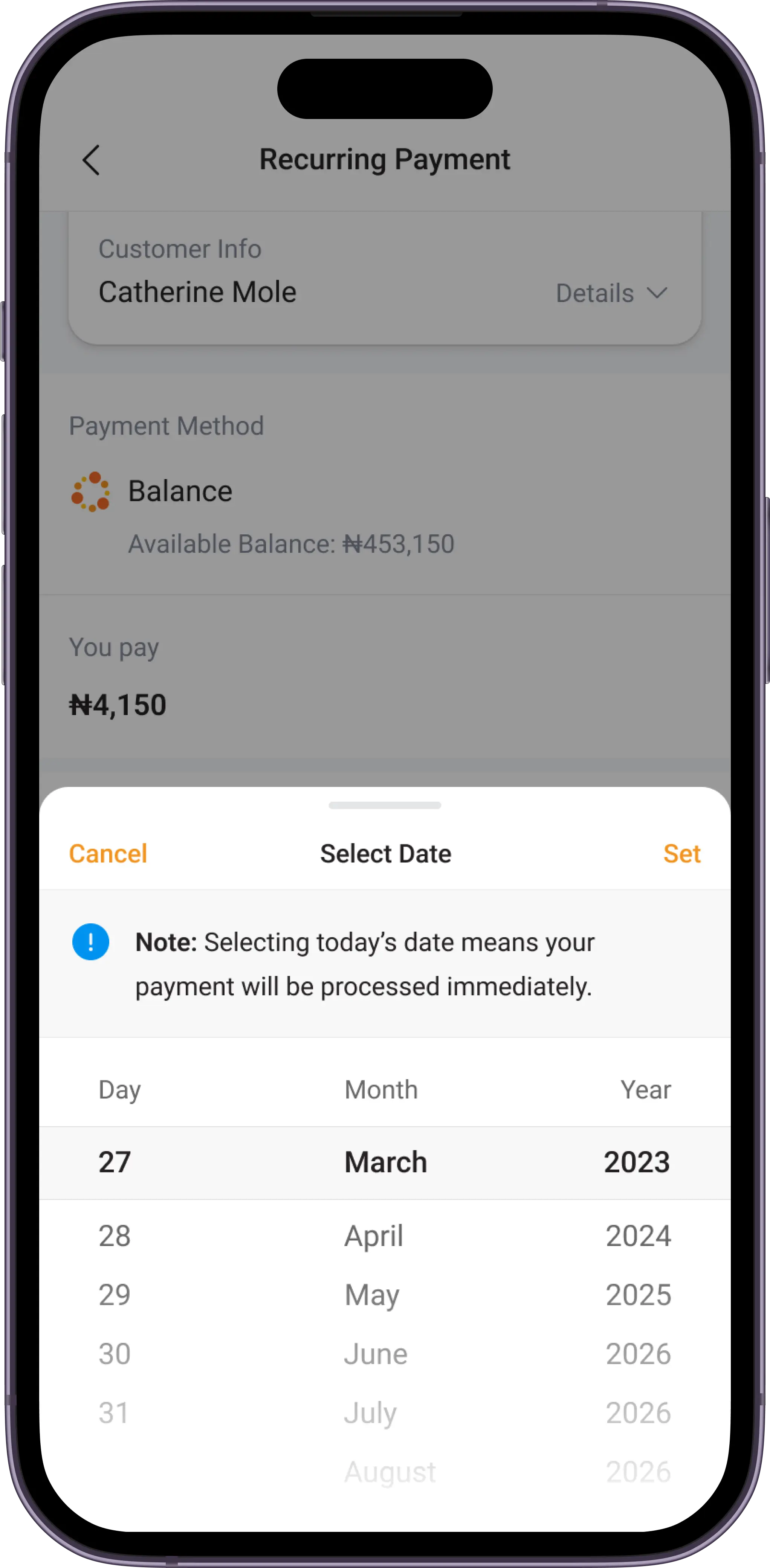

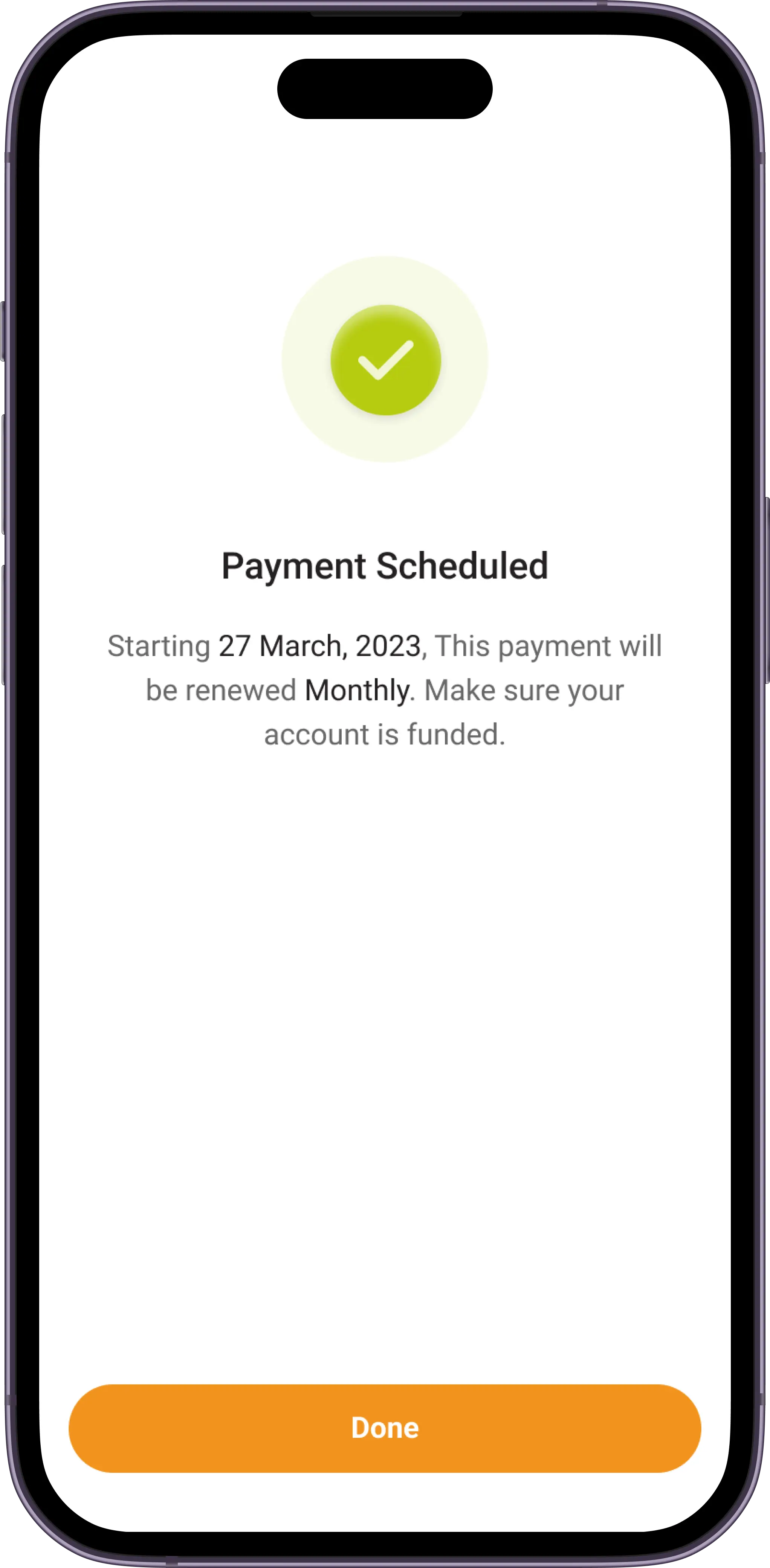

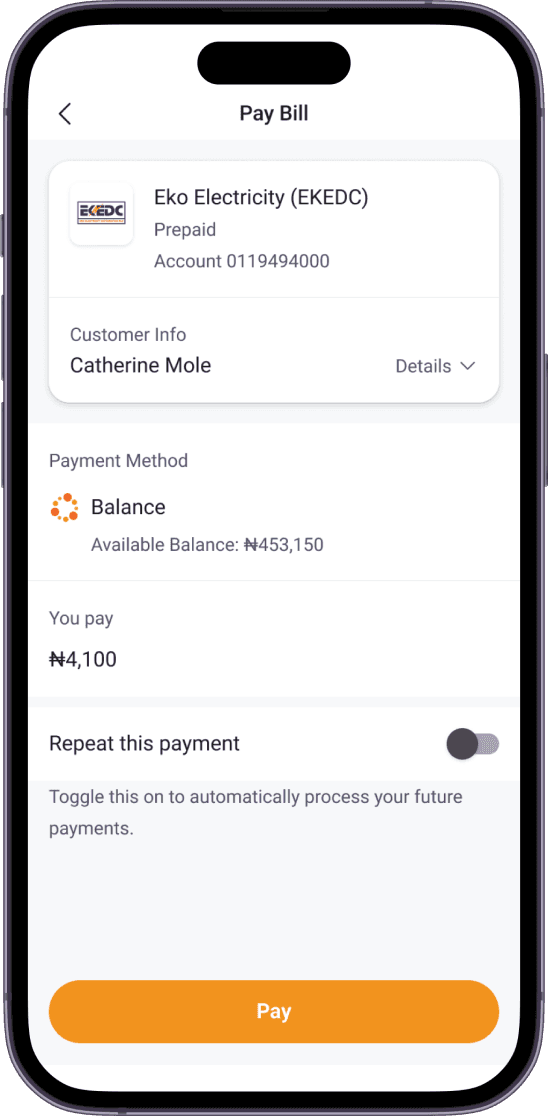

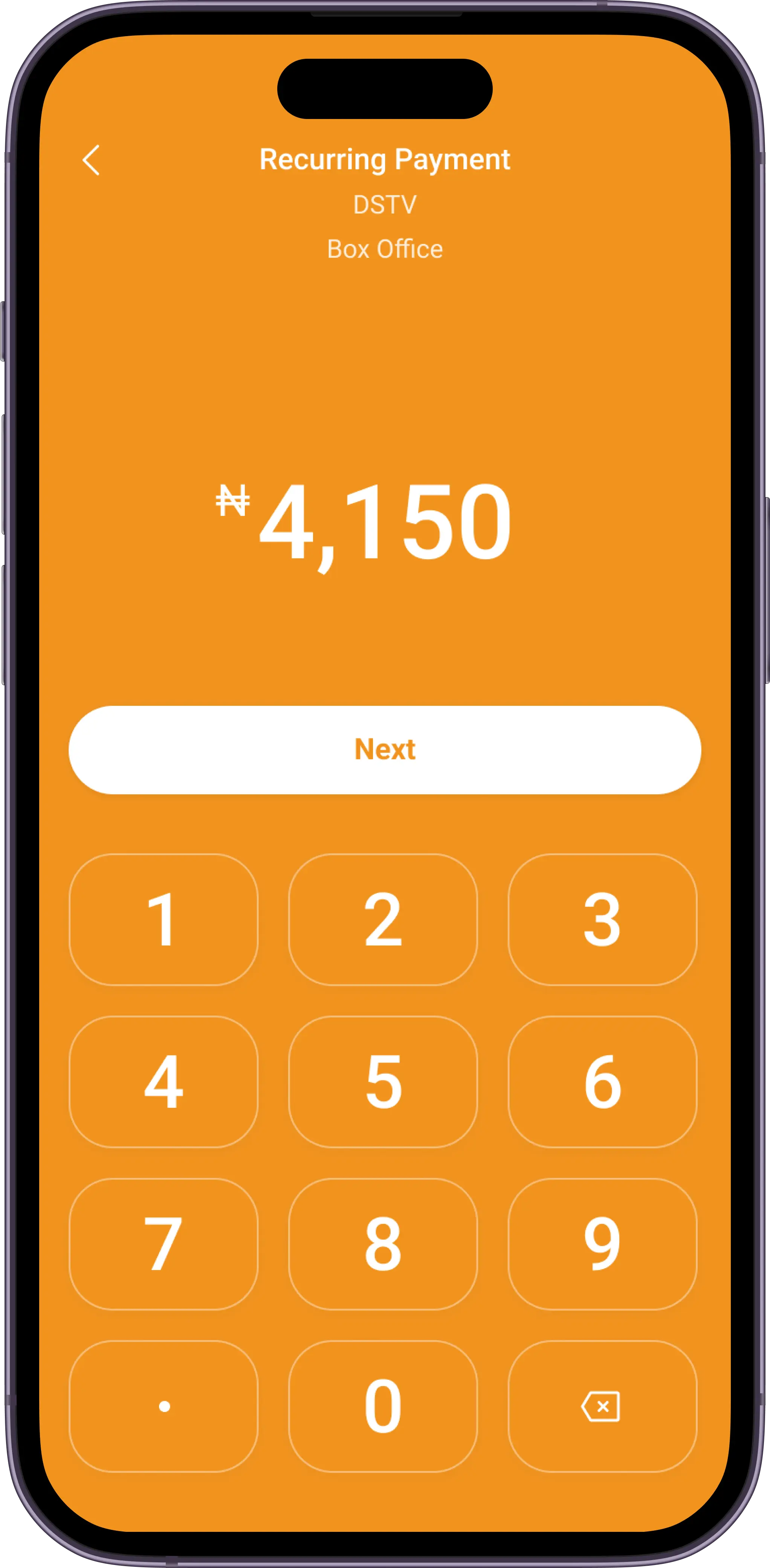

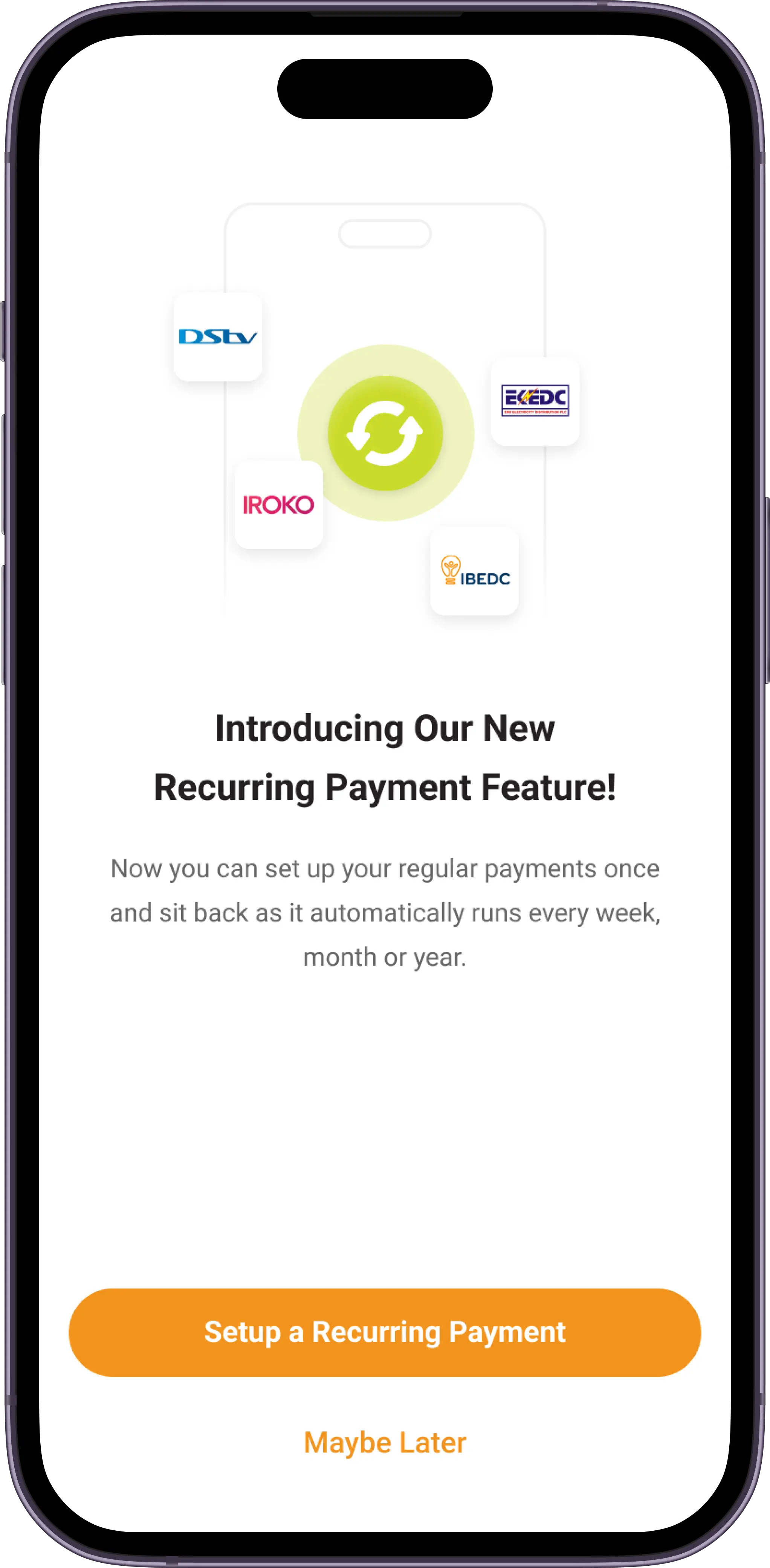

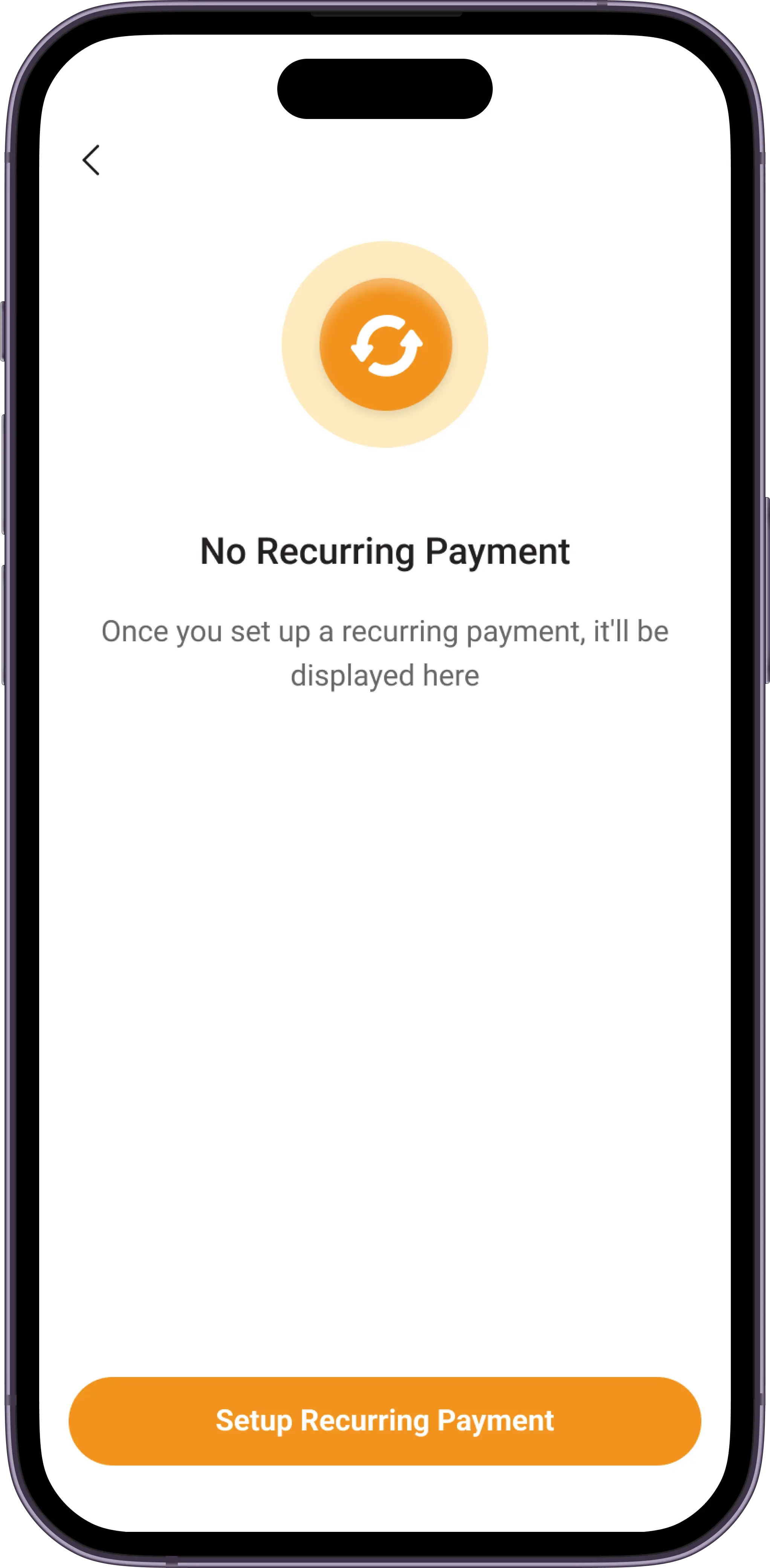

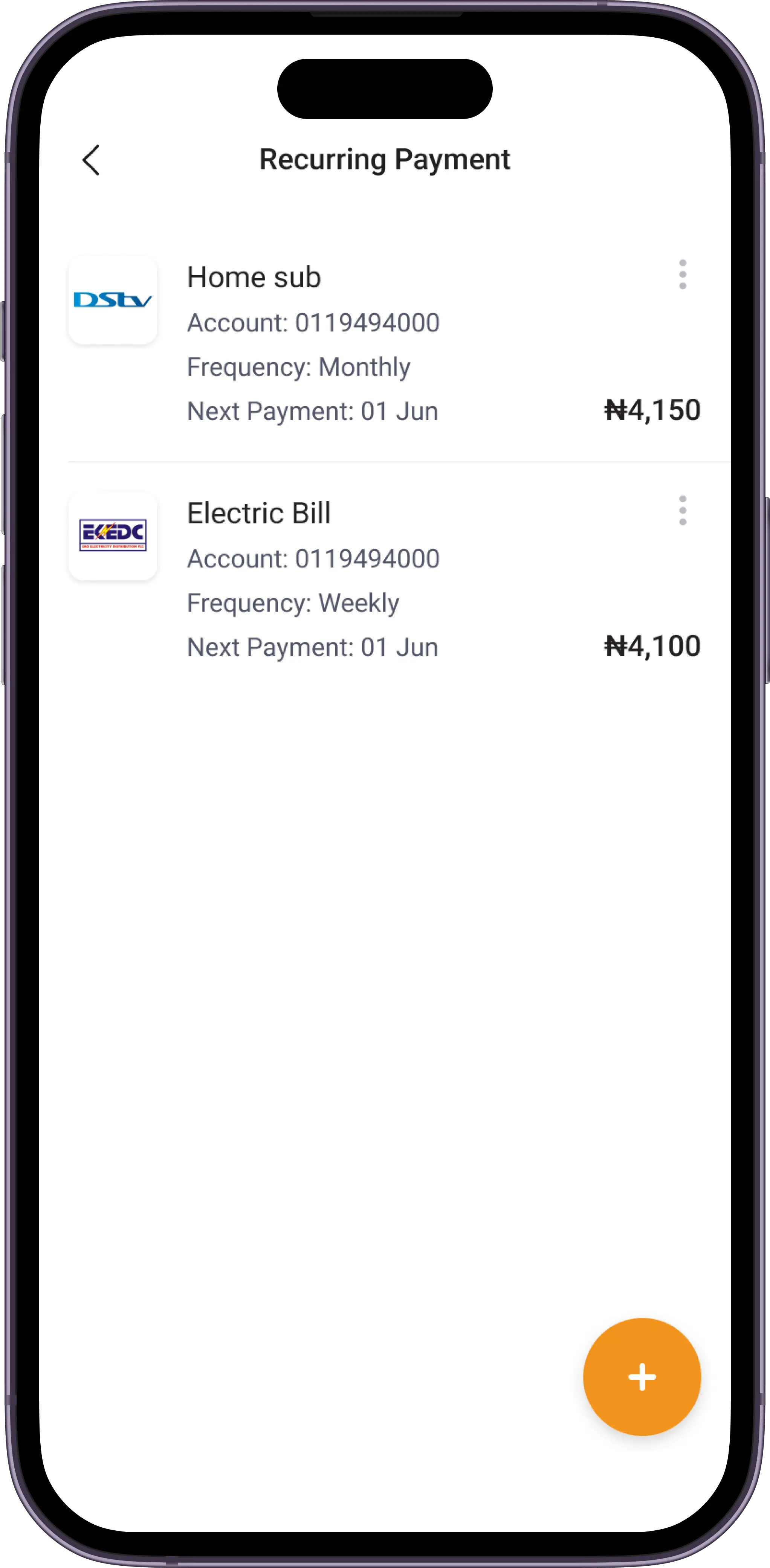

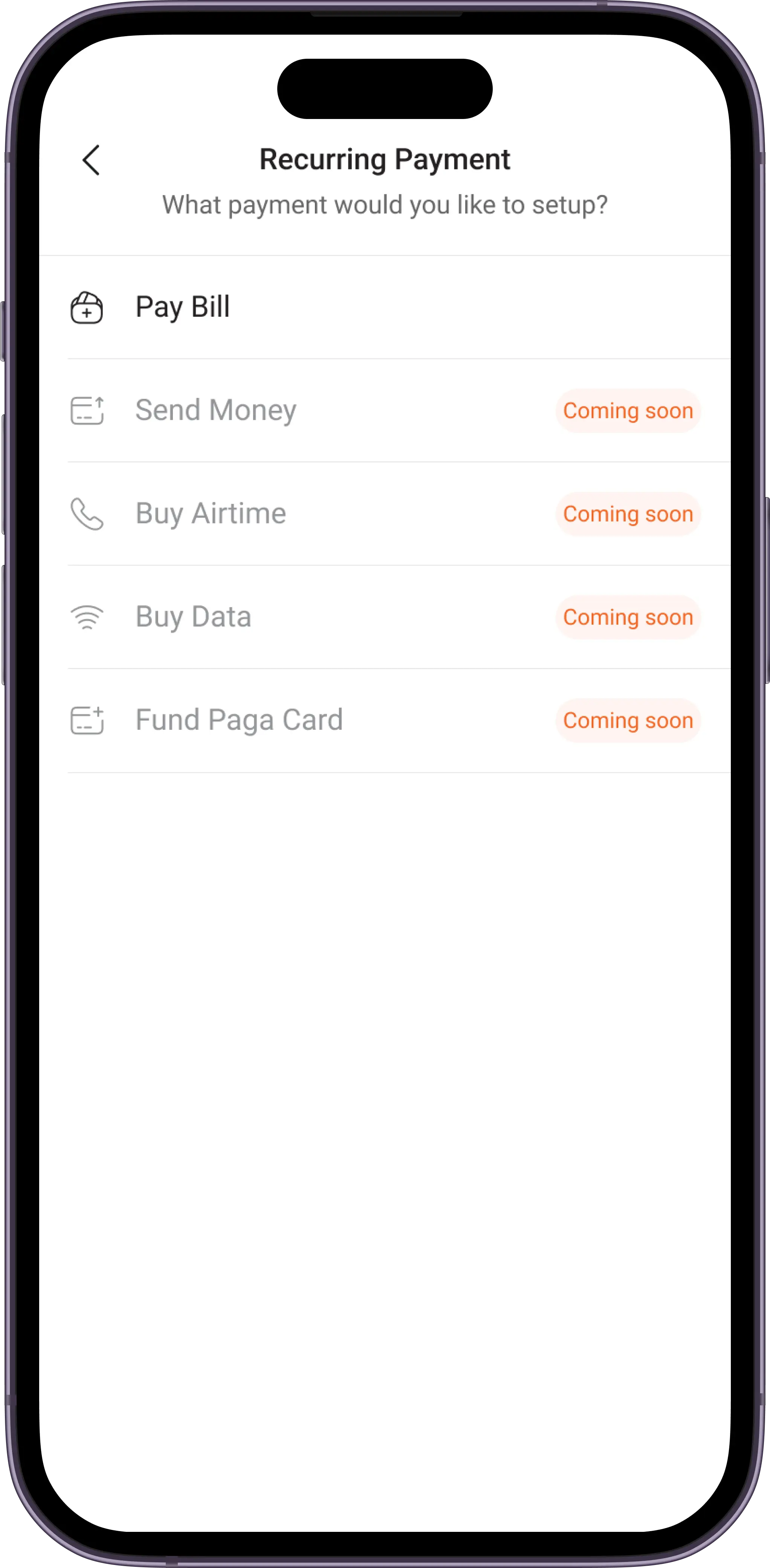

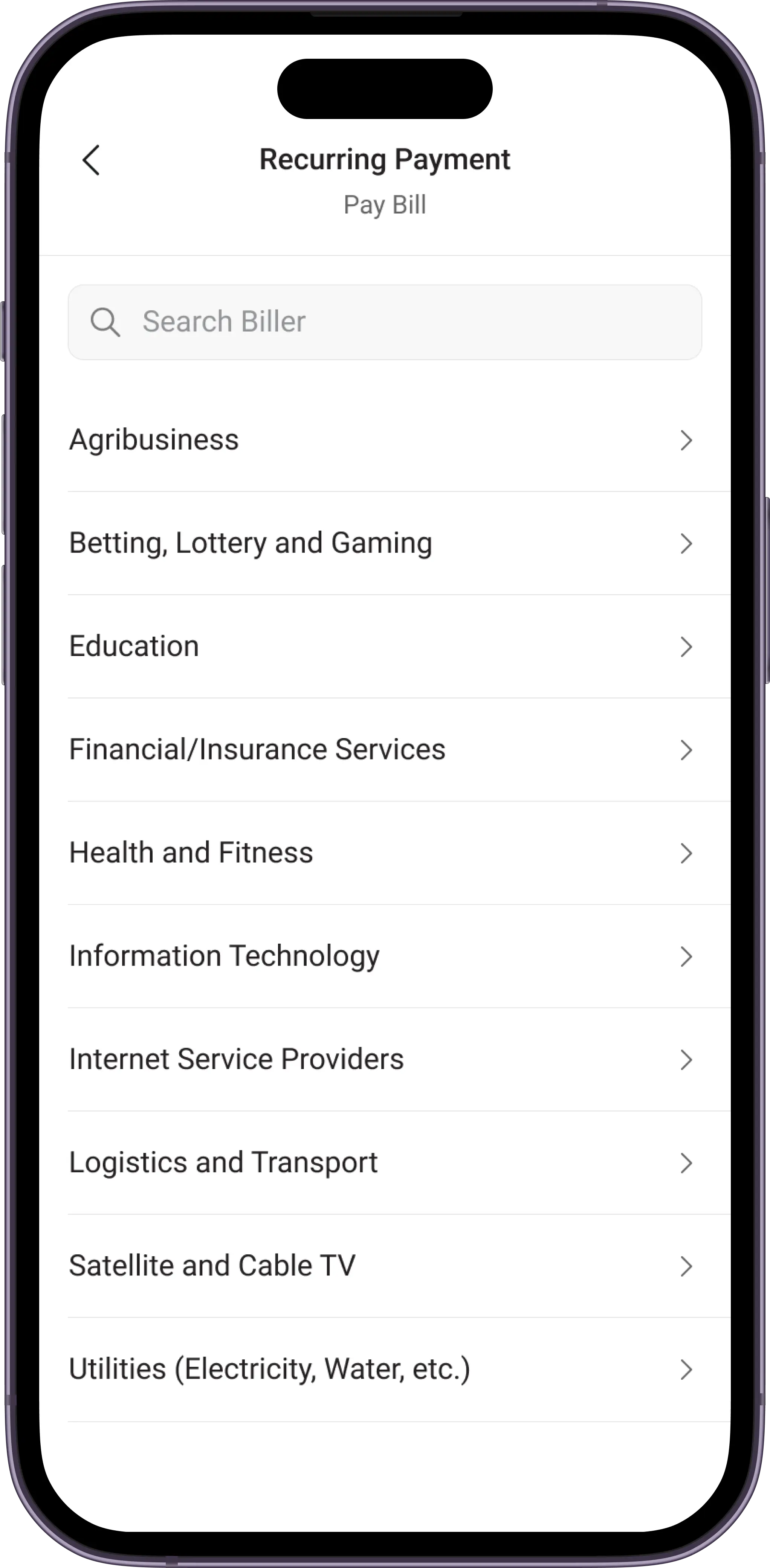

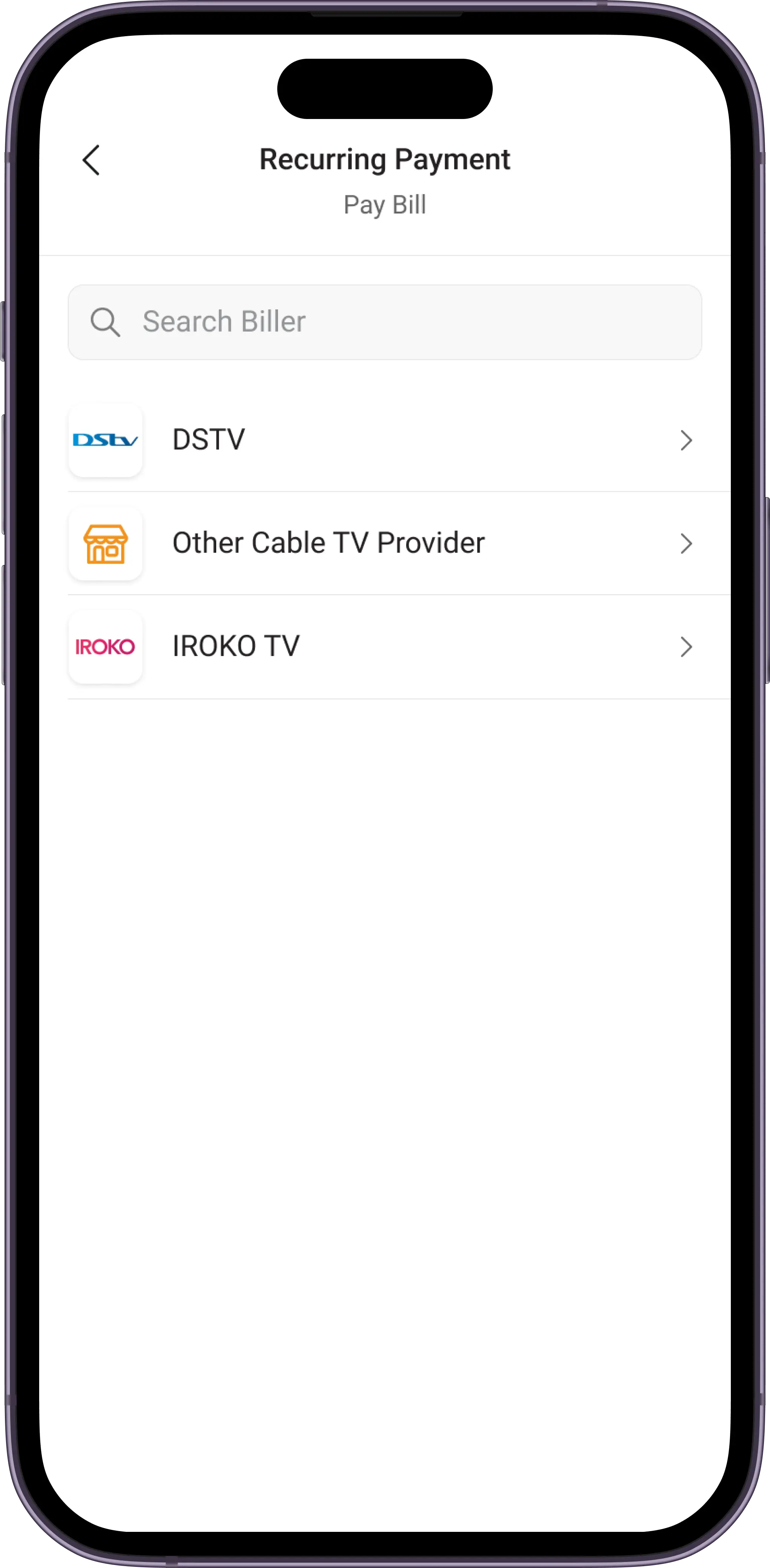

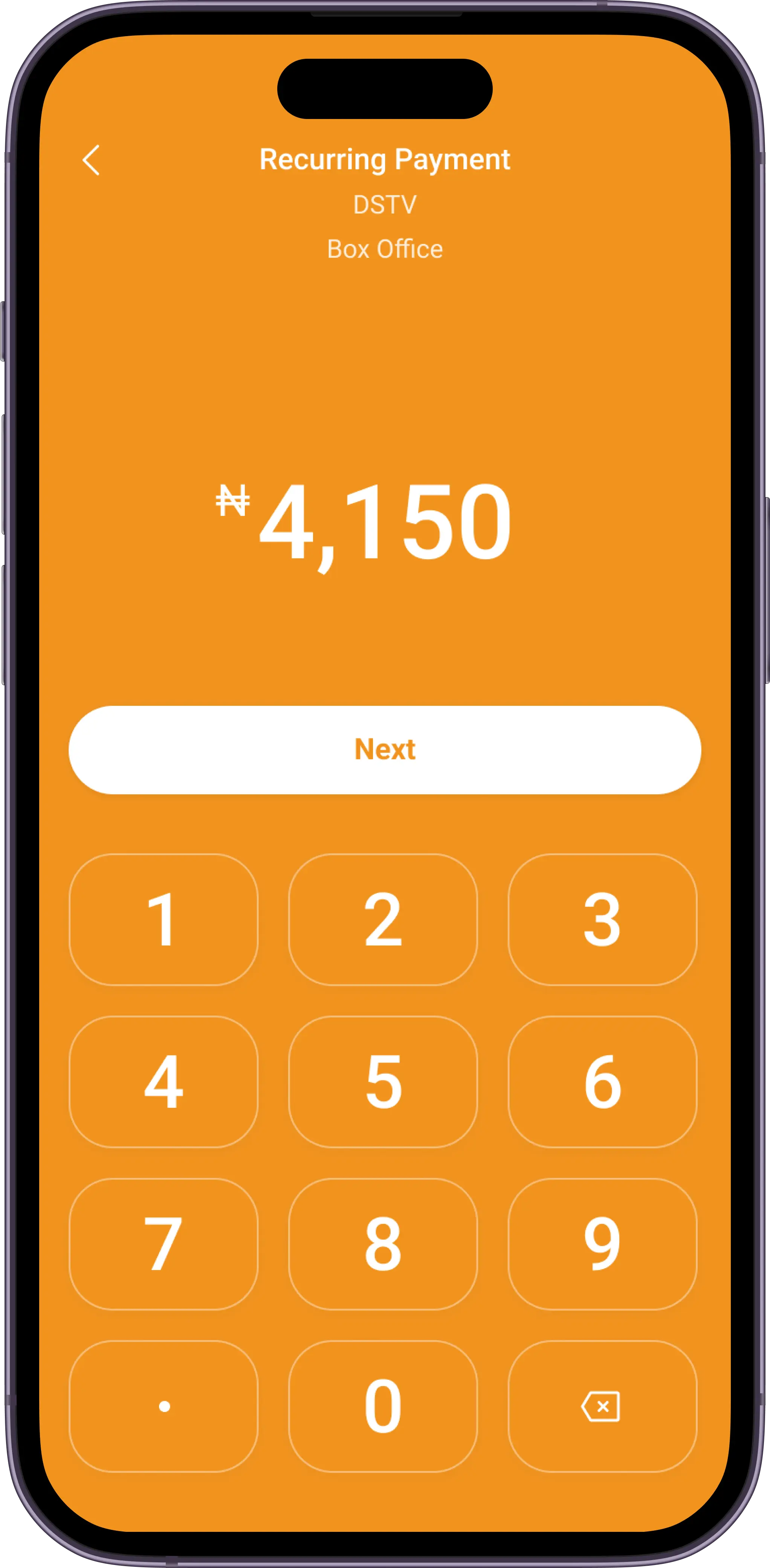

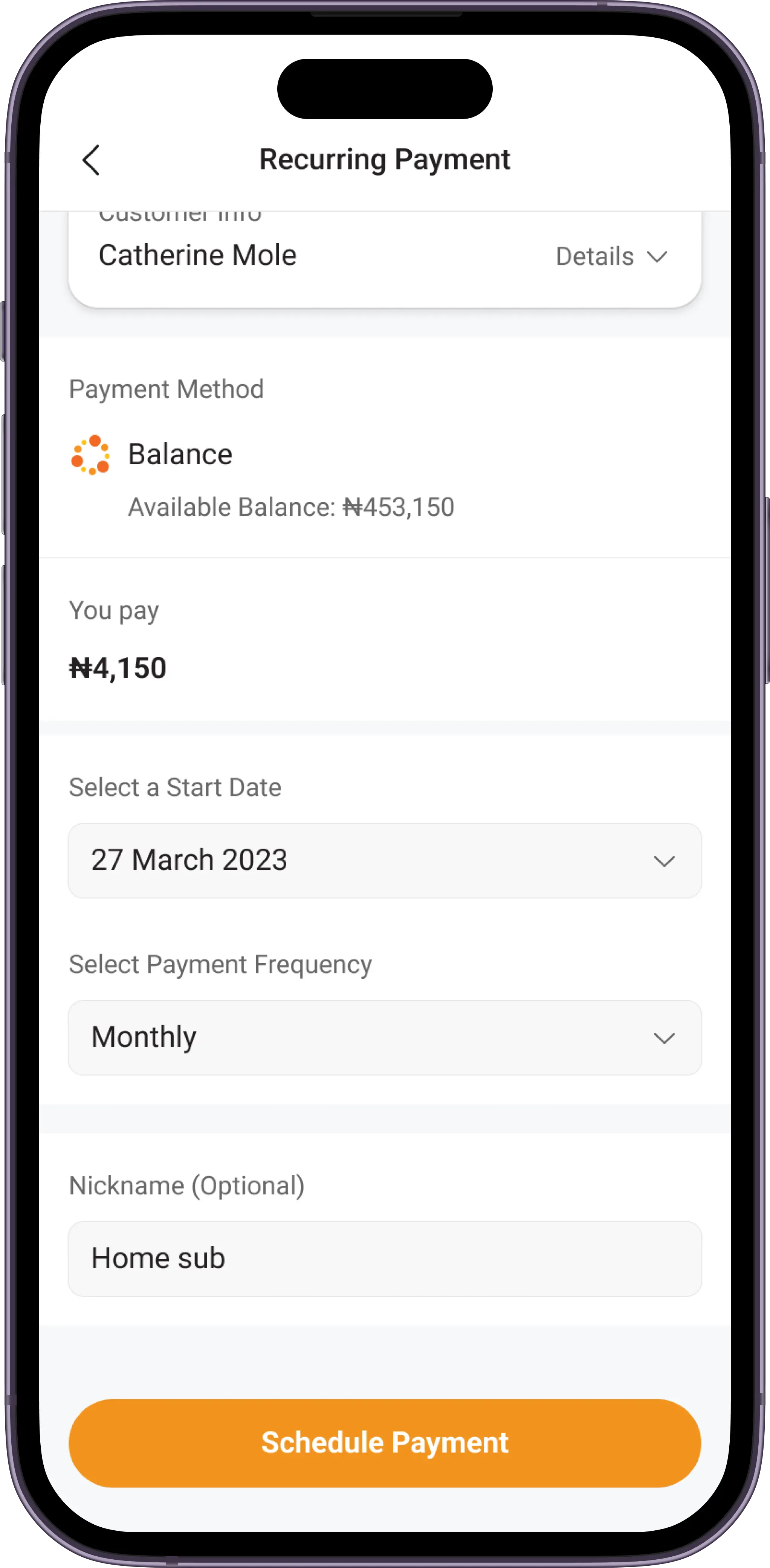

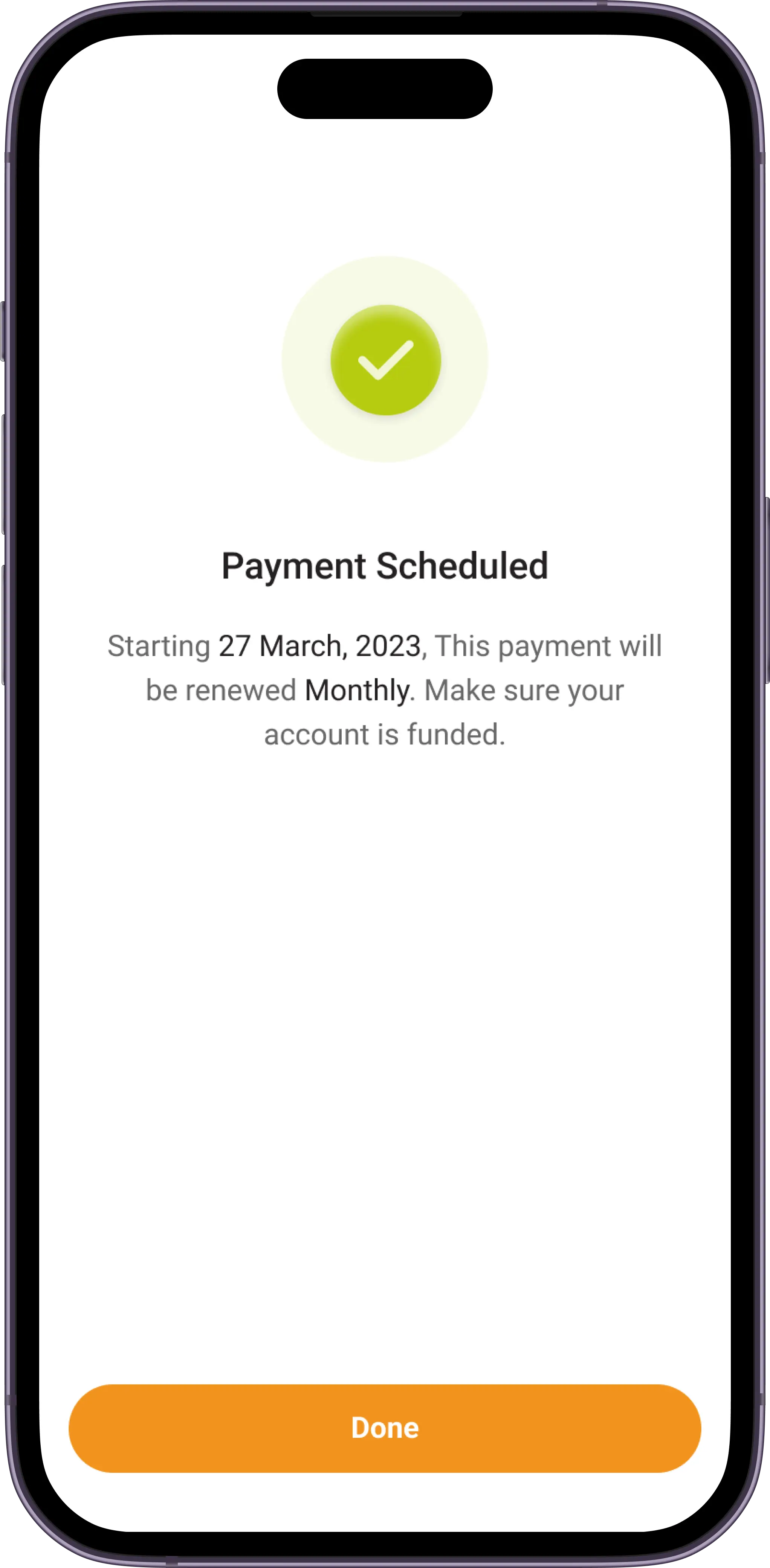

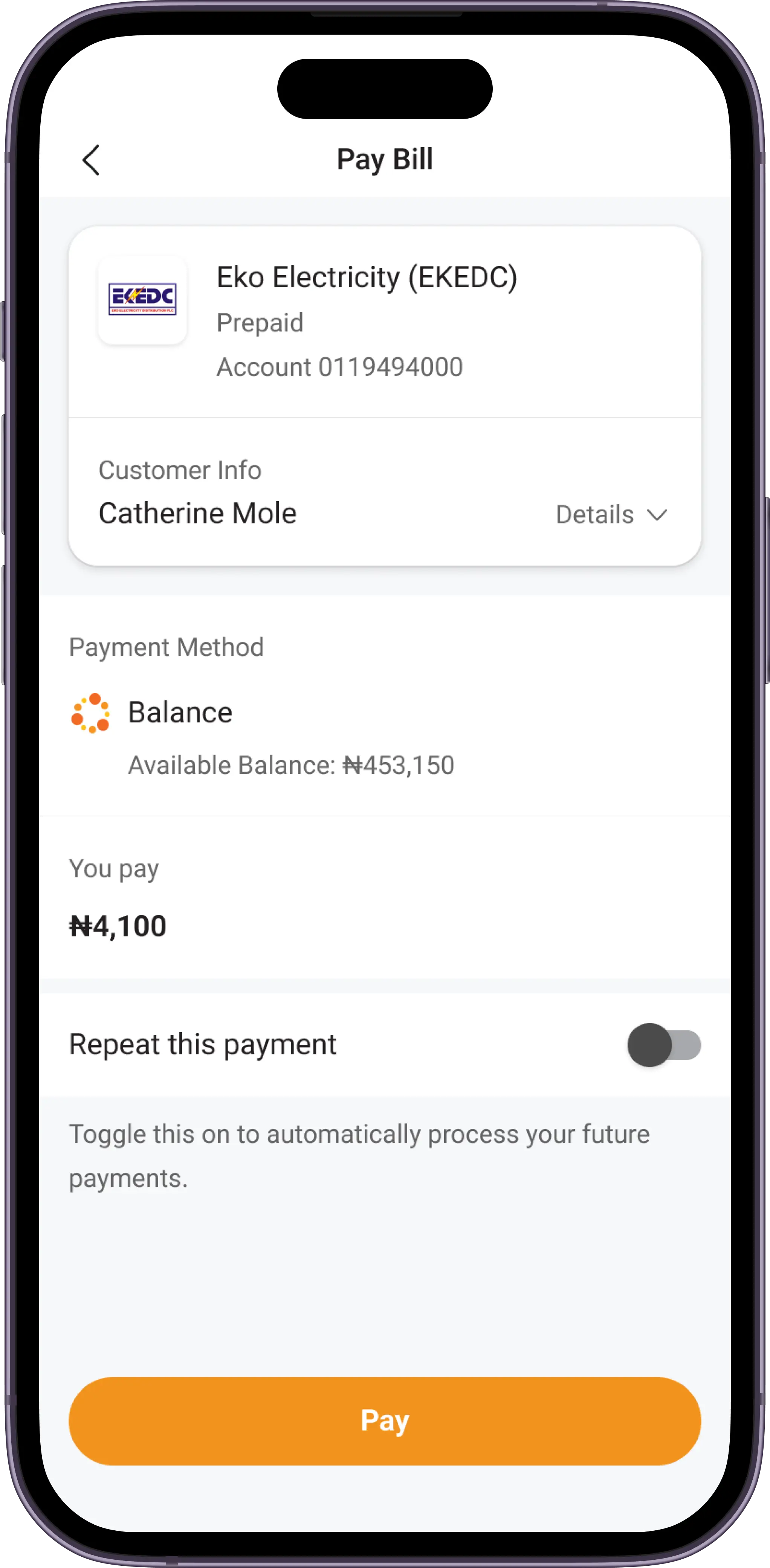

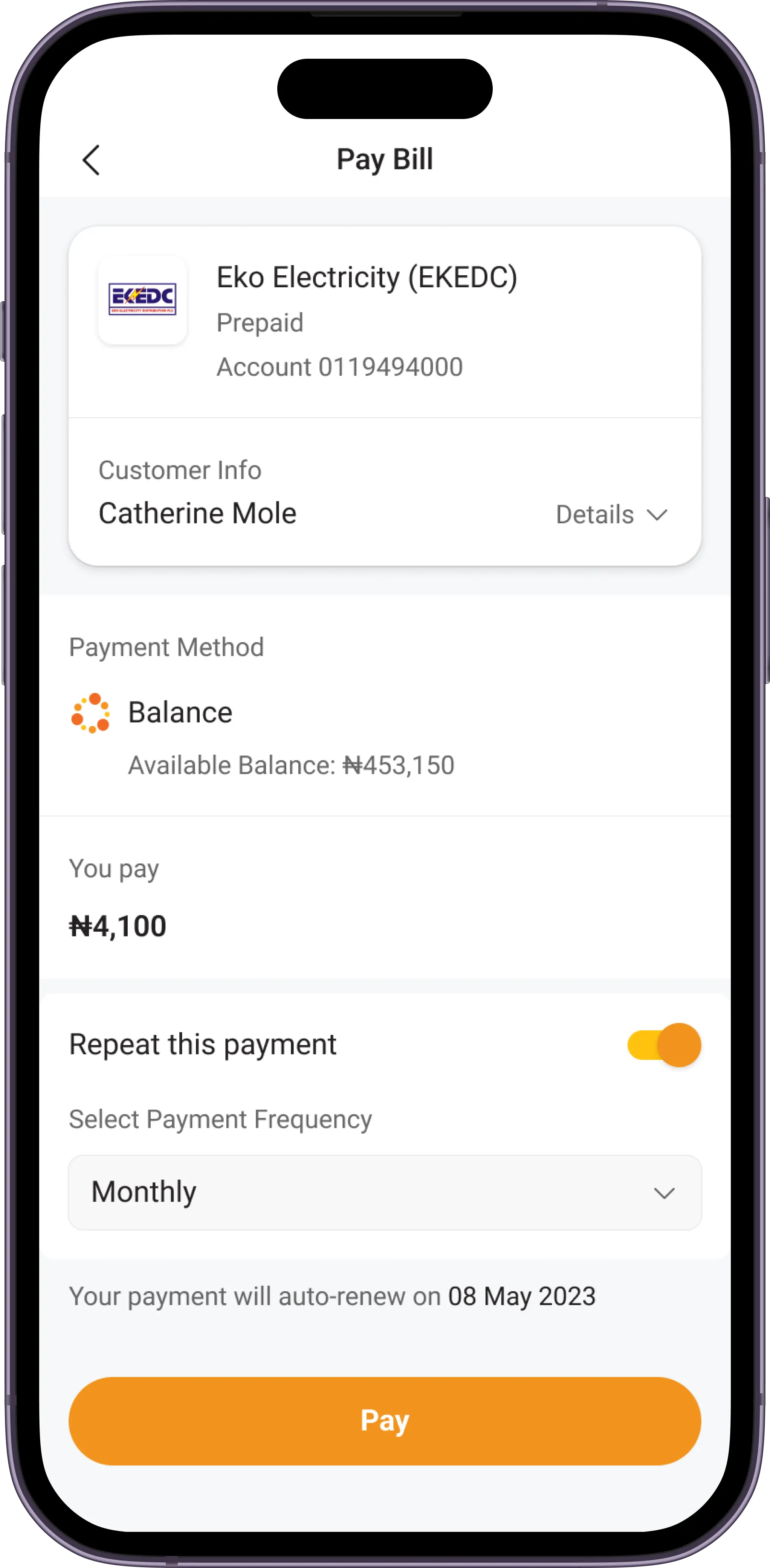

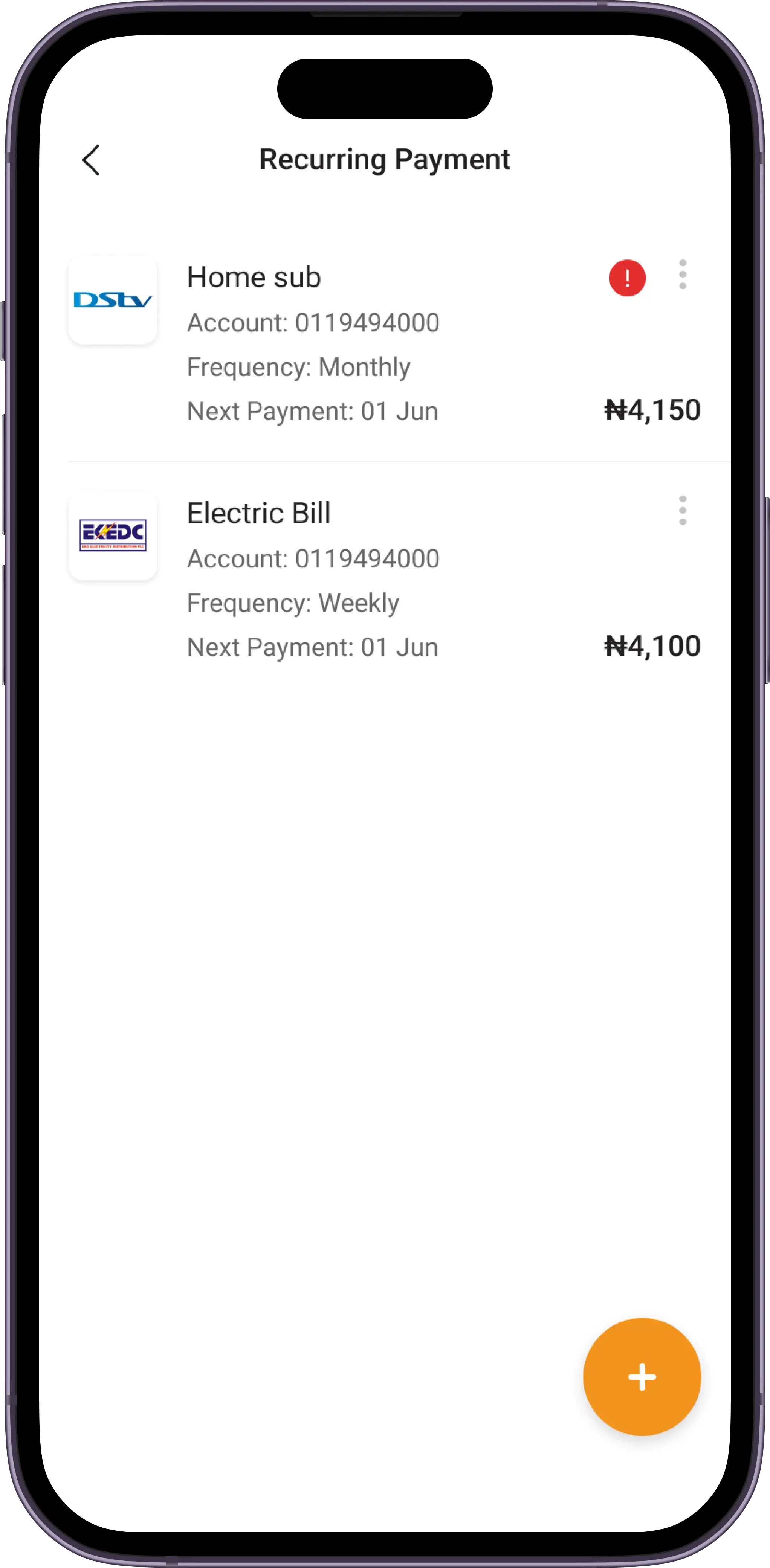

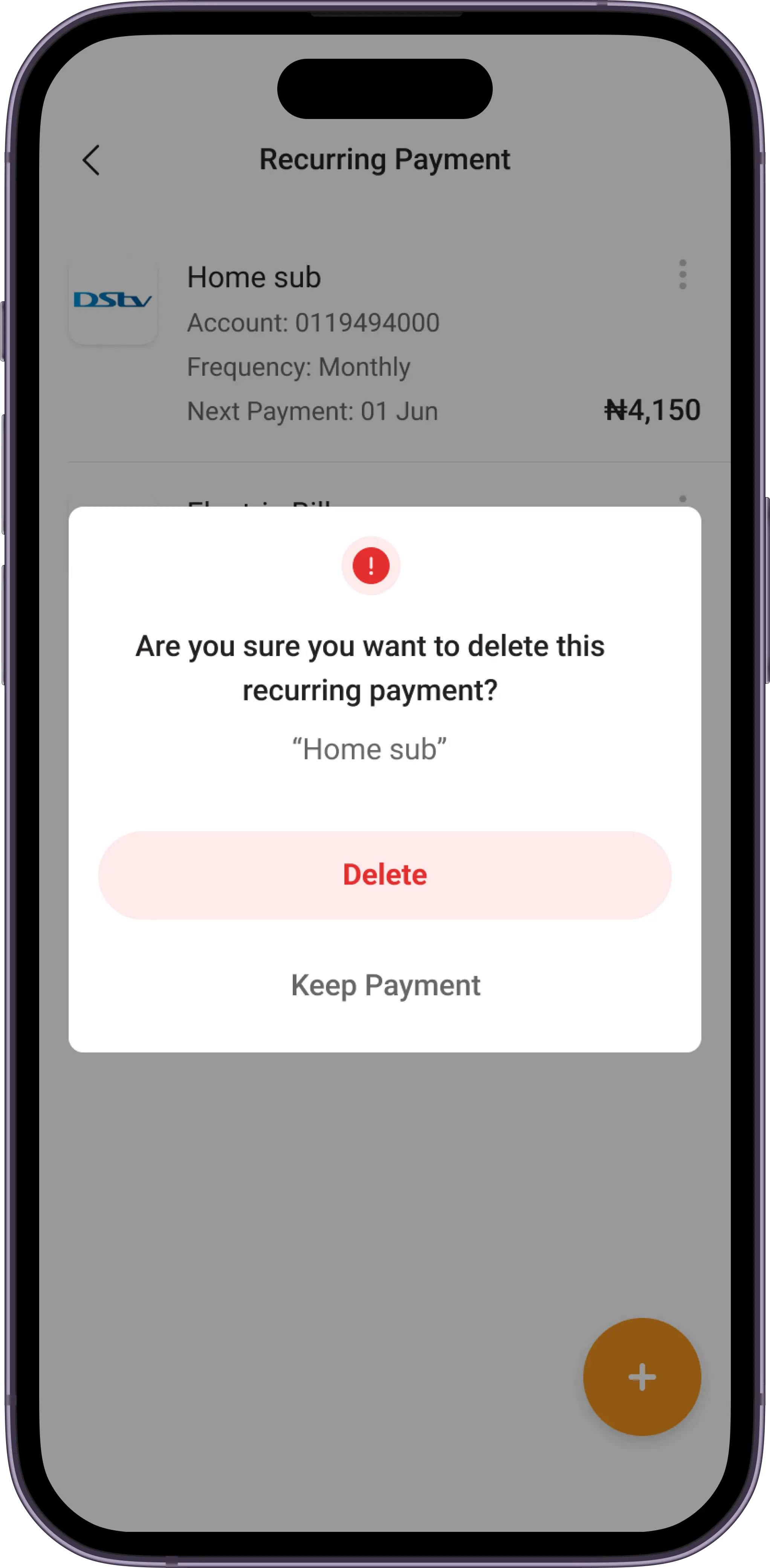

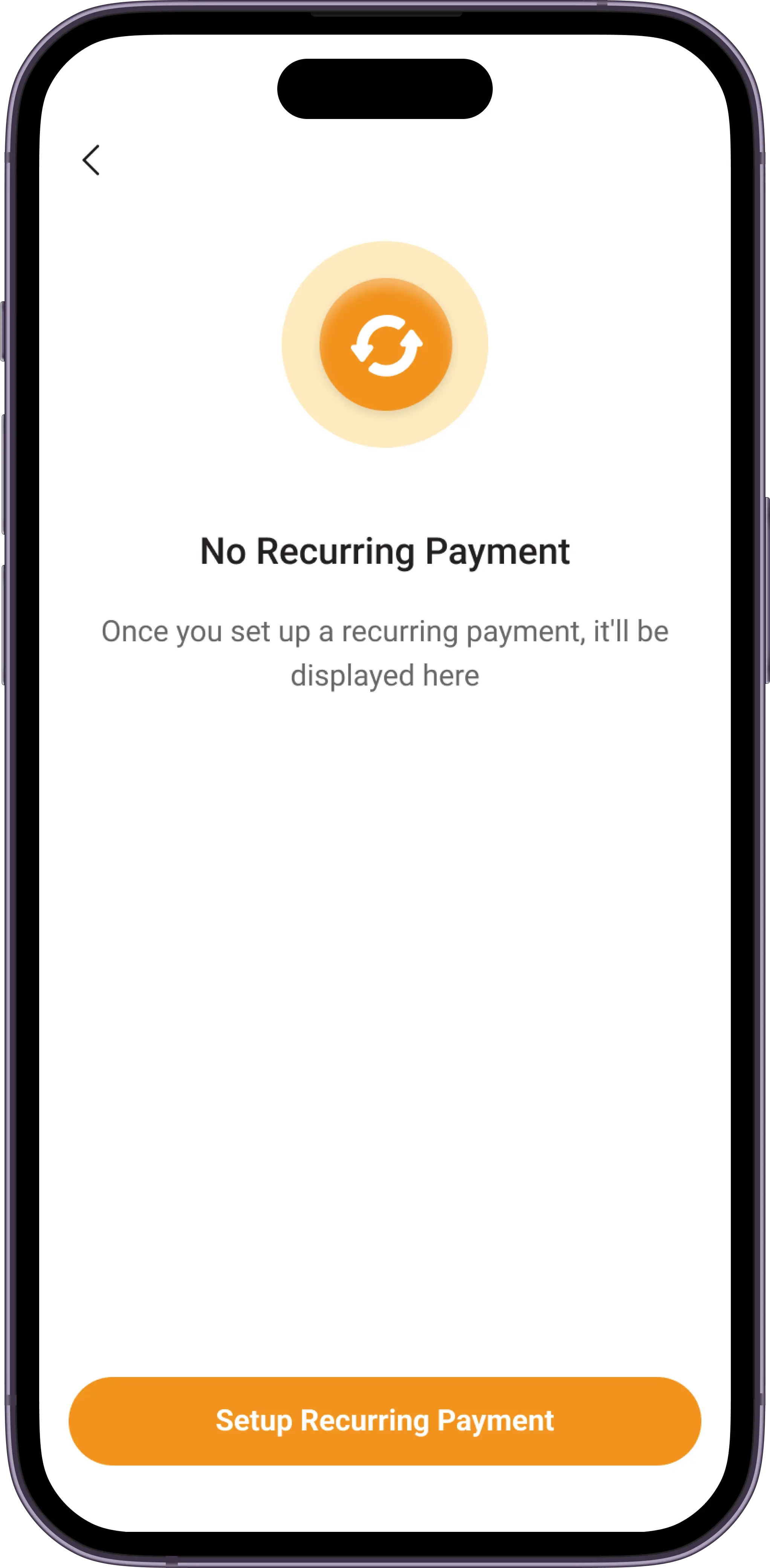

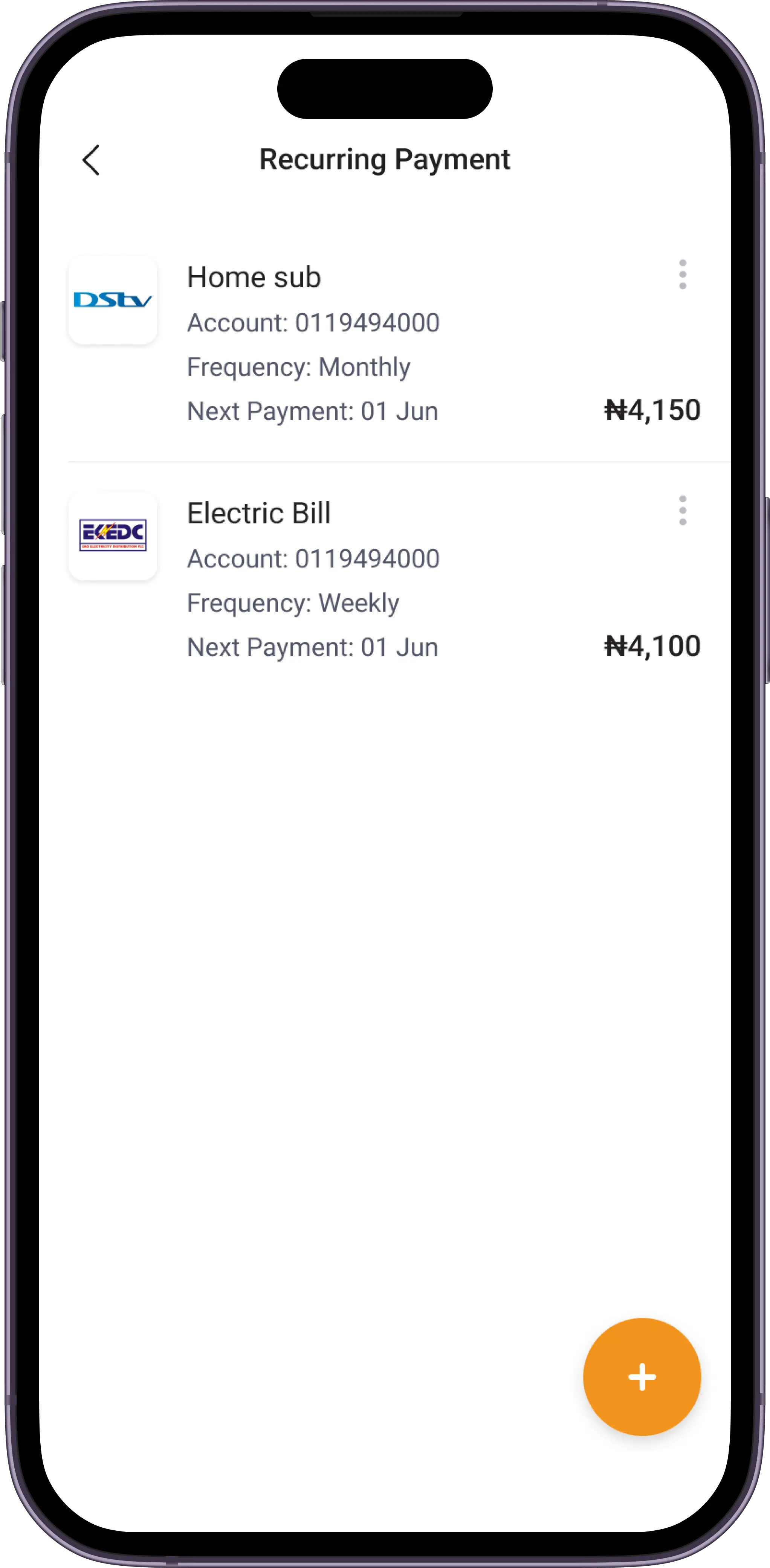

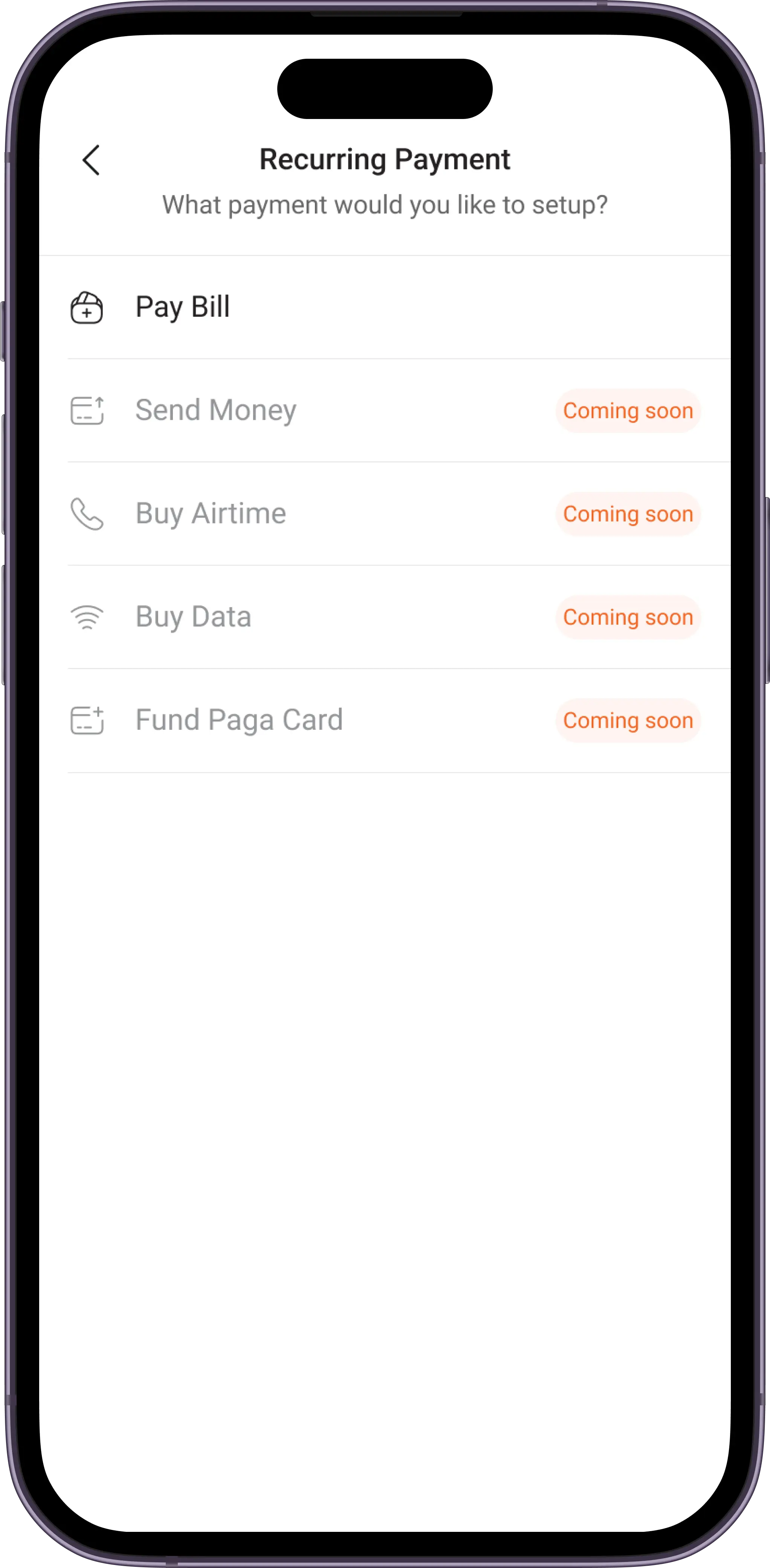

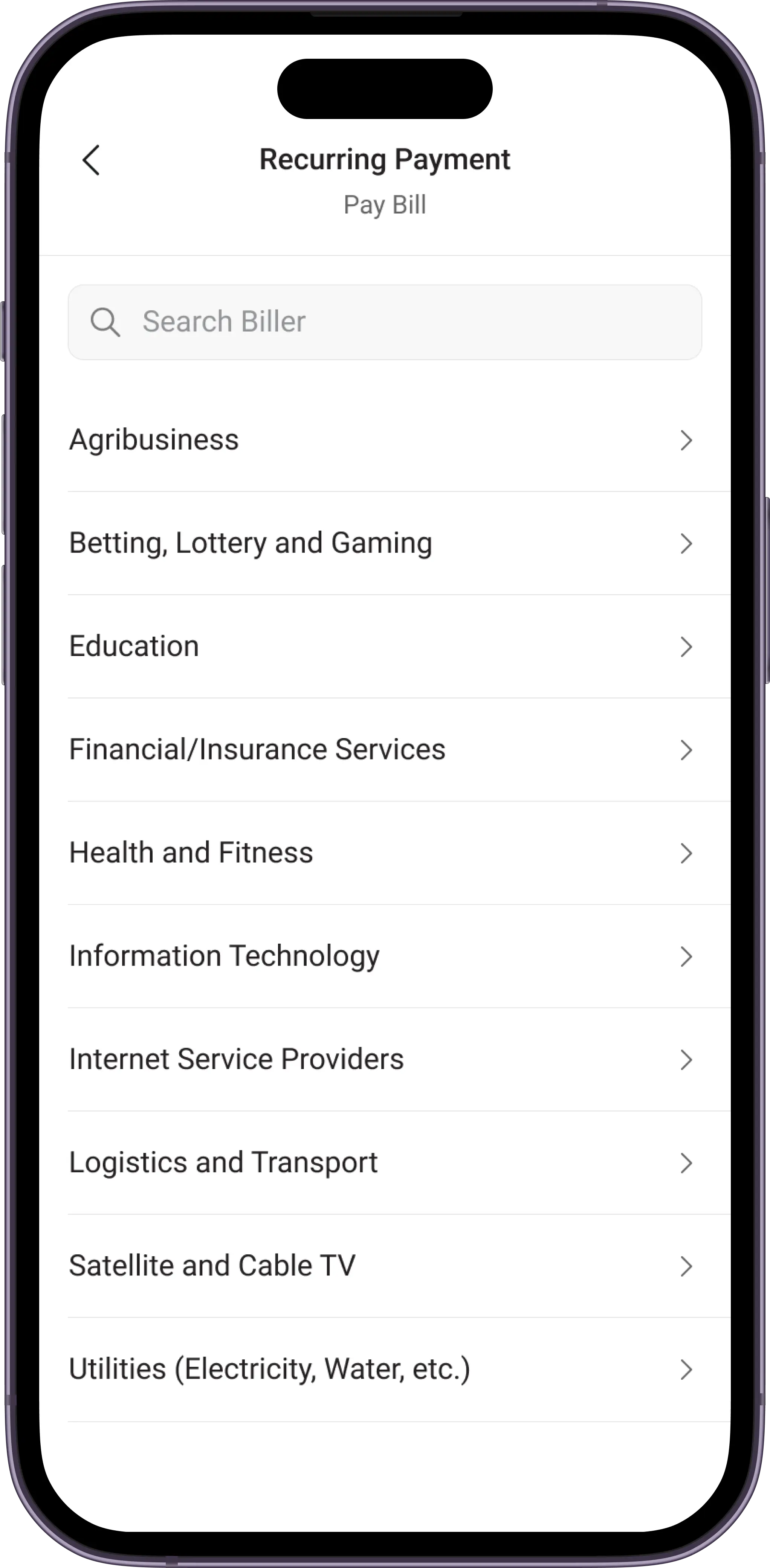

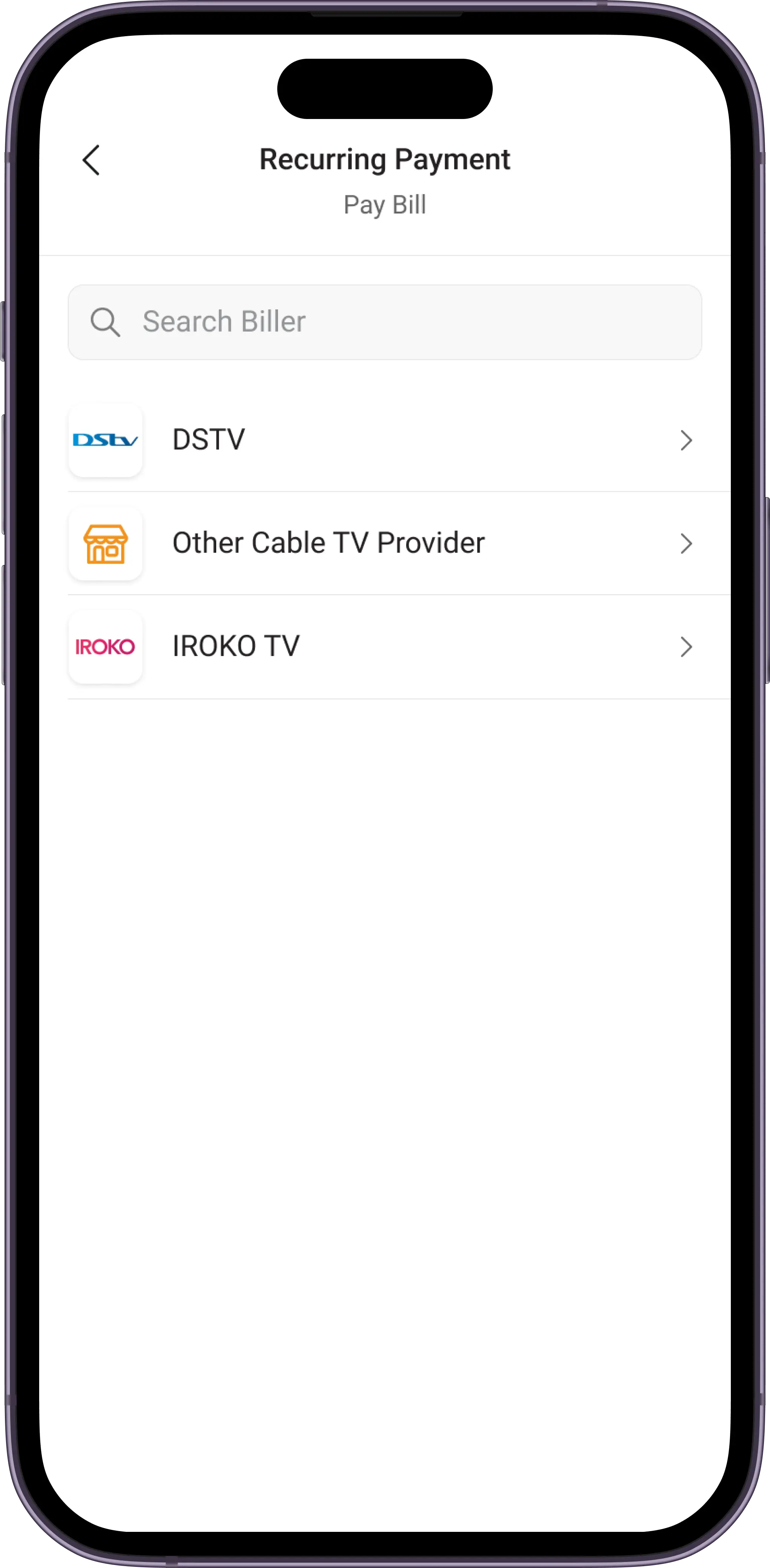

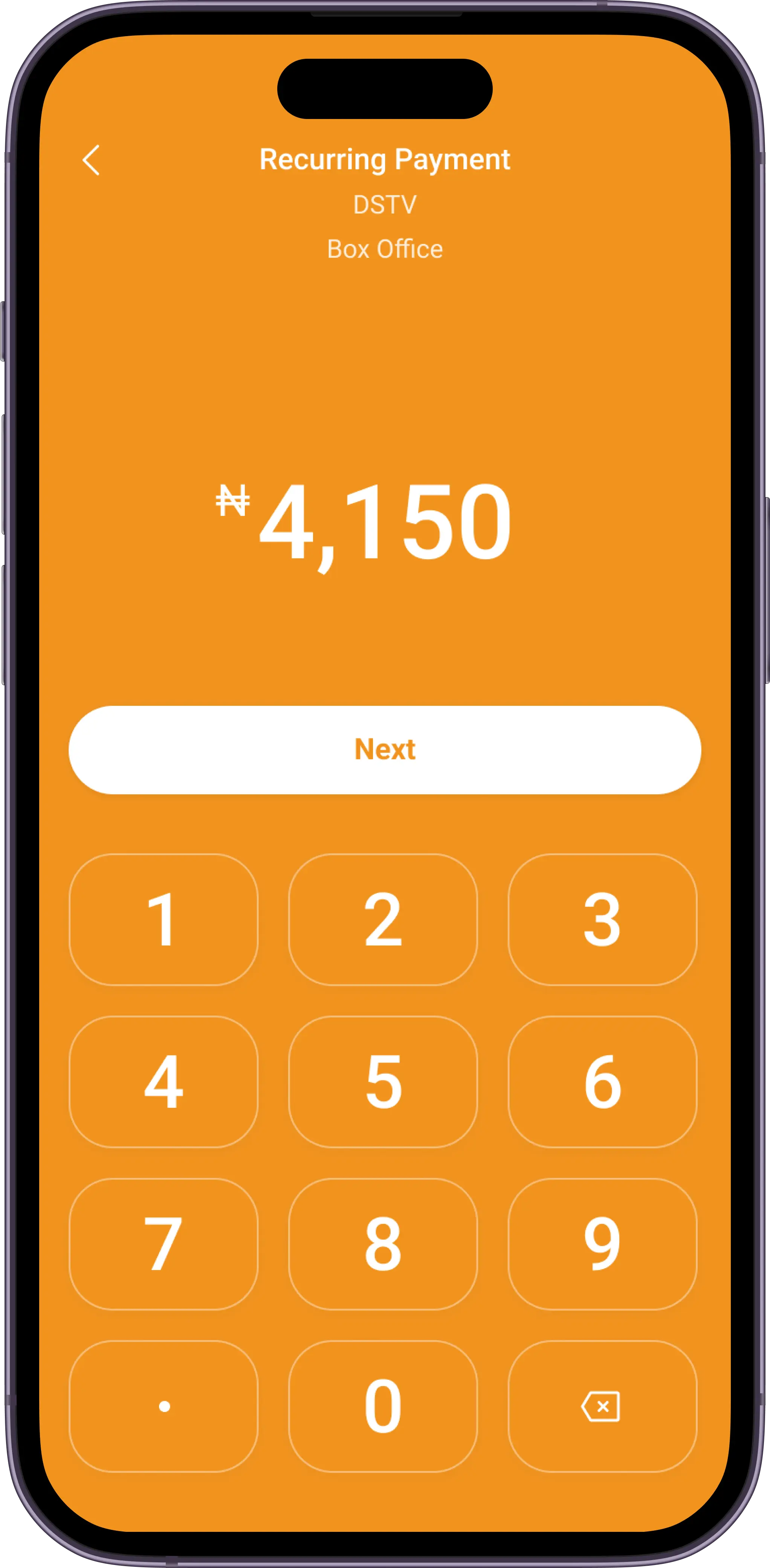

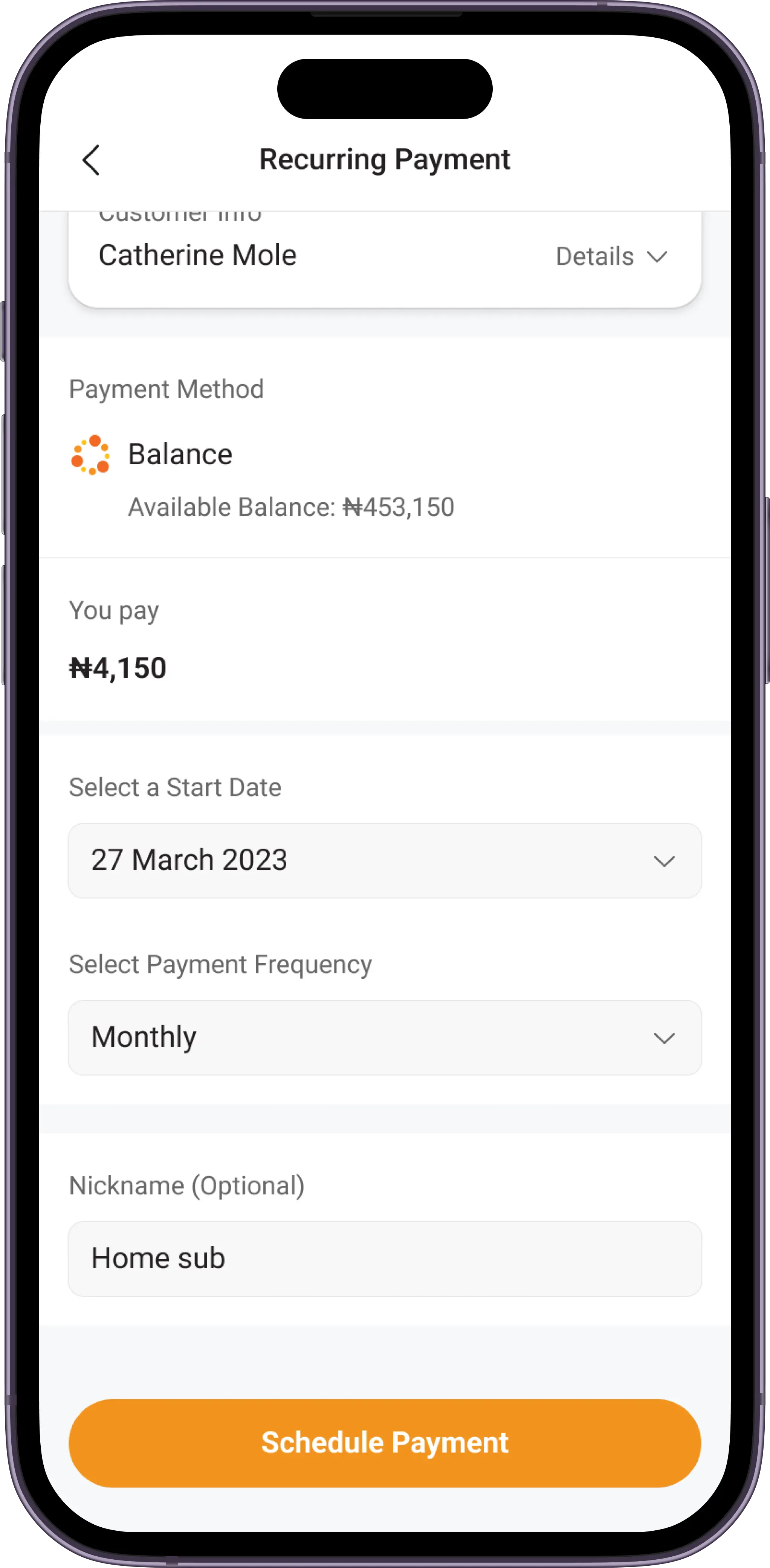

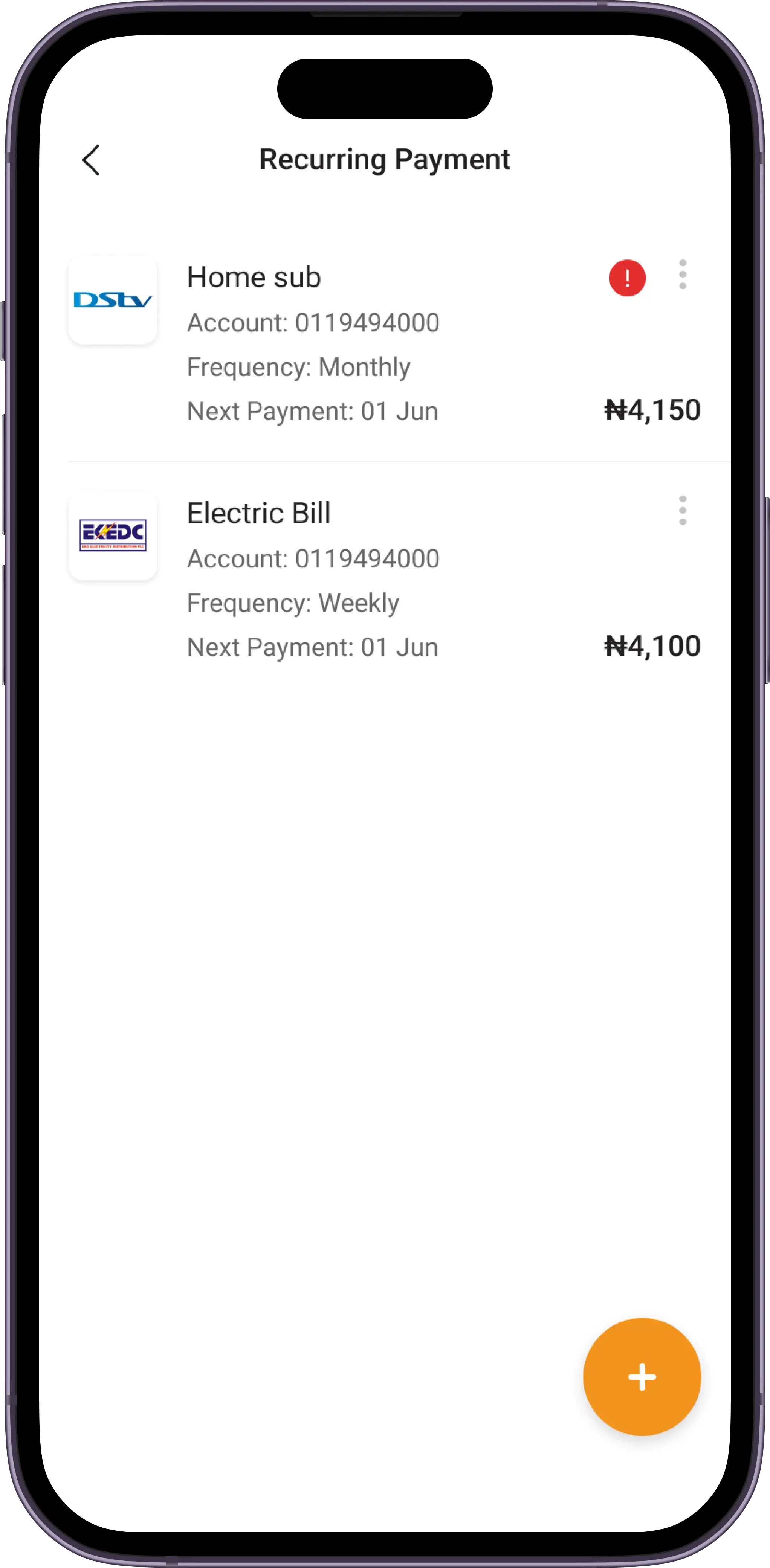

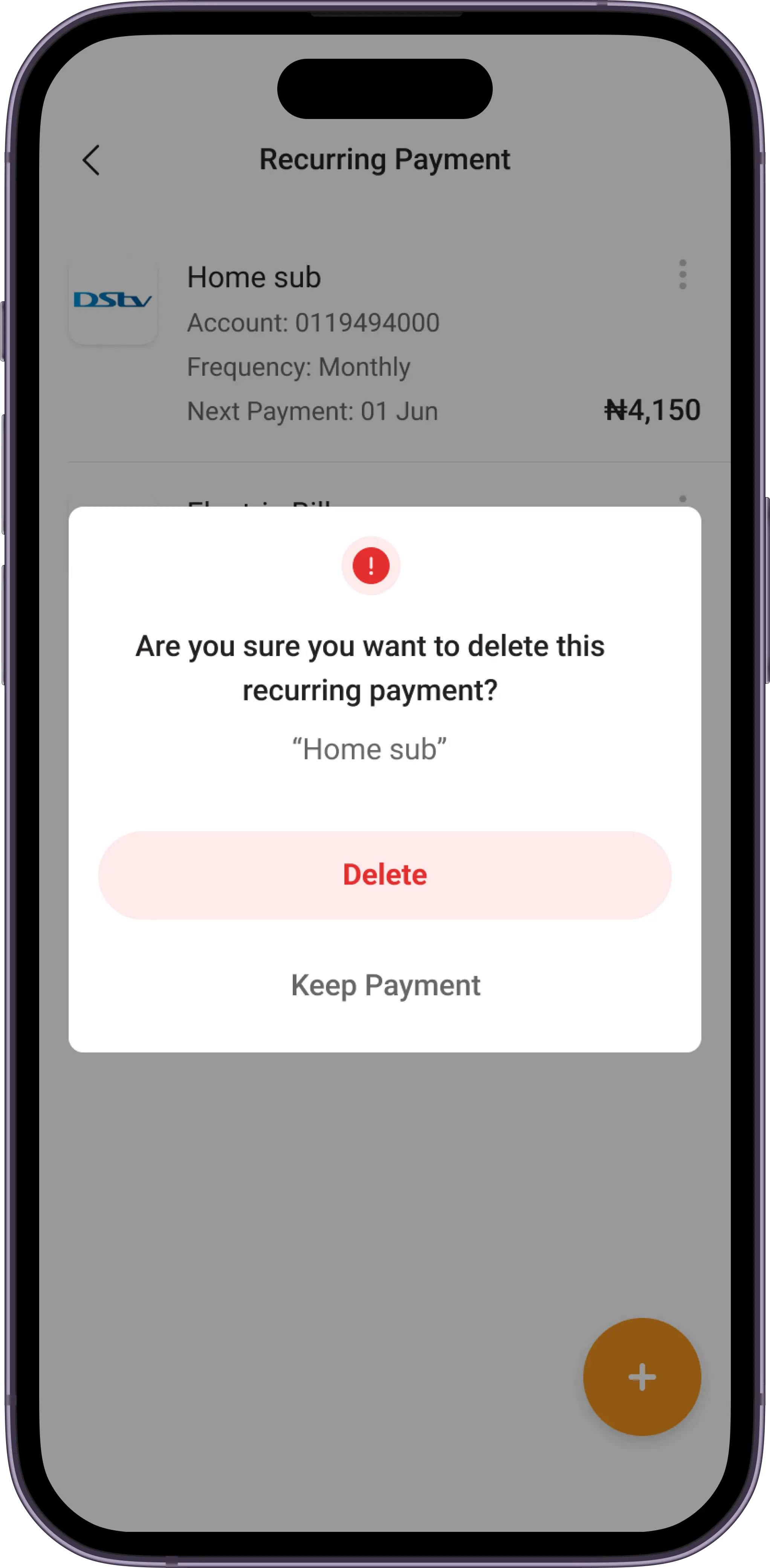

Let's design

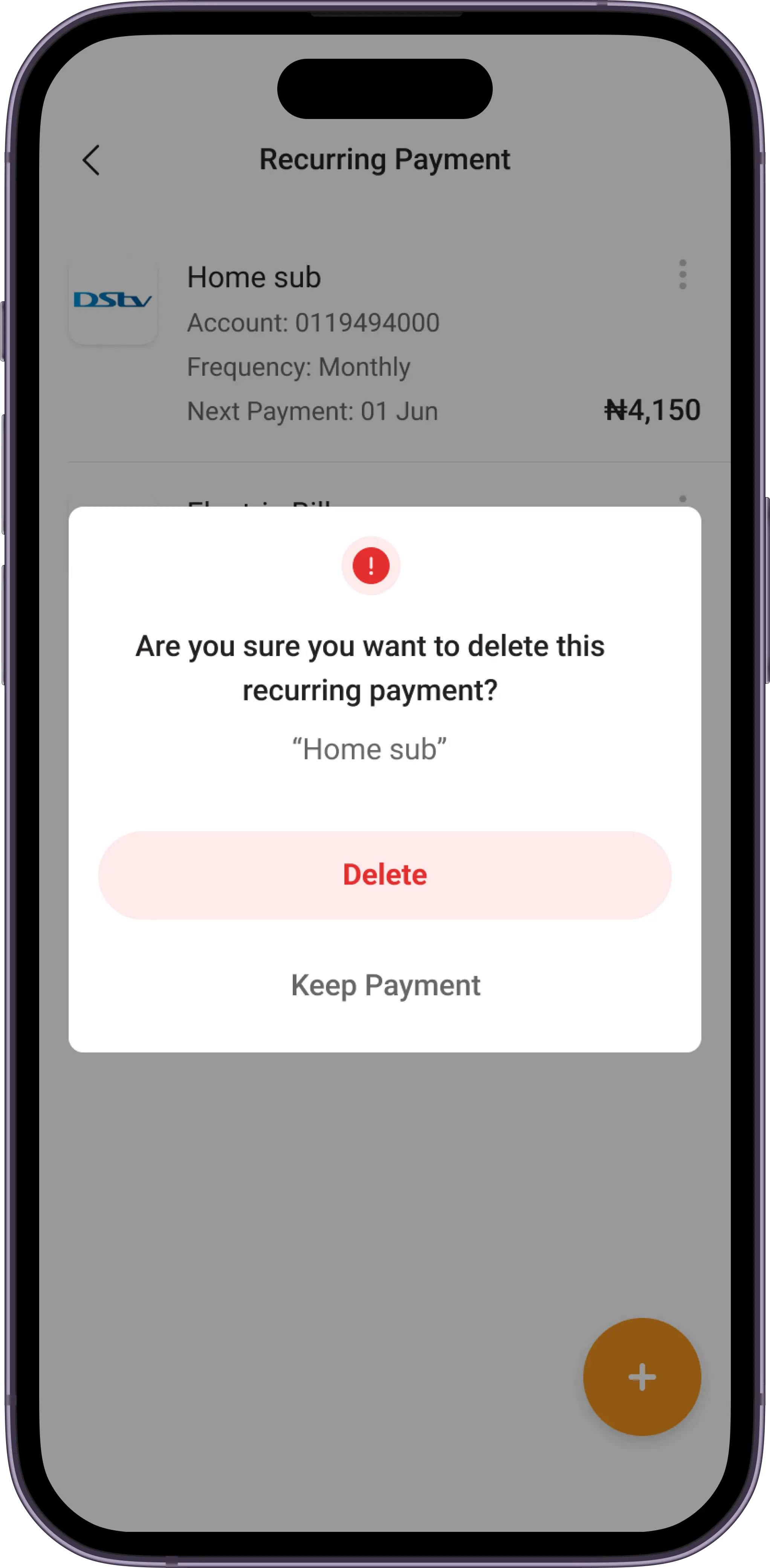

Now to my favourite part of the whole process, designing the interface! After going though the whole 9 yards and multiple back and forth with stake holders, it was finally time to start designing. I stared off with wireframes which maintained the original aesthetic of the app as a whole, then proceeded to flesh them out to high fidelity prototypes upon stakeholder validation.

The outcome and effect

After comparing the past and present metrics for user engagement post launch, we discovered that the feature had great positive impacts on user engagement, these include;

Increase in Monthly Active Users

The introduction of Recurring Payments led to a notable 19% increase in total number of active users.

Increase in user retention

There was also a whooping 15% increase in user retention post feature launch

Curtail call

In summary, the introduction of Recurring Payments has proven to be a resounding success.

Through its seamless automation and user-centric design, we've not only simplified financial management but also significantly boosted user engagement.

Also in the process I learnt how to design SLCs - Simple Lovable and Complete products that brings delight to its users.

Next

Onboarding

Case Study

Recurring Payments

This is a brief overview of this project (3 min read)

My role

User Interface Designer

User Experience Designer

Interaction Designer

First let me tell you about Paga

Paga is a leading mobile money company that is building an ecosystem to enable people to digitally send and receive money, and creating simple financial access for everyone.

What is a recurring payment?

Recurring payment refers to a payment model in which consumers give merchant permission to deduct money automatically from their accounts on a regular basis for products and services that are supplied to them continuously.

JUN

24

Next due date

Why are we doing this?

In a bid to increase user engagement and retention on Paga, the idea of a Recurring Payments feature emerged. The Recurring Payments Feature, designed as an extension of the existing platform, enables users to configure and automate payments for various recurring expenses such as subscriptions, memberships, and bills. Through this feature, users can experience a stress-free approach to managing their finances, while the platform strengthens its position as an indispensable tool in their daily lives.

What we aim to achieve

Seamless financial management

Simplify the process of managing regular financial obligations by allowing users to set up automatic payments.

Trust & reliability

Establish the platform as a dependable partner in users' financial routines, thereby building long-lasting trust.

Enhanced user engagement

Create a feature that not only fulfils a functional need but also encourages users to interact with the product on an ongoing basis.

Taking a deep dive

To lay the foundation for the Recurring Payments feature, I teamed up with key stakeholders and the product owner to conduct research and take a deep dive into this big idea.

This deep dive included conducting user interviews which included asking a number of strategically curated open-ended questions to get users current means of managing payments, and the struggles they face in the process.

Feedback from the surveys were carefully analysed to identify common points of friction between these users.

Deep in the ocean

After carefully understanding what users needed and were used to, i took an even deeper dive into how other products adopted automated payment models. This ranged from simple auto-debits to advanced predictive algorithms.

This process gave me a better understanding of both successes and shortcomings of various products, which in turn provided valuable insights that drove my design decisions.

Road blocks

Limited engineering resources

Limited engineering resources posed a challenge. The feature's complexity, encompassing automated renewals, customizable schedules, and seamless interactions, required balance. Striking the right mix between a comprehensive experience and resource capacity was crucial.

Ensuring simple flexibility

It was difficult to strike a balance between user flexibility and an easy-to-use UI. Users desired both customisation and the ease of automation. The challenge was creating a system that could be easily adjusted and still provided a clutter-free experience.

Building a bridge

To address the resource and complexity issues, we decided to build a SLC (Simple Lovable and Complete). This meant that we would build only the most essential feature of this product which is to allow auto-renewal of payments, that way we have a small product that can be built quickly, is useable and functional and we can choose to progressively introduce complexity by introducing other features - like customisation and much more later on. This way the engineers were able to implement quickly and the feature would roll-out with a clutter-free experience.

User flows

In a bid to achieve flexibility, the feature can be activated directly from the dashboard as well as during an ongoing payment flow.

Setting up a RP from the dashboard

Setting up a RP during payment

Let's design

Now to my favourite part of the whole process, designing the interface! After going though the whole 9 yards and multiple back and forth with stake holders, it was finally time to start designing. I stared off with wireframes which maintained the original aesthetic of the app as a whole, then proceeded to flesh them out to high fidelity prototypes upon stakeholder validation.

The outcome and effect

After comparing the past and present metrics for user engagement post launch, we discovered that the feature had great positive impacts on user engagement, these include;

Increase in Monthly Active Users

The introduction of Recurring Payments led to a notable 19% increase in total number of active users.

Increase in user retention

There was also a whooping 15% increase in user retention post feature launch

Curtail call

In summary, the introduction of Recurring Payments has proven to be a resounding success.

Through its seamless automation and user-centric design, we've not only simplified financial management but also significantly boosted user engagement.

Also in the process I learnt how to design SLCs - Simple Lovable and Complete products that brings delight to its users.

Next

Onboarding

Case Study

Recurring Payments

This is a brief overview of this project (3 min read)

My role

User Interface Designer

User Experience Designer

Interaction Designer

First let me tell you about Paga

Paga is a leading mobile money company that is building an ecosystem to enable people to digitally send and receive money, and creating simple financial access for everyone.

What is a recurring payment?

Recurring payment refers to a payment model in which consumers give merchant permission to deduct money automatically from their accounts on a regular basis for products and services that are supplied to them continuously.

JUN

24

Next due date

Why are we doing this?

In a bid to increase user engagement and retention on Paga, the idea of a Recurring Payments feature emerged. The Recurring Payments Feature, designed as an extension of the existing platform, enables users to configure and automate payments for various recurring expenses such as subscriptions, memberships, and bills. Through this feature, users can experience a stress-free approach to managing their finances, while the platform strengthens its position as an indispensable tool in their daily lives.

What we aim to achieve

Seamless financial management

Simplify the process of managing regular financial obligations by allowing users to set up automatic payments.

Trust & reliability

Establish the platform as a dependable partner in users' financial routines, thereby building long-lasting trust.

Enhanced user engagement

Create a feature that not only fulfils a functional need but also encourages users to interact with the product on an ongoing basis.

Taking a deep dive

To lay the foundation for the Recurring Payments feature, I teamed up with key stakeholders and the product owner to conduct research and take a deep dive into this big idea.

This deep dive included conducting user interviews which included asking a number of strategically curated open-ended questions to get users current means of managing payments, and the struggles they face in the process.

Feedback from the surveys were carefully analysed to identify common points of friction between these users.

Deep in the ocean

After carefully understanding what users needed and were used to, i took an even deeper dive into how other products adopted automated payment models. This ranged from simple auto-debits to advanced predictive algorithms.

This process gave me a better understanding of both successes and shortcomings of various products, which in turn provided valuable insights that drove my design decisions.

Road blocks

Limited engineering resources

Limited engineering resources posed a challenge. The feature's complexity, encompassing automated renewals, customizable schedules, and seamless interactions, required balance. Striking the right mix between a comprehensive experience and resource capacity was crucial.

Ensuring simple flexibility

It was difficult to strike a balance between user flexibility and an easy-to-use UI. Users desired both customisation and the ease of automation. The challenge was creating a system that could be easily adjusted and still provided a clutter-free experience.

Building a bridge

To address the resource and complexity issues, we decided to build a SLC (Simple Lovable and Complete). This meant that we would build only the most essential feature of this product which is to allow auto-renewal of payments, that way we have a small product that can be built quickly, is useable and functional and we can choose to progressively introduce complexity by introducing other features - like customisation and much more later on. This way the engineers were able to implement quickly and the feature would roll-out with a clutter-free experience.

User flows

In a bid to achieve flexibility, the feature can be activated directly from the dashboard as well as during an ongoing payment flow.

Setting up a RP from the dashboard

Setting up a RP during payment

Let's design

Now to my favourite part of the whole process, designing the interface! After going though the whole 9 yards and multiple back and forth with stake holders, it was finally time to start designing. I stared off with wireframes which maintained the original aesthetic of the app as a whole, then proceeded to flesh them out to high fidelity prototypes upon stakeholder validation.

The outcome and effect

After comparing the past and present metrics for user engagement post launch, we discovered that the feature had great positive impacts on user engagement, these include;

Increase in Monthly Active Users

The introduction of Recurring Payments led to a notable 19% increase in total number of active users.

Increase in user retention

There was also a whooping 15% increase in user retention post feature launch

Curtail call

In summary, the introduction of Recurring Payments has proven to be a resounding success.

Through its seamless automation and user-centric design, we've not only simplified financial management but also significantly boosted user engagement.

Also in the process I learnt how to design SLCs - Simple Lovable and Complete products that brings delight to its users.

Next

Onboarding

open for work